Question

Explain it step by step how to do this and process so I can understand. Also, where does calculation will go in the financial statements.

Explain it step by step how to do this and process so I can understand. Also, where does calculation will go in the financial statements. And appropriate journal entries of those changes. The Below I listed the financial statements I was provided.

Information:

The company decided early on in its history that its proprietary production data would be more effective if it built its own specialized production equipment. The company has earned much more than the initial outlay for its special production methods, despite the higher upfront costs for new equipment.Although the company has historically done this production in-house, a local university recently approached them to request that they provide them with equipment for producing specialty bags on their own. Due to the fact that many members of Saola's Board of Directors (and several of its major shareholders) are alumni of this university, Saola's management decided to sell the university a three machine system.

As part of the deal, Saola's management has insisted that the university also purchase a maintenance contract (which begins once the last machine is installed). In this way, Saola's engineers and machinists will be able to maintain the equipment, minimizing the risk of losing their competitive advantage. $920,000 is the total contract price for the machines and maintenance. By the end of 2022, Saola had installed both the first and third machines for which the university had paid $506,000. Saola's management team expects the final machine to be installed in January 2023, following which the maintenance contract will begin. The university will pay the balance of the contract once the last one has been installed.

Saola rounds all revenue allocation percentages to the nearest percentage point in order to ensure accuracy. Therefore, 12.333% (or 0.1233) would be rounded down to 12% (or .12). Saola will adjust the percentage for the last obligation (or the one that will be completed last) if the sum of the rounded percentages exceeds (or falls short) of 100% (or 1). When you round your percentages, if the sum doesn't equal 100% (if it gives you 99% or 101%), manually adjust the last obligation's percentage to 100%.(I'm also confused by this part, could you explain and show me how?)

Here are the instructions for calculation

Saola's management would like to know the effect of your adjustment on the following ratios:

* Profit Margin (Net Income / Net Sales)

* Current Ratio

* LONG

How to make the appropriate journal entries, if any, to reflect the installation of the machines (including any necessary adjustments to income tax expense) and the university's first payment. Assume Saola spent $184,000 on the first machine, $331,000 on the second, and $193,000 on the third. The average cost of the maintenance contract is $41,000. Saola's work building these machines has already been appropriately recorded in inventory.Make any necessary modifications to the financial statements. Include only the amount the client has paid.

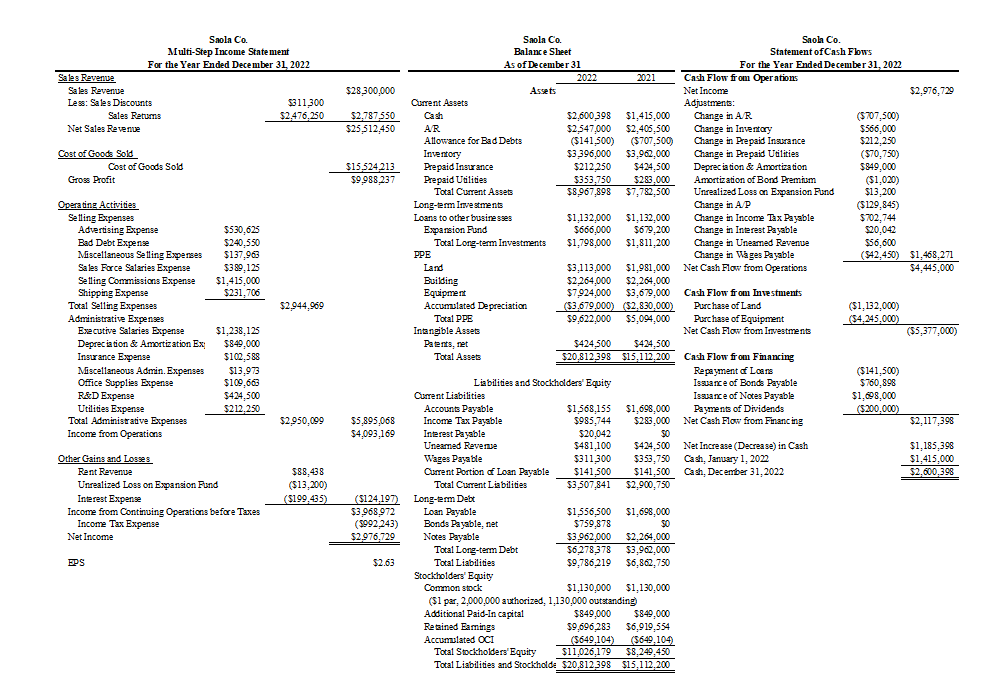

Financial Statements Listed Below:

