Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain me detail how to solving it! Thanks!! I would like to submit on my tax return 2023 to the CRA of Canada. I got

Explain me detail how to solving it! Thanks!!

I would like to submit on my tax return 2023 to the CRA of Canada.

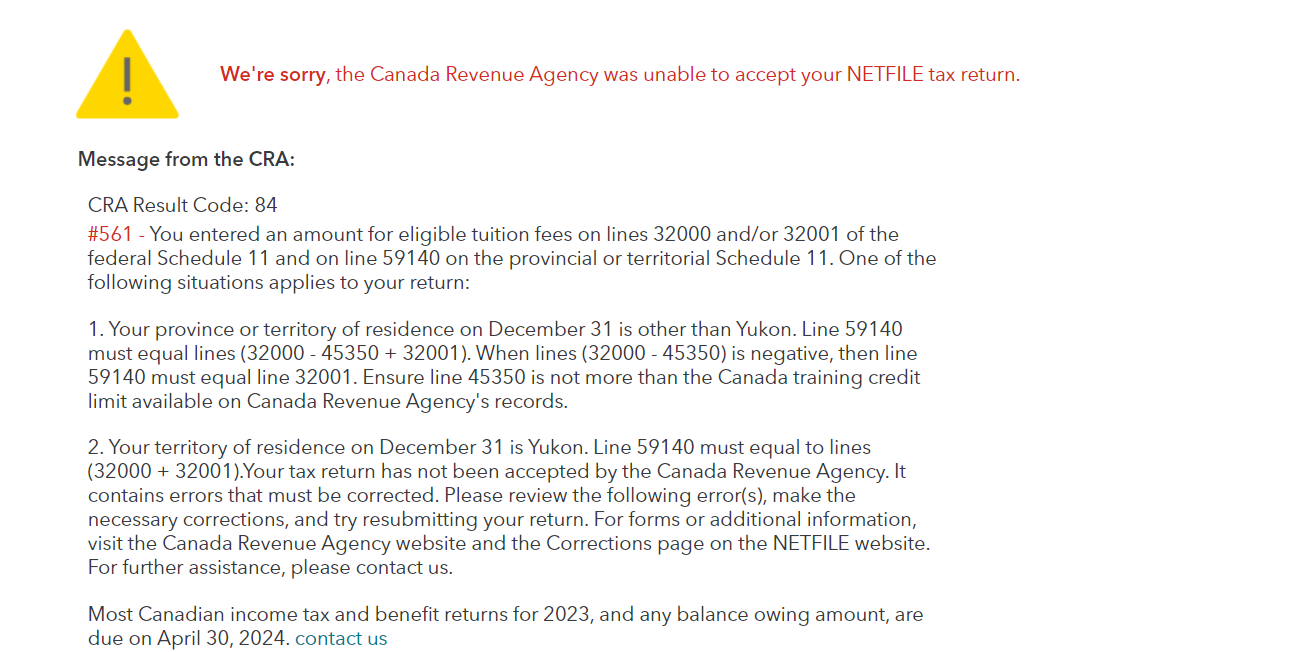

I got an error messages in the last page, and I want to know how to resolve to this.

We're sorry, the Canada Revenue Agency was unable to accept your NETFILE tax return. Message from the CRA: CRA Result Code: 84 #561 - You entered an amount for eligible tuition fees on lines 32000 and/or 32001 of the federal Schedule 11 and on line 59140 on the provincial or territorial Schedule 11. One of the following situations applies to your return: 1. Your province or territory of residence on December 31 is other than Yukon. Line 59140 must equal lines (32000-45350 + 32001). When lines (32000-45350) is negative, then line 59140 must equal line 32001. Ensure line 45350 is not more than the Canada training credit limit available on Canada Revenue Agency's records. 2. Your territory of residence on December 31 is Yukon. Line 59140 must equal to lines (32000 + 32001).Your tax return has not been accepted by the Canada Revenue Agency. It contains errors that must be corrected. Please review the following error(s), make the necessary corrections, and try resubmitting your return. For forms or additional information, visit the Canada Revenue Agency website and the Corrections page on the NETFILE website. For further assistance, please contact us. Most Canadian income tax and benefit returns for 2023, and any balance owing amount, are due on April 30, 2024. contact us

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started