Question

Explain how each of the following events or series of events and the related adjusting entry will affect the amount of net income and the

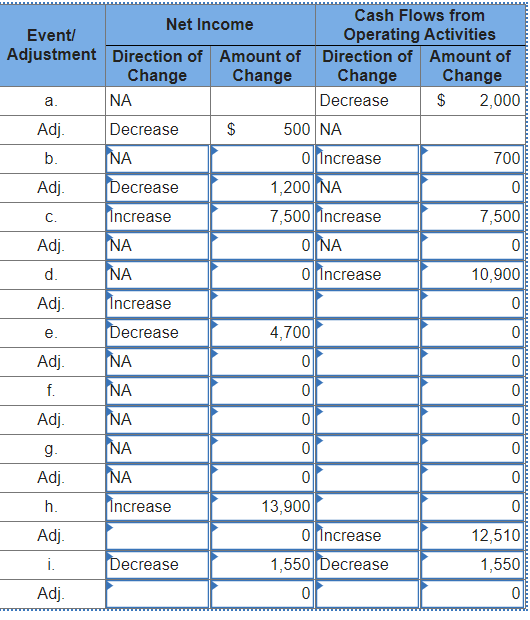

Explain how each of the following events or series of events and the related adjusting entry will affect the amount of net income and the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change (increase, decrease, or NA) and the amount of the change. Organize your answers according to the following table. The first event is recorded as an example. If an event does not have a related adjusting entry, record only the effects of the event. (Not all cells require entry. Do not round intermediate calculations and round your final answers to nearest whole dollar amount.)

- Paid $2,000 cash on October 1 to purchase a one-year insurance policy.

- Purchased $1,500 of supplies on account. Paid $800 cash on accounts payable. The ending balance in the Supplies account, after adjustment, was $300.

- Provided services for $7,500 cash.

- Collected $10,900 in advance for services to be performed in the future. The contract called for services to start on May 1 and to continue for one year.

- Accrued salaries amounting to $4,700.

- Sold land that cost $18,000 for $18,000 cash.

- Acquired $48,000 cash from the issue of common stock.

- Earned $13,900 of revenue on account. Collected $12,510 cash from accounts receivable.

- Paid cash operating expenses of $1,550.

Explain how each of the following events or series of events and the related adjusting entry will affect the amount of net income and the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change (increase, decrease, or NA) and the amount of the change. Organize your answers according to the following table. The first event is recorded as an example. If an event does not have a related adjusting entry, record only the effects of the event. (Not all cells require entry. Do not round intermediate calculations and round your final answers to nearest whole dollar amount.)

- Paid $2,000 cash on October 1 to purchase a one-year insurance policy.

- Purchased $1,500 of supplies on account. Paid $800 cash on accounts payable. The ending balance in the Supplies account, after adjustment, was $300.

- Provided services for $7,500 cash.

- Collected $10,900 in advance for services to be performed in the future. The contract called for services to start on May 1 and to continue for one year.

- Accrued salaries amounting to $4,700.

- Sold land that cost $18,000 for $18,000 cash.

- Acquired $48,000 cash from the issue of common stock.

- Earned $13,900 of revenue on account. Collected $12,510 cash from accounts receivable.

- Paid cash operating expenses of $1,550.

a. INA C. Net Income Cash Flows from Event/ Operating Activities Adjustment Direction of Amount of Direction of Amount of Change Change Change Change NA Decrease $ 2,000 Adj. Decrease $ 500 NA b. o Increase 700 Adj Decrease 1,200 NA 0 Increase 7,500 Increase 7,500 Adj. INA O NA 0 d. NA o increase 10,900 Adj. Increase 0 Decrease 4,700 0 Adj. NA 0 0 f. INA 0 0 Adj. 0 0 g. INA 0 0 Adj. 01 0 h. Increase 13,900 0 Adj. o Increase 12,510 i. Decrease 1,550 Decrease 1,550 Adj. 0 0 e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started