Answered step by step

Verified Expert Solution

Question

1 Approved Answer

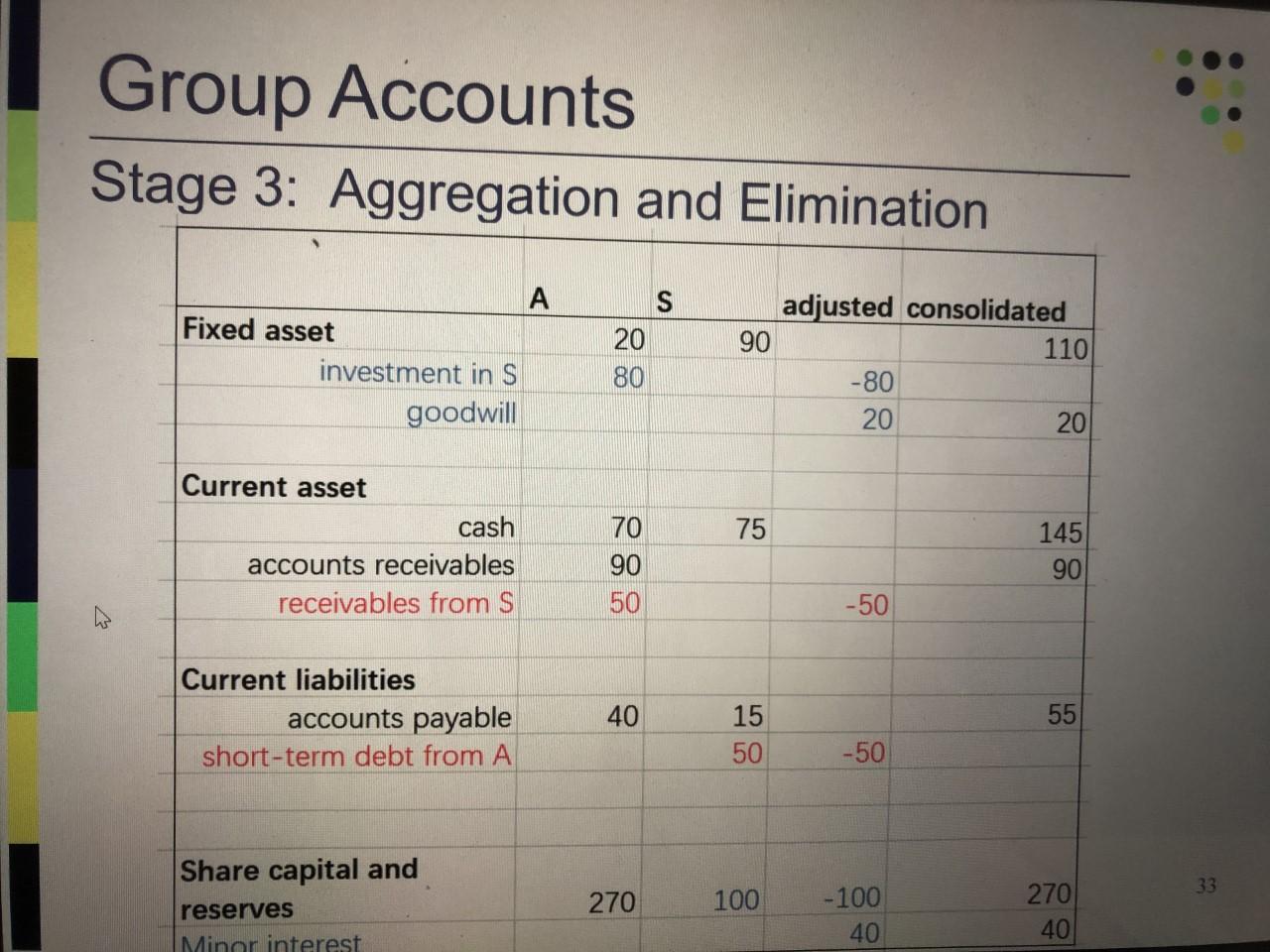

Explain me this exercice and the calculation of consolidation in details H owns 60% of the share capital of S, which it bought for 80m,

Explain me this exercice and the calculation of consolidation in details

H owns 60% of the share capital of S, which it bought for €80m, before S had begun trading, when its only asset was €100m in cash

Thus, Goodwill = €80 - 60 = €20

Minority Interest = 40% x €100 = €40

Before the end of the year, S had borrowed some funds from the group (€50), and a 3 rd party creditor (€15), and invested those, together with €25 of its cash in plant and machinery (fixed assets)

Group Accounts Stage 3: Aggregation and Elimination Fixed asset investment in S goodwill Current asset cash accounts receivables receivables from S Current liabilities accounts payable short-term debt from A Share capital and reserves Minor interest A 20 80 70 90 50 40 270 90 75 15 50 100 adjusted consolidated -80 20 -50 -50 -100 40 110 20 145 90 55 270 40 33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In this exercise we have a scenario where H the holding company owns 60 of the share capital of S the subsidiary H acquired its 60 stake in S for 80 m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started