Answered step by step

Verified Expert Solution

Question

1 Approved Answer

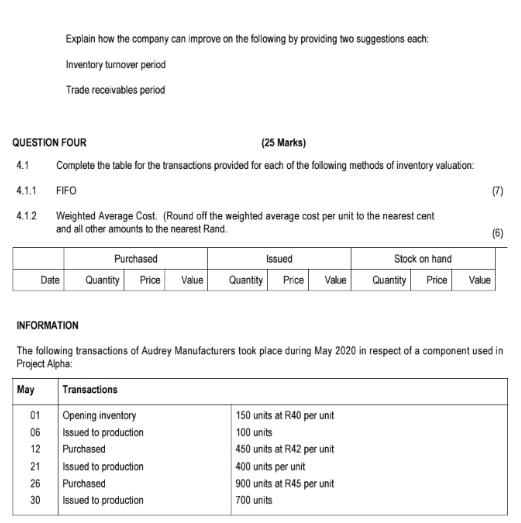

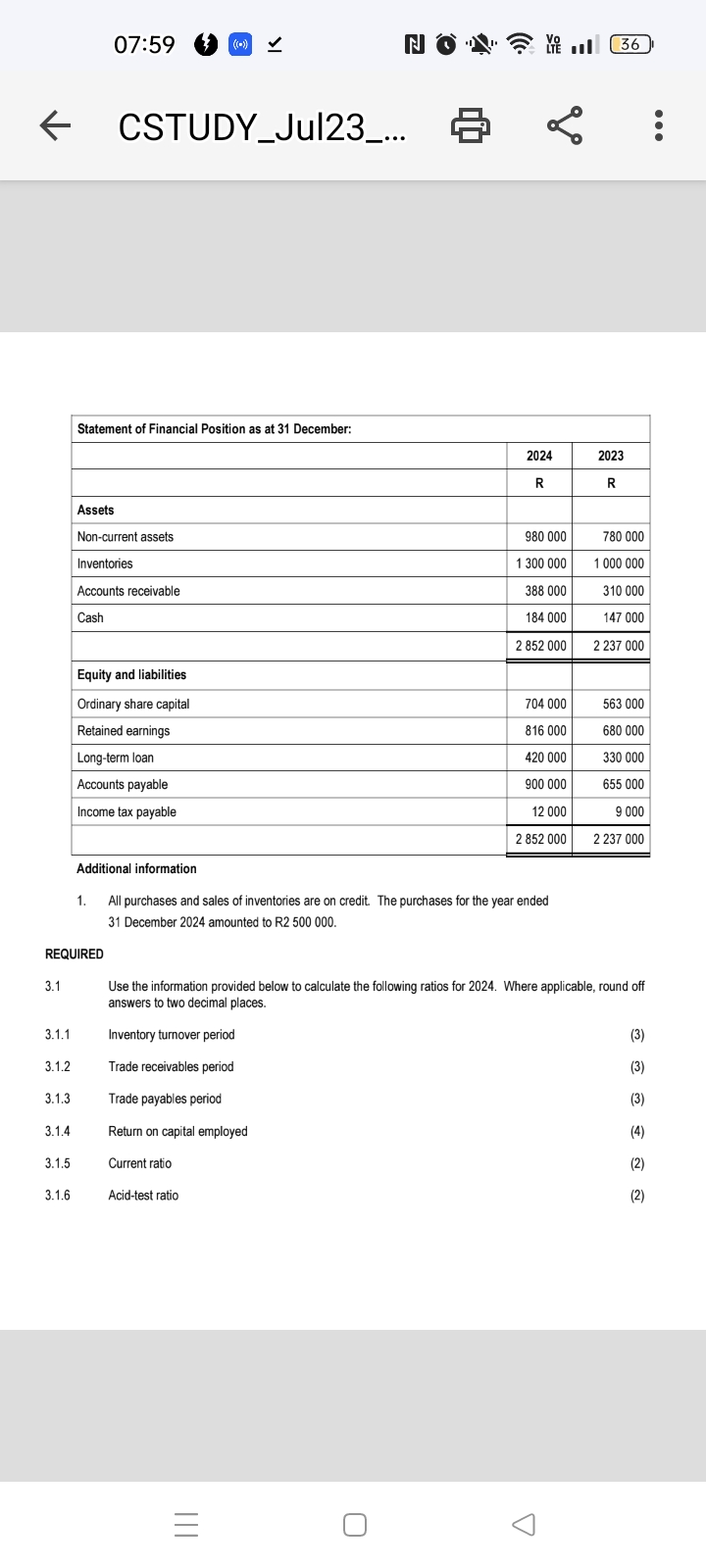

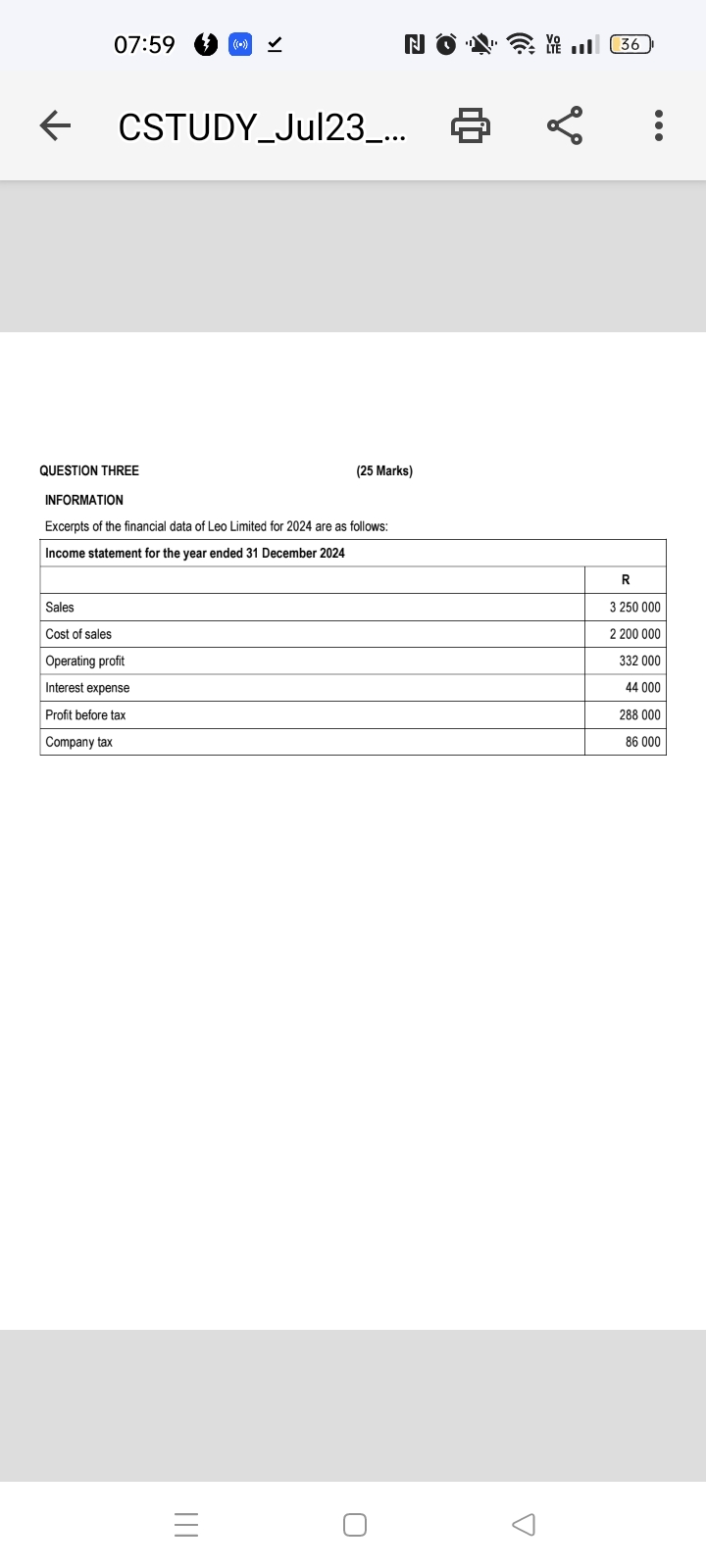

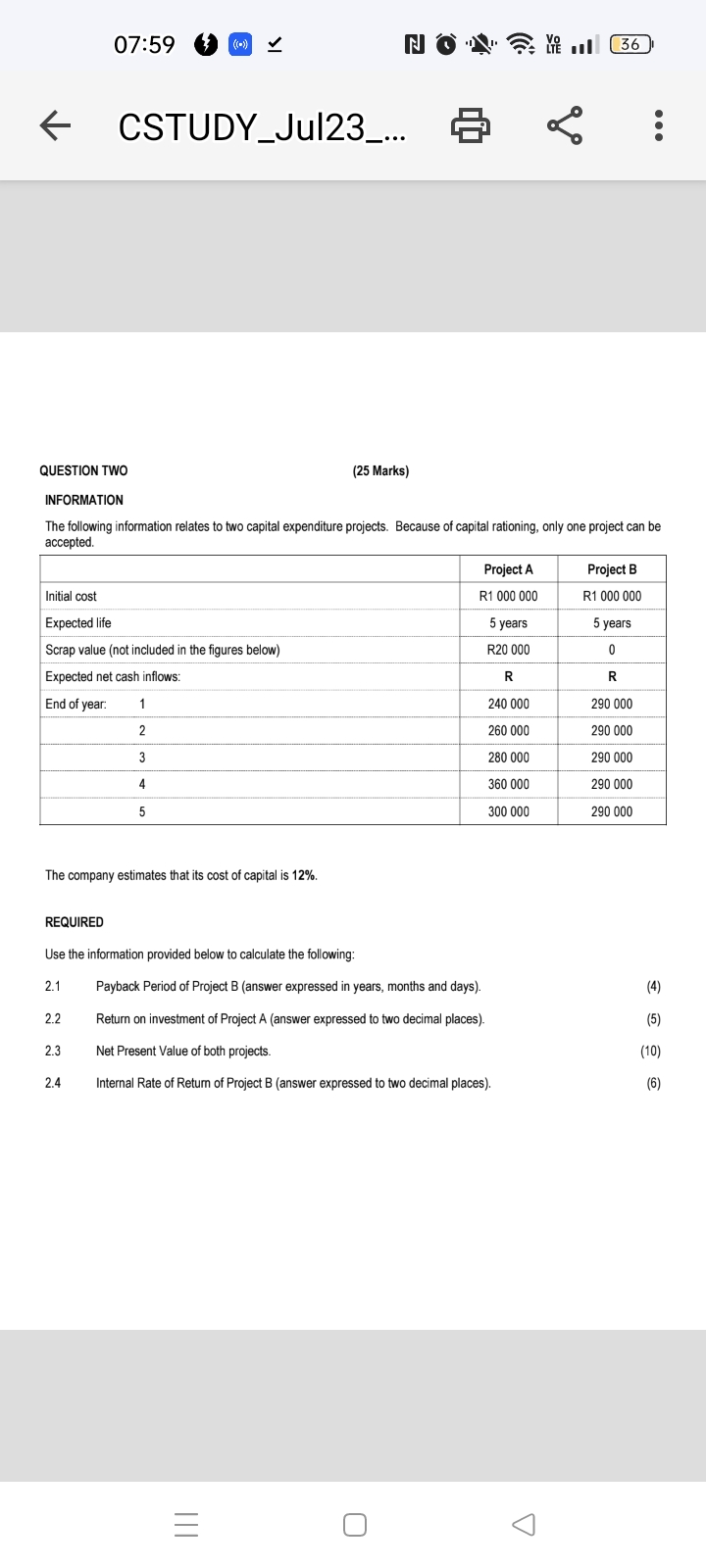

Explain how the company can improve on the following by providing two suggestions each: Inventory turnover period Trade receivables period QUESTION FOUR 4.1 (25

