Explain in details by Excel if possible please

Explain in details by Excel if possible please

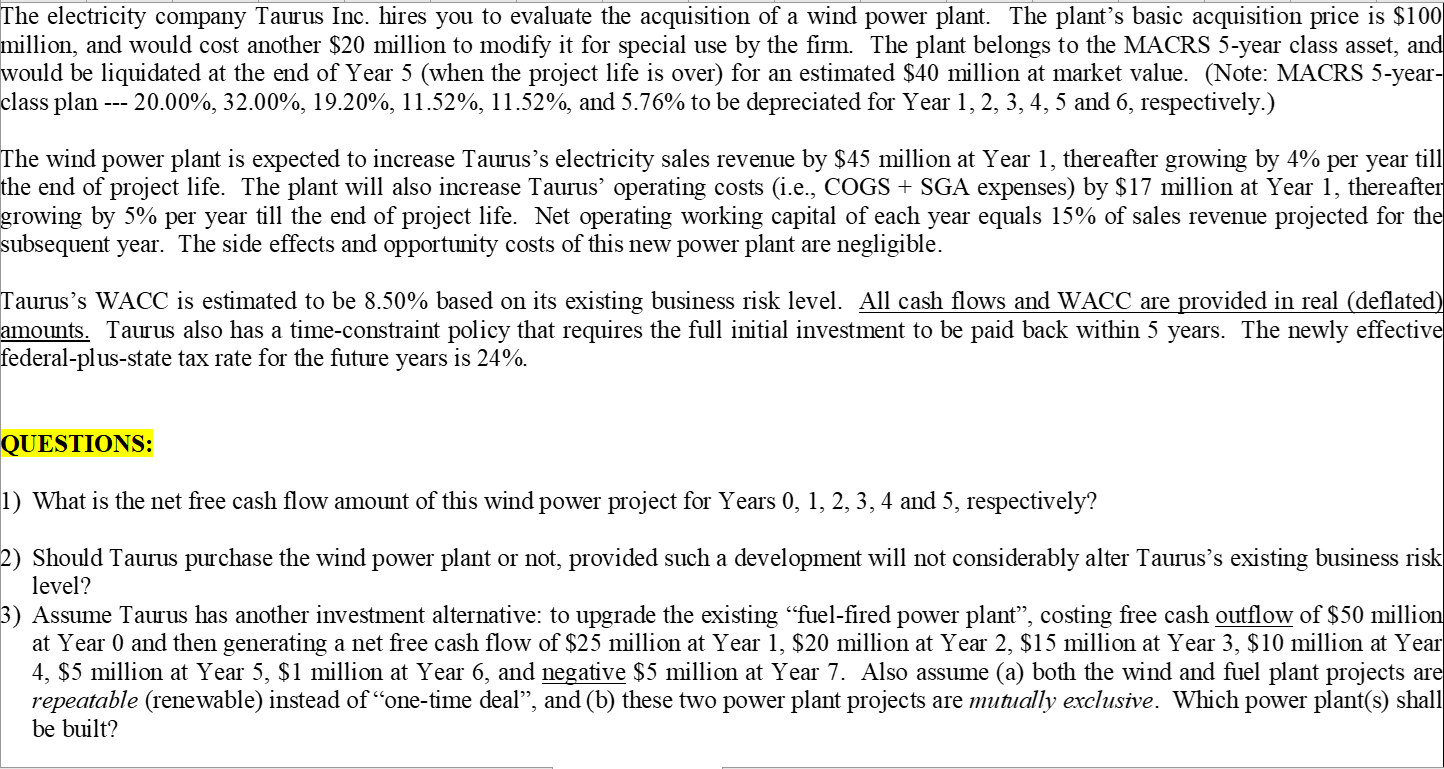

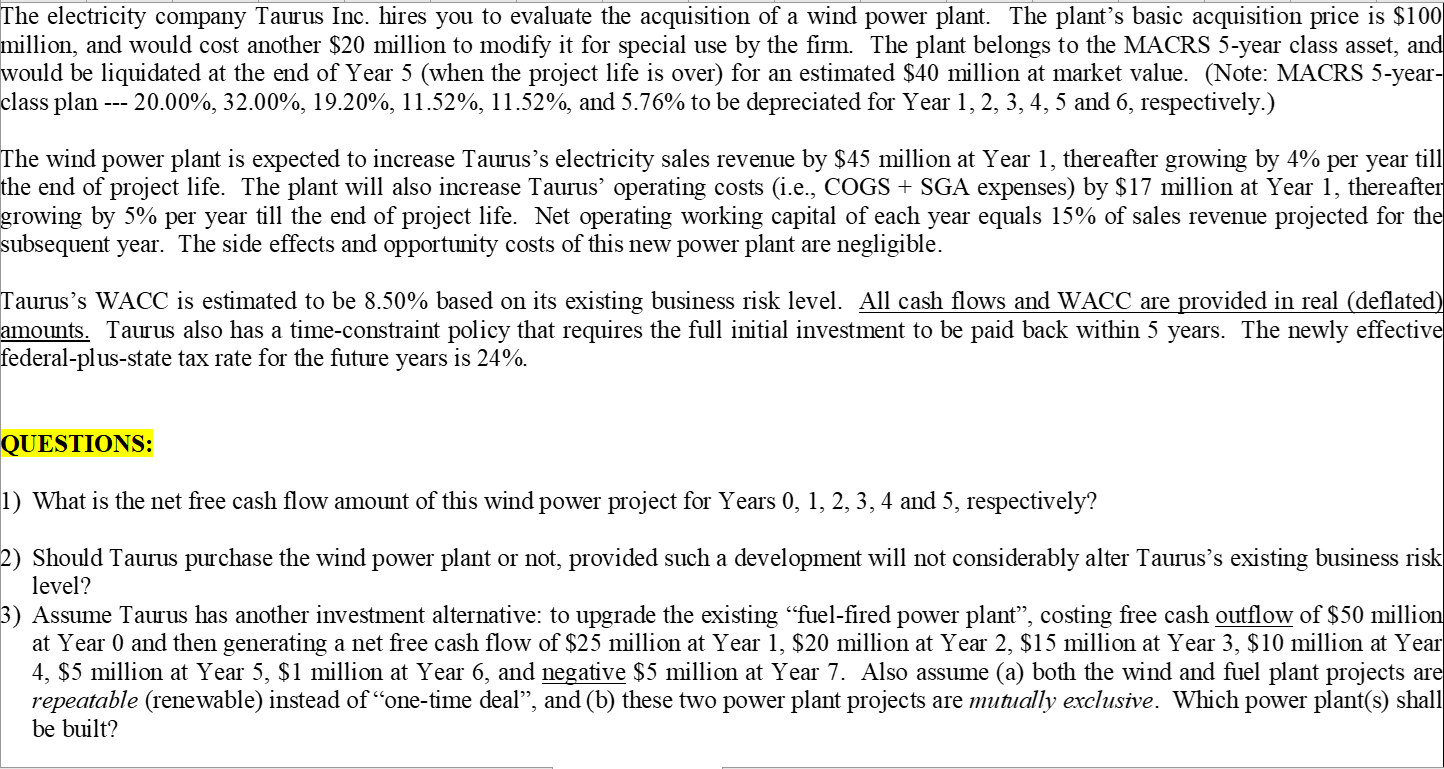

The electricity company Taurus Inc. hires you to evaluate the acquisition of a wind power plant. The plant's basic acquisition price is $100 million, and would cost another $20 million to modify it for special use by the firm. The plant belongs to the MACRS 5-year class asset, and would be liquidated at the end of Year 5 (when the project life is over) for an estimated $40 million at market value. (Note: MACRS 5-year- class plan 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76% to be depreciated for Year 1, 2, 3, 4, 5 and 6, respectively.) --- The wind power plant is expected to increase Taurus's electricity sales revenue by $45 million at Year 1, thereafter growing by 4% per year till the end of project life. The plant will also increase Taurus operating costs (i.e., COGS + SGA expenses) by $17 million at Year 1, thereafter growing by 5% per year till the end of project life. Net operating working capital of each year equals 15% of sales revenue projected for the subsequent year. The side effects and opportunity costs of this new power plant are negligible. Taurus's WACC is estimated to be 8.50% based on its existing business risk level. All cash flows and WACC are provided in real (deflated) amounts. Taurus also has a time-constraint policy that requires the full initial investment to be paid back within 5 years. The newly effective federal-plus-state tax rate for the future years 24%. QUESTIONS: 1) What is the net free cash flow amount of this wind power project for Years 0, 1, 2, 3, 4 and 5, respectively? 2) Should Taurus purchase the wind power plant or not, provided such a development will not considerably alter Taurus's existing business risk level? 3) Assume Taurus has another investment alternative: to upgrade the existing "fuel-fired power plant, costing free cash outflow of $50 million at Year 0 and then generating a net free cash flow of $25 million at Year 1, $20 million at Year 2, $15 million at Year 3, $10 million at Year 4, $5 million at Year 5, $1 million at Year 6, and negative $5 million at Year 7. Also assume (a) both the wind and fuel plant projects are repeatable (renewable) instead of one-time deal, and (b) these two power plant projects are mutually exclusive. Which power plant(s) shall be built

Explain in details by Excel if possible please

Explain in details by Excel if possible please