Answered step by step

Verified Expert Solution

Question

1 Approved Answer

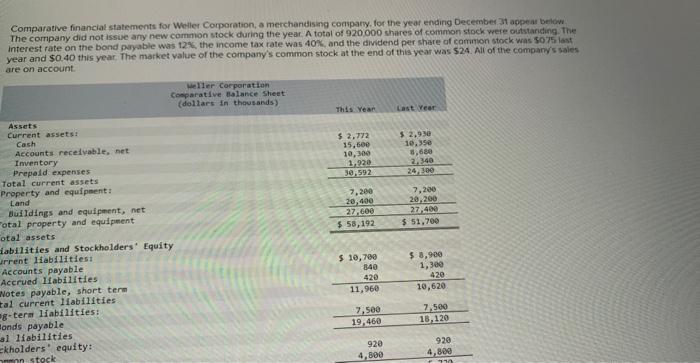

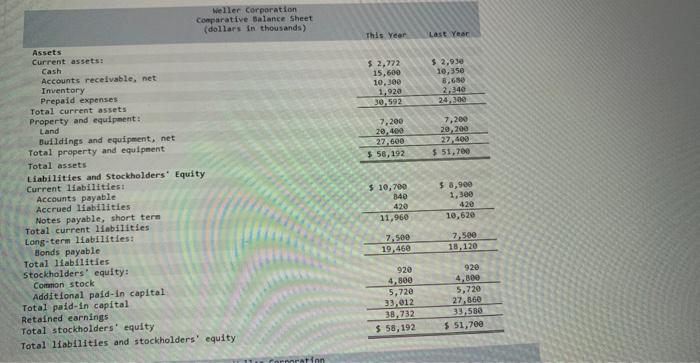

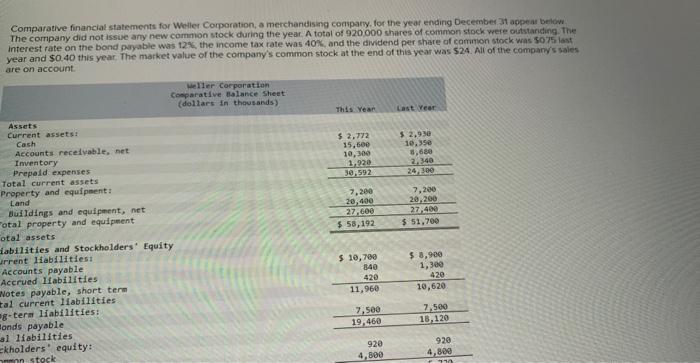

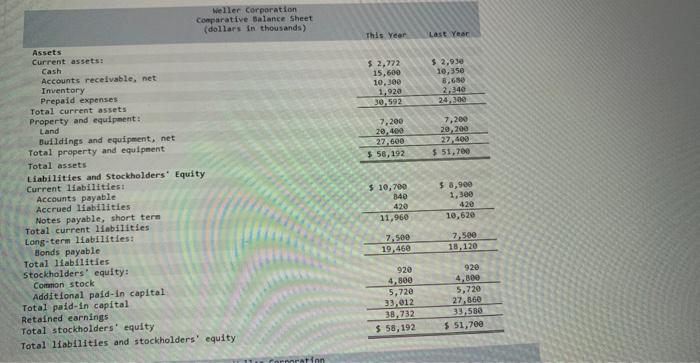

explain step by step with formulas please asap Comparative financial statements for Weller Corperation, a merchandising conspaty, for the year endirig December 3t appear below

