Answered step by step

Verified Expert Solution

Question

1 Approved Answer

explain how does intermarket swap work? why when the yield spread gets smaller, the corporate bonds will outperform the treasury bonds? Active Bond Investment Basis:

explain how does intermarket swap work? why when the yield spread gets smaller, the corporate bonds will outperform the treasury bonds?

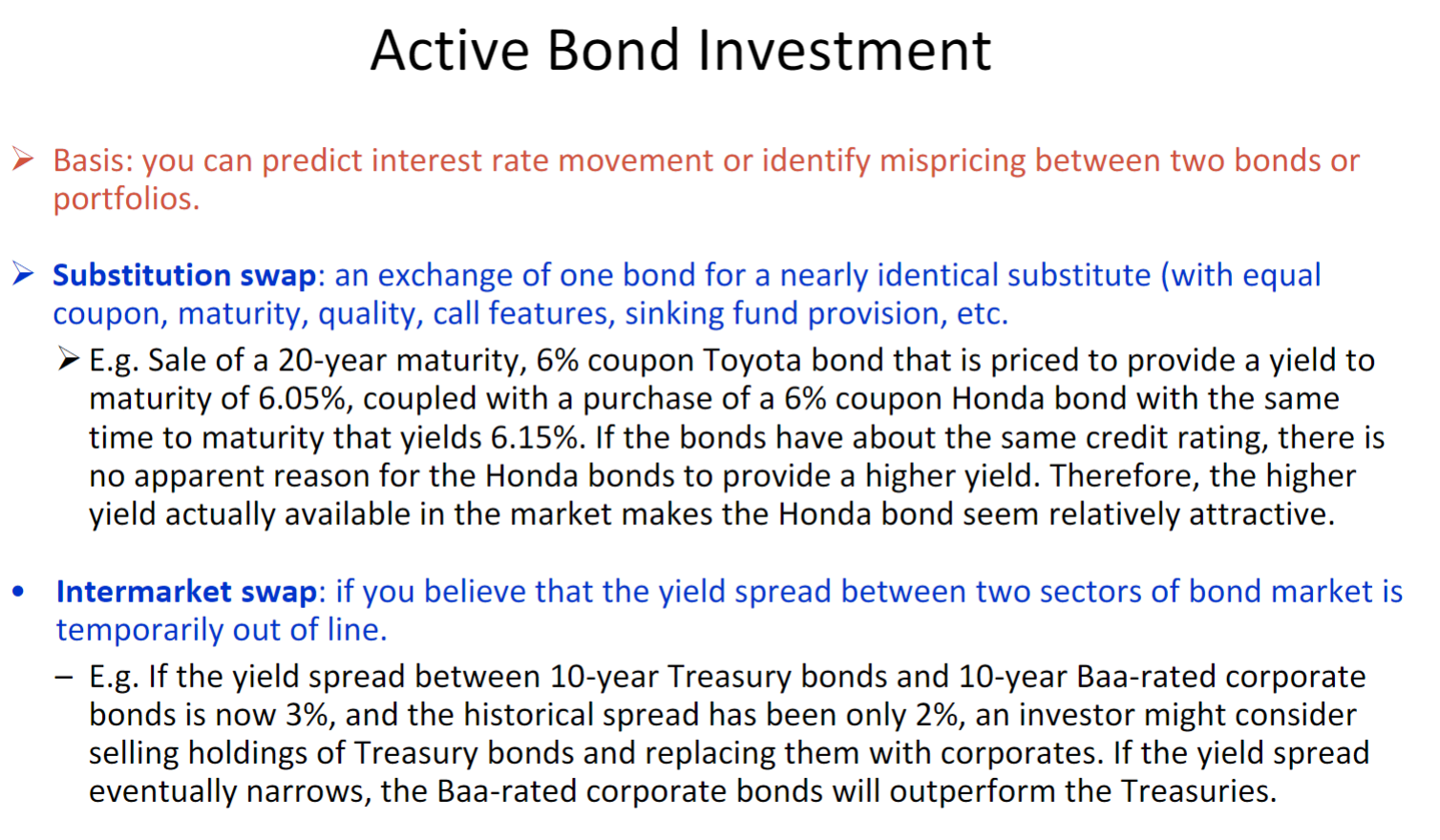

Active Bond Investment Basis: you can predict interest rate movement or identify mispricing between two bonds or portfolios. Substitution swap: an exchange of one bond for a nearly identical substitute (with equal coupon, maturity, quality, call features, sinking fund provision, etc. E.g. Sale of a 20-year maturity, 6% coupon Toyota bond that is priced to provide a yield to maturity of 6.05%, coupled with a purchase of a 6% coupon Honda bond with the same time to maturity that yields 6.15%. If the bonds have about the same credit rating, there is no apparent reason for the Honda bonds to provide a higher yield. Therefore, the higher yield actually available in the market makes the Honda bond seem relatively attractive. Intermarket swap: if you believe that the yield spread between two sectors of bond market is temporarily out of line. - E.g. If the yield spread between 10-year Treasury bonds and 10-year Baa-rated corporate bonds is now 3%, and the historical spread has been only 2%, an investor might consider selling holdings of Treasury bonds and replacing them with corporates. If the yield spread eventually narrows, the Baa-rated corporate bonds will outperform the Treasuries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Intermarket swap involves taking advantage of temporary mispricing between different sectors ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started