Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain how and why you calculated the the post-acquisition contribution made by the subsidiary to the group in this question Consolidated Entity $'000 5,430 g

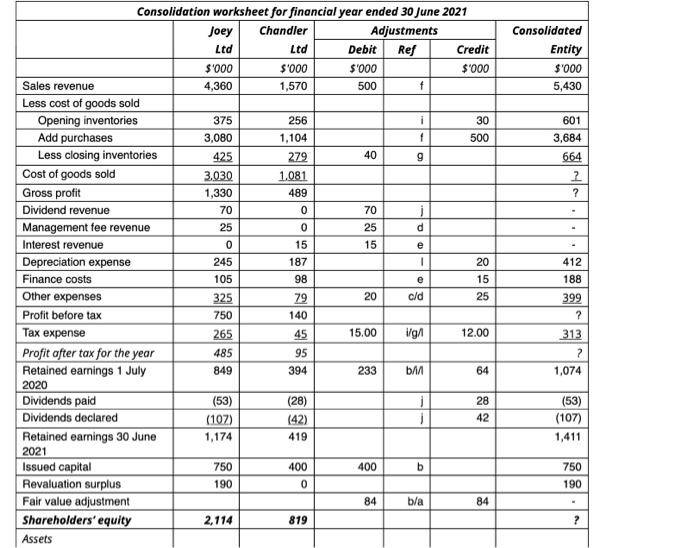

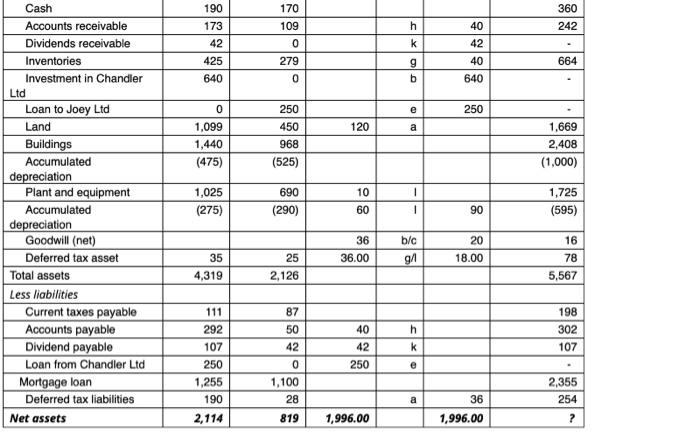

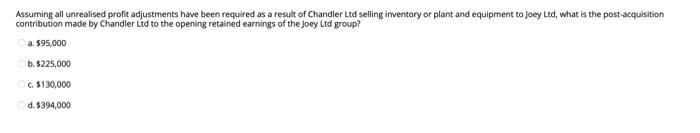

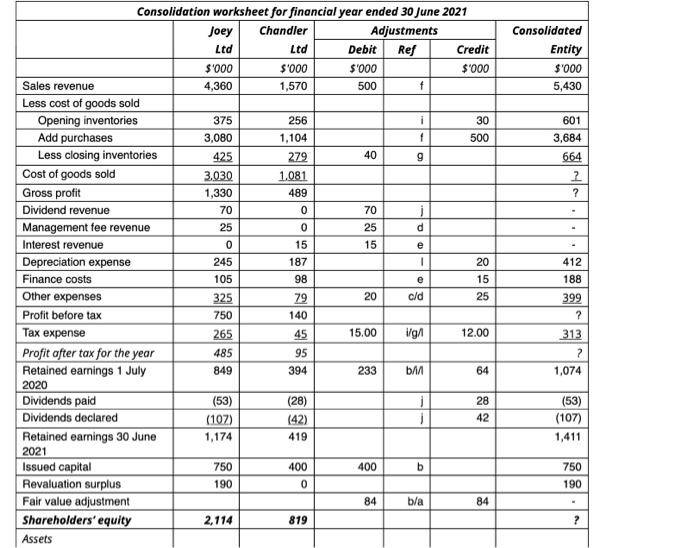

Explain how and why you calculated the the post-acquisition contribution made by the subsidiary to the group in this question

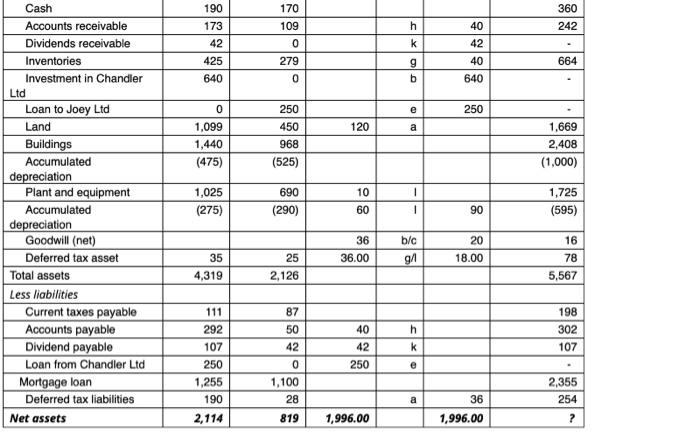

Consolidated Entity $'000 5,430 g 601 3,684 664 . ? e Consolidation worksheet for financial year ended 30 June 2021 Joey Chandler Adjustments Ltd Ltd Debit Ref Credit $'000 $'000 $'000 $'000 Sales revenue 4,360 1,570 500 Less cost of goods sold Opening inventories 375 256 i 30 Add purchases 3,080 1,104 f 500 Less closing inventories 425 279 40 Cost of goods sold 3.030 1.081 Gross profit 1,330 489 Dividend revenue 70 0 70 i Management fee revenue 25 0 25 d Interest revenue 0 15 15 Depreciation expense 245 187 20 Finance costs 105 98 15 Other expenses 325 79 20 c/d 25 Profit before tax 750 140 Tax expense 265 45 15.00 i/g/ 12.00 Profit after tax for the year 485 95 Retained earnings 1 July 394 233 b/ 64 2020 Dividends paid (53) (28) 28 Dividends declared (107) (42) 1 42 Retained earnings 30 June 1,174 419 2021 Issued capital 750 400 400 b Revaluation surplus 190 0 Fair value adjustment 84 b/a 84 Shareholders' equity 2,114 819 Assets 412 188 e 399 ? 313 ? 1,074 849 (53) (107) 1,411 750 190 ? 170 360 242 h 190 173 42 425 640 109 0 40 42 k 279 664 g b 40 640 0 0 e 250 120 a 1,099 1,440 (475) 250 450 968 (525) 1,669 2,408 (1,000) 1,025 (275) 690 (290) 10 60 Cash Accounts receivable Dividends receivable Inventories Investment in Chandler Ltd Loan to Joey Ltd Land Buildings Accumulated depreciation Plant and equipment Accumulated depreciation Goodwill (net) Deferred tax asset Total assets Less liabilities Current taxes payable Accounts payable Dividend payable Loan from Chandler Ltd Mortgage loan Deferred tax liabilities Net assets 1,725 (595) 1 90 36 16 b/c g/ 20 18.00 36.00 35 4,319 25 2,126 78 5,567 h k 111 292 107 250 1,255 190 198 302 107 40 42 250 87 50 42 0 1,100 28 e 2,355 254 a 36 1,996.00 2,114 819 1,996.00 ? Assuming all unrealised profit adjustments have been required as a result of Chandler Ltd selling inventory or plant and equipment to Joey Ltd, what is the post-acquisition contribution made by Chandler Ltd to the opening retained earnings of the Joey Ltd group? a. $95.000 b. $225,000 C. $130,000 d. 5394,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started