explain step by step with formulas please

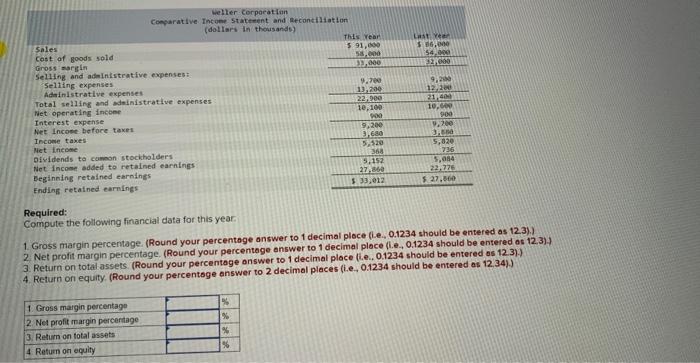

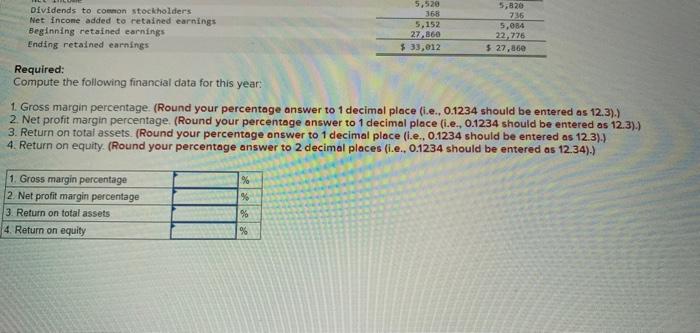

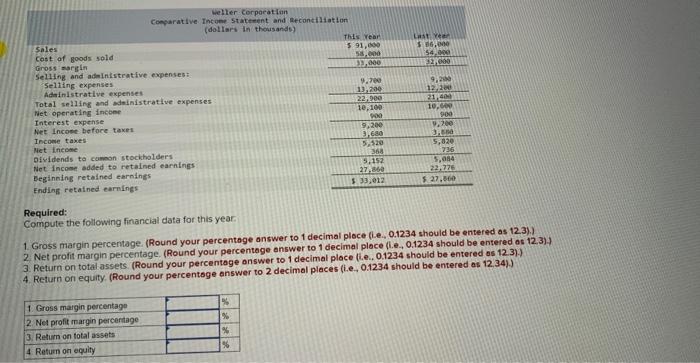

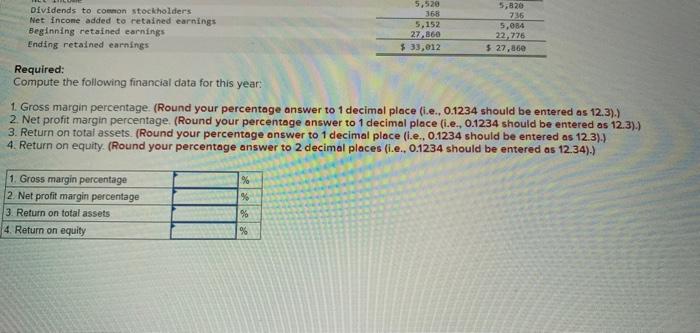

Comparative financial statements for Weller Corperation, a merchandising conspaty, for the year endirig December 3t appear below The company did not issise any new common stock during the year. A totol of 920.000 shimes of common stock were oiststariding. The interest rate on the bond paryable was 129g, the income tax rate was 40 Wh, and the dividend per share of campion stock was 5075 last year and $0.40 this year. The market yalue of the compary's common stock at the end of this year was 524 . Ali of the company's sales are on account. Weller corporation comparative Balance sheet (dollars in thousands) Thds veer Last year Assets Current assets: Cash Accounts recelvable, net Imventory Prepaid expenses: Total current assets Property and equlpent: Land Bulldings and equipment, net Total property and equipment \begin{tabular}{rr} $2,772 & $2,930 \\ 15,600 & 10,350 \\ 10,390 & 8,650 \\ 1,920 & 2,340 \\ \hline 30,592 & 24,300 \\ \hline 7,200 & 7,260 \\ 28,400 & 20,200 \\ \hline 27,600 & 27,400 \\ \hline$58,192 & $51,700 \\ \hline \end{tabular} Total assets Liabilities and Stockholders: Equity. Current liabilitiest Accounts payable Accrued liabilities Notes payable, short tern \begin{tabular}{rr} $10,700 & $8,920 \\ 840 & 1,300 \\ 420 & 420 \\ \hline 11,960 & 10,626 \end{tabular} Total current linbilities tong-term llabilitiest Honds payable \begin{tabular}{rr} 7,500 & 7,590 \\ \hline 19,460 & 18,120 \\ \hline \end{tabular} Total liabllities Stockholders" equity: Commen stock Additional paid-in capital Total paid-in capital Retained earnings Total stockholders' equity \begin{tabular}{rr} 920 & 920 \\ 4,800 & 4,800 \\ \hline 5,720 & 5,720 \\ 33,012 & 27,860 \\ \hline 38,732 & 33,580 \\ \hline$56,192 & $51,700 \\ \hline \end{tabular} Total liabllitles and stockholders' equity Required: Compute the following financial data for this year. 1. Gross margin percertage. (Round your percentoge answer to 1 decimal ploce (Le., 0.1234 should be entered as 12.3)) 2 Net profit margin percentage. (Round your percentoge onswer to 1 decimal ploce (l.e. 0.1234 should be entered as 12.3). 3. Return on total assets. (Round your percentage answer to 1 decimal place (lie., 0.1234 should be entered os 12.3).) 4. Return on equity. (Round your percentoge answer to 2 decimol places (i.e, 0.1234 should be entered as 12.34)) Required: Compute the following financial data for this year: 1. Gross margin percentage. (Round your percentage answer to 1 decimol place (i.e., 0.1234 should be entered as 12.3) ). 2. Net profit margin percentage. (Round your percentage answer to 1 decimal place (i.e., 0.1234 should be entered as 12 .3).) 3. Retum on totai assets. (Round your percentage onswer to 1 decimal place (i.e., 0.1234 should be entered as 12.3 ).) 4. Return on equity. (Round your percentage answer to 2 decimal places (i.e., 0.1234 should be entered as 12.34 ).) asap

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started