Answered step by step

Verified Expert Solution

Question

1 Approved Answer

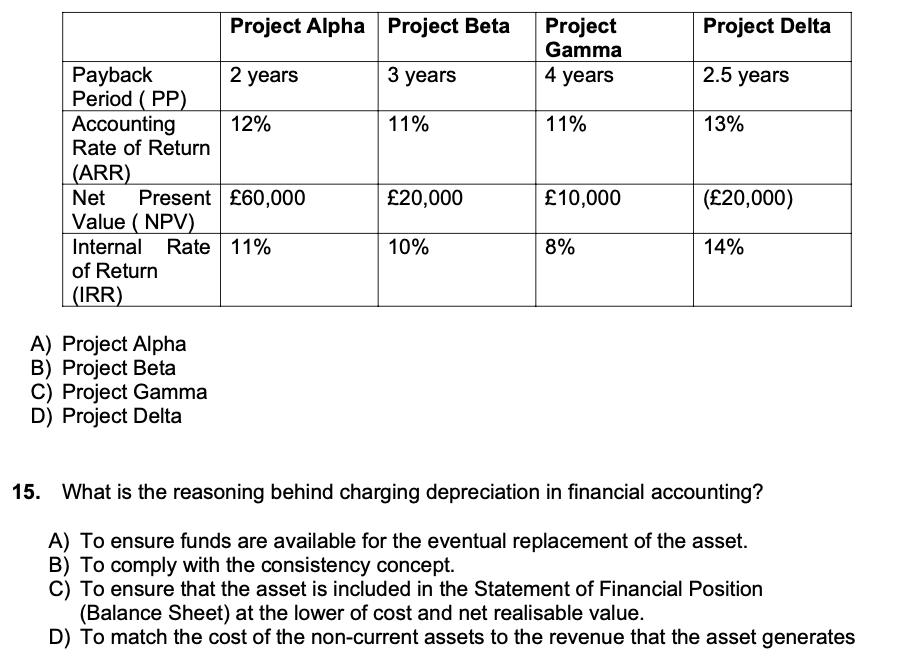

Your company has a Cost of Capital of 10%. You are presented with the results of a CapitalInvestment Appraisal of FOUR different projects (see below).

Your company has a Cost of Capital of 10%. You are presented with the results of a CapitalInvestment Appraisal of FOUR different projects (see below). Which project should be accepted?

Payback Period (PP) Accounting Rate of Return (ARR) Net Value (NPV) Internal Rate 11% Present 60,000 of Return (IRR) Project Alpha Project Beta 2 years 3 years 12% A) Project Alpha B) Project Beta C) Project Gamma D) Project Delta 11% 20,000 10% Project Gamma 4 years 11% 10,000 8% Project Delta 2.5 years 13% (20,000) 14% 15. What is the reasoning behind charging depreciation in financial accounting? A) To ensure funds are available for the eventual replacement of the asset. B) To comply with the consistency concept. C) To ensure that the asset is included in the Statement of Financial Position (Balance Sheet) at the lower of cost and net realisable value. D) To match the cost of the non-current assets to the revenue that the asset generates

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1While evaluating capital investment proposalNPV and IRR are mostly usedNPV greater than 1 represent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started