Explain the attachment

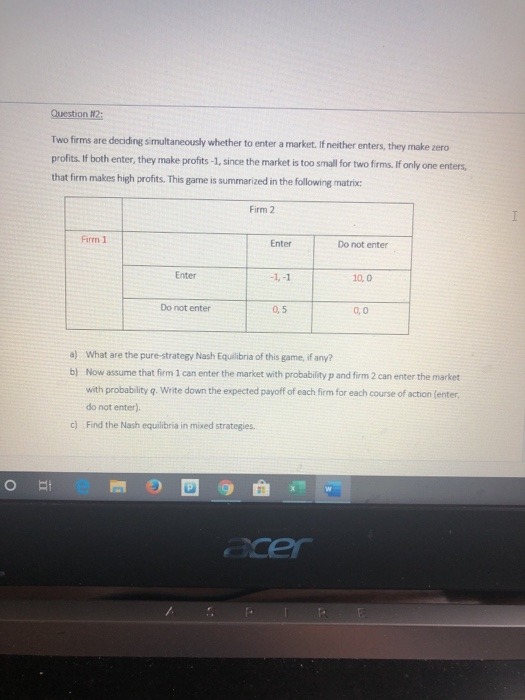

QUESTION 5 a) "Since debt capital is cheaper than equity, companies should resort to one hundred percent use of debt to finance the investment" Discuss the limitations of the above financial policy QUESTION 6 a) What are the differences between an "operating lease" and a "finance lease" QUESTION 7 a Discuss the main factors which a company should consider when determining the appropriate mix of long-term and short-term debt in its capital structure. ( b ) Malindi Leisure Industries is already highly geared by industry standards, but wishes to raise external capital to finance the development of a new beach resort. Outline the arguments for and against a rights issue by Malindi Leisure Industries. (c) Examine the relative merits of leasing versus hire purchase as a means of acquiring capital assets. QUESTION 8 (a List and explain five factors that should be taken into account by a businessman in making the choice between financing by short-term and long-term source (b) Enumerate four advantages of convertible bonds from the point of view of the borrower. If you want your dreams to become true `don't over-sleep. Unknown.Question #2; Two firms are deciding simultaneously whether to enter a market. If neither enters, they make zero profits. If both enter, they make profits -1, since the market is too small for two firms. If only one enters, that firm makes high profits. This game is summarized in the following matrix: Firm 2 H Firm 1 Enter Do not enter Enter -1, -1 10, 0 Do not enter 0. 5 al. What are the pure-strategy Nash Equilibria of this game, if any? by Now assume that firm 1 can enter the market with probability p and firm 2 can enter the market with probability q. Write down the expected payoff of each firm for each course of action (enter, do not enter). cl Find the Nash equilibria in mixed strategies. O e P W acerA1. Assume that Canada is an importer of televisions and that there are no trade restrictions. Canadian con- sumers buy 1 million televisions per year, of which 400 000 are produced domestically and 600 000 are imported. a. Suppose that a technological advance among Japa- nese television manufacturers causes the world price of televisions to fall by $100. Draw a graph to show how this change affects the welfare of Canadian consumers and Canadian producers and how it affects total surplus in Canada. b. After the fall in price, consumers buy 1.2 million televisions, of which 200 000 are produced domes- tically and 1 million are imported. Calculate the change in consumer surplus, producer surplus, and total surplus from the price reduction. c. If the government responded by putting a $100 tariff on imported televisions, what would this do? Calculate the revenue that would be raised and the deadweight loss. Would it be a good policy from the standpoint of Canadian