Saola Ca Multi-Step Income Statement For the Year Ended December 31, 2022 Saola Ca Balance Sheet As of December 31 Saola Co. Statement of Cash Flows For the Year Ended December 31, 2022 Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Net Sales Revenue Cost of Goods Sold Cost of Goods Sold Gross Profit Operating Activities Selling Expenses Advertising Expense $530,625 Bad Debt Expense $240,550 Miscellaneous Selling Expenses $137,963 Sales Force Salaries Expense $389,125 Selling Commissions Expense $1,415,000 Shipping Expense $231,706 Total Selling Expenses $2,944,969 Administrative Expenses Executive Salaries Expense $1,238,125 Intangible Assets 2022 2021 Cash Flow from Operations $28,300,000 Assets Net Income $2,976,729 $311,300 $2,476,250 Current Assets Adjustments: $2,787,550 $25,512,450 Cash A/R Allowance for Bad Debts Inventory $15,524,213 Prepaid Insurance $212,250 $2,600,398 $1,415,000 $2,547,000 $2,405,500 ($141,500) ($707,500) $3,396,000 $3,962,000 $424,500 Change in A/R ($707,500) Change in Inventory $566,000 Change in Prepaid Insurance $212,250 Change in Prepaid Utilities ($70,750) Depreciation & Amortization $849,000 $9,988,237 Prepaid Utilities $353,750 $283,000 Total Current Assets $8,967,898 $7,782,500 Long-term Investments Amortization of Bond Premium Unrealized Loss on Expansion Fund Change in A/P ($1,020) $13,200 ($129,845) Loans to other businesses $1,132,000 $1,132,000 Change in Income Tax Payable $702,744 Expansion Fund Total Long-term Investments $666,000 $1,798,000 PPE Land Building Equipment Accumulated Depreciation Total PPE $679,200 $1,811,200 $3,113,000 $1,981,000 $2,264,000 $2,264,000 $7,924,000 $3,679,000 ($3,679,000) ($2,830,000) $9,622,000 $5,094,000 Change in Unearned Revenue Change in Wages Payable Net Cash Flow from Operations Cash Flow from Investments Purchase of Land Purchase of Equipment Net Cash Flow from Investments Change in Interest Payable $20,042 $56,600 ($42,450) $1,468,271 $4,445,000 ($1,132,000) ($4,245,000) ($5,377,000) Depreciation & Amortization Ex $849,000 Insurance Expense $102,588 Patents, net Total Assets $424,500 $20,812,398 $424,500 $15,112,200 Cash Flow from Financing Miscellaneous Admin. Expenses $13,973 Repayment of Loans ($141,500) Office Supplies Expense $109,663 Liabilities and Stockholders' Equity Issuance of Bonds Payable $760,898 R&D Expense $424,500 Current Liabilities Issuance of Notes Payable $1,698,000 Utilities Expense $212,250 Accounts Payable $1,568,155 $1,698,000 Payments of Dividends ($200,000) Total Administrative Expenses $2,950,099 $5,895,068 Income Tax Payable Income from Operations $4,093,169 Interest Payable $985,744 $20,042 $283,000 Net Cash Flow from Financing $2,117,398 $0 Unearned Revenue $481,100 $424,500 Net Increase (Decrease) in Cash $1,185,398 Other Gains and Losses Wages Payable $311,300 $353,750 Cash, January 1, 2022 $1,415,000 Rent Revenue $88,438 Current Portion of Loan Payable $141,500 $141,500 Cash, December 31,2022 $2,600,398 Unrealized Loss on Expansion Fund ($13,200) Total Current Liabilities $3,507,841 $2,900,750 Interest Expense ($199,435) ($124,197) Long-term Debt Income from Continuing Operations before Taxes $3,968,972 Loan Payable $1,556,500 $1,698,000 Income Tax Expense ($992,243) Bonds Payable, net $759,878 Net Income $2,976,729 Notes Payable $3,962,000 $2,264,000 Total Long-term Debt $6,278,378 $3,962,000 EPS $2.63 Total Liabilities $9,786,219 $6,862,750 Stockholders' Equity Common stock $1,130,000 $1,130,000 ($1 par, 2,000,000 authorized, 1,130,000 outstanding) $849,000 $849,000 Additional Paid-In capital Retained Earings Accumulated OCI Total Stockholders' Equity $9,696,283 $6,919,554 ($649,104) ($649,104) $11,026,179 $8,249,450 Total Liabilities and Stockhold: $20,812,398 $15,112,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started