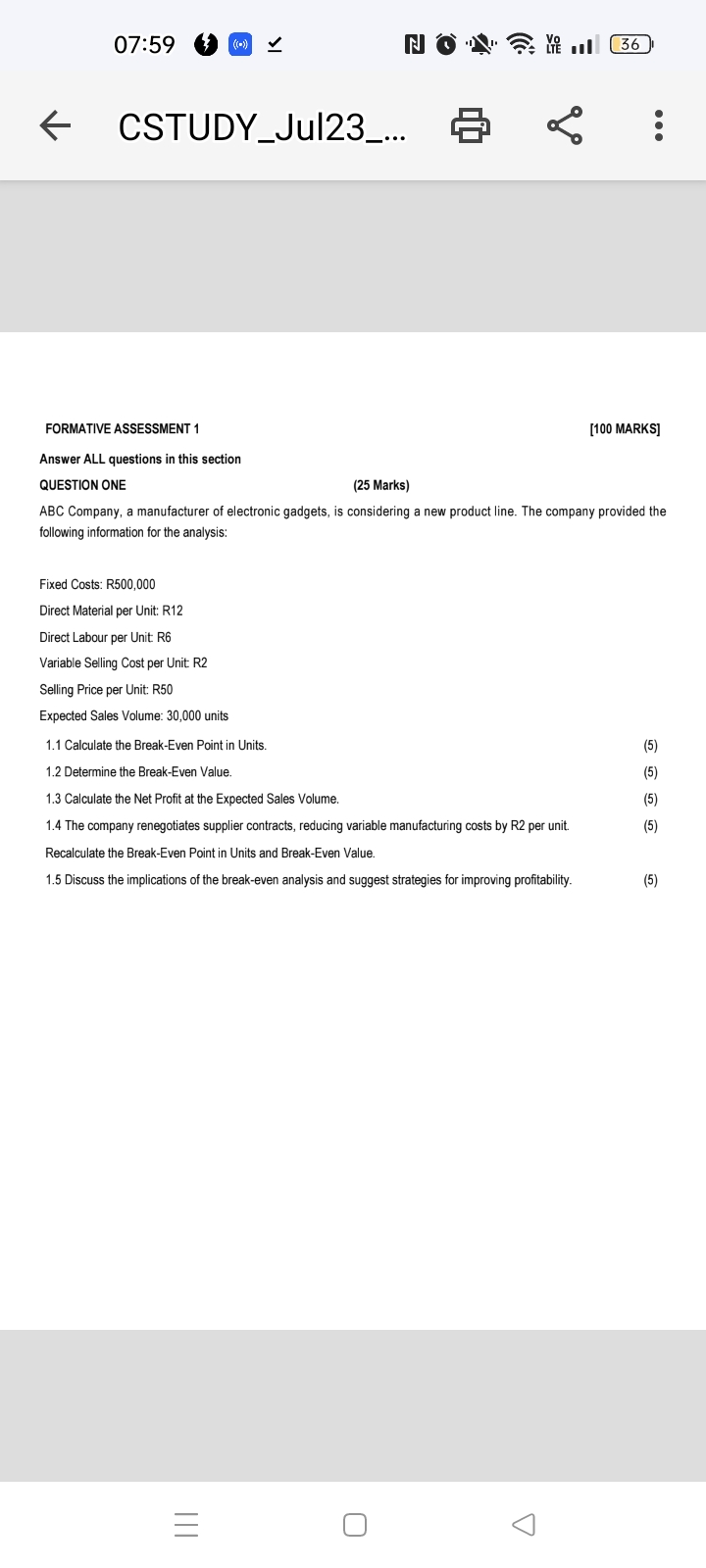

Explain how the company can improve on the following by providing two suggestions each: Inventory turnover period Trade receivables period QUESTION FOUR 4.1 (25 Marks) Complete the table for the transactions provided for each of the following methods of inventory valuation: 4.1.1 FIFO (7) 4.1.2 Weighted Average Cost. (Round off the weighted average cost per unit to the nearest cent and all other amounts to the nearest Rand. (6) Purchased Issued Stock on hand Date Quantity Price Value Quantity Price Value Quantity Price Value INFORMATION The following transactions of Audrey Manufacturers took place during May 2020 in respect of a component used in Project Alpha: May Transactions 01 Opening inventory 06 Issued to production 12 21 26 30 Purchased Issued to production Purchased Issued to production 150 units at R40 per unit 100 units 450 units at R42 per unit 400 units per unit 900 units at R45 per unit 700 units 07:59 ) NO CSTUDY_Jul23_... Statement of Financial Position as at 31 December: Assets Non-current assets Inventories Accounts receivable Cash Equity and liabilities Ordinary share capital Retained earnings Long-term loan Accounts payable Income tax payable ..I 36 8 2024 2023 R R 980 000 780 000 1 300 000 1 000 000 388 000 310 000 184 000 147 000 2 852 000 2 237 000 704 000 563 000 816 000 680 000 420 000 330 000 900 000 655 000 12 000 9 000 2 852 000 2 237 000 Additional information 1. All purchases and sales of inventories are on credit. The purchases for the year ended 31 December 2024 amounted to R2 500 000. REQUIRED 3.1 31 Use the information provided below to calculate the following ratios for 2024. Where applicable, round off answers to two decimal places. 3.1.1 Inventory turnover period 3.1.2 Trade receivables period 3.1.3 Trade payables period 3.1.4 Return on capital employed 3.1.5 Current ratio 3.1.6 Acid-test ratio ||| = (3) (3) (3) (4) (2) (2) 07:59 ) CSTUDY_Jul23_... NO QUESTION THREE INFORMATION (25 Marks) Excerpts of the financial data of Leo Limited for 2024 are as follows: Income statement for the year ended 31 December 2024 Sales Cost of sales Operating profit Interest expense Profit before tax Company tax ||| = 8 36 R 3 250 000 2 200 000 332 000 44 000 288 000 86 000 07:59 ) CSTUDY_Jul23_... NO 8 36 QUESTION TWO INFORMATION (25 Marks) The following information relates to two capital expenditure projects. Because of capital rationing, only one project can be accepted. Initial cost Expected life Scrap value (not included in the figures below) Expected net cash inflows: End of year: 1 2 3 4 5 The company estimates that its cost of capital is 12%. REQUIRED Use the information provided below to calculate the following: Project A Project B R1 000 000 R1 000 000 5 years 5 years R20 000 0 R R 240 000 290 000 260 000 290 000 280 000 290 000 360 000 290 000 300 000 290 000 2.1 Payback Period of Project B (answer expressed in years, months and days). (4) 2.2 Return on investment of Project A (answer expressed to two decimal places). (5) 2.3 Net Present Value of both projects. (10) 2 Internal Rate of Return of Project B (answer expressed to two decimal places). (6) ||| = 07:59 ) CSTUDY_Jul23_... FORMATIVE ASSESSMENT 1 Answer ALL questions in this section QUESTION ONE NO (25 Marks) 8 36 [100 MARKS] ABC Company, a manufacturer of electronic gadgets, is considering a new product line. The company provided the following information for the analysis: Fixed Costs: R500,000 Direct Material per Unit: R12 Direct Labour per Unit: R6 Variable Selling Cost per Unit: R2 Selling Price per Unit: R50 Expected Sales Volume: 30,000 units 1.1 Calculate the Break-Even Point in Units. 1.2 Determine the Break-Even Value. 1.3 Calculate the Net Profit at the Expected Sales Volume. 1.4 The company renegotiates supplier contracts, reducing variable manufacturing costs by R2 per unit. Recalculate the Break-Even Point in Units and Break-Even Value. 1.5 Discuss the implications of the break-even analysis and suggest strategies for improving profitability. ||| = (5) (5) (5) (5) (5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started