Answered step by step

Verified Expert Solution

Question

1 Approved Answer

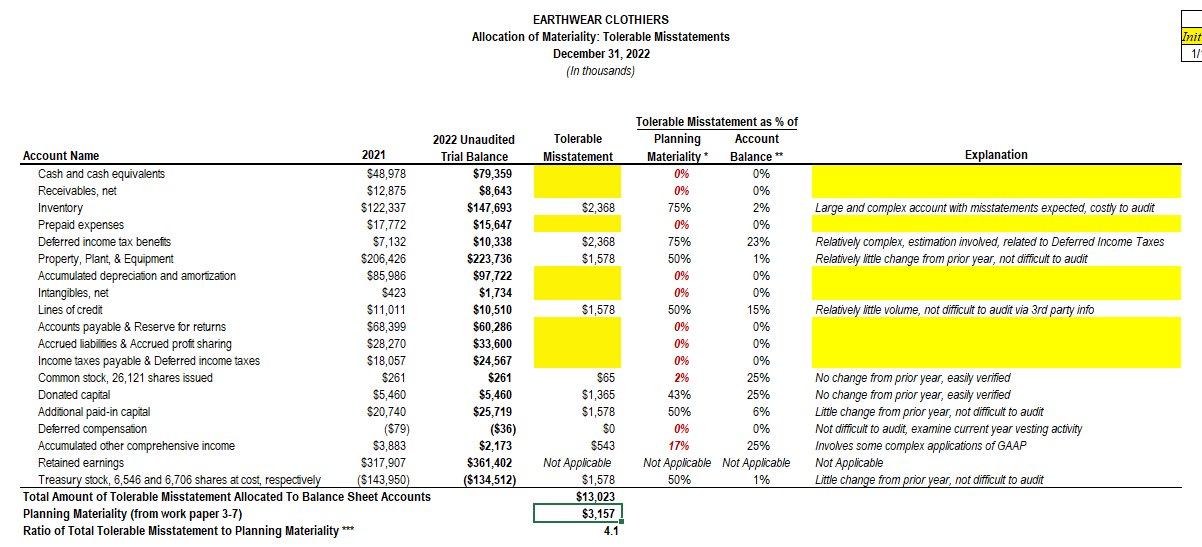

explain how to calcuate tolerable misstatement in this excel problem for the following highlighted in yellow color Account Name Cash and cash equivalents Receivables, net

explain how to calcuate tolerable misstatement in this excel problem for the following highlighted in yellow color

Account Name Cash and cash equivalents Receivables, net Inventory Prepaid expenses Deferred income tax benefits Property, Plant, & Equipment Accumulated depreciation and amortization Intangibles, net Lines of credit 2021 Planning Materiality (from work paper 3-7) Ratio of Total Tolerable Misstatement to Planning Materiality *** $48,978 $12,875 $122,337 $17,772 $7,132 $206,426 $85,986 $423 $11,011 $68,399 $28,270 Accounts payable & Reserve for returns Accrued liabilities & Accrued profit sharing Income taxes payable & Deferred income taxes Common stock, 26,121 shares issued Donated capital Additional paid-in capital Deferred compensation Accumulated other comprehensive income Retained earnings Treasury stock, 6,546 and 6,706 shares at cost, respectively Total Amount of Tolerable Misstatement Allocated To Balance Sheet Accounts $18,057 $261 $5,460 $20,740 ($79) $3,883 $317,907 ($143,950) EARTHWEAR CLOTHIERS Allocation of Materiality: Tolerable Misstatements December 31, 2022 (In thousands) 2022 Unaudited Trial Balance $79,359 $8,643 $147,693 $15,647 $10.338 $223,736 $97,722 $1,734 $10,510 $60,286 $33,600 $24,567 $261 $5,460 $25,719 ($36) $2,173 $361,402 ($134,512) Tolerable Misstatement $2,368 $2,368 $1,578 $1,578 $65 $1,365 $1,578 $0 $543 Not Applicable $1,578 $13,023 $3,157 4.1 Tolerable Misstatement as % of Account Balance ** Planning Materiality* 0% 0% 75% 0% 75% 50% 0% 0% 50% 0% 0% 0% 2% 0% 0% 2% 0% 23% 1% 0% 0% 15% 0% 0% 0% 25% 43% 25% 50% 6% 0% 0% 17% 25% Not Applicable Not Applicable 50% 1% Explanation Large and complex account with misstatements expected, costly to audit Relatively complex, estimation involved, related to Deferred Income Taxes Relatively little change from prior year, not difficult to audit Relatively little volume, not difficult to audit via 3rd party info No change from prior year, easily verified No change from prior year, easily verified Little change from prior year, not difficult to audit Not difficult to audit, examine current year vesting activity Involves some complex applications of GAAP Not Applicable Little change from prior year, not difficult to audit Init 1/

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the tolerable misstatement for the highlighted accounts in the provided information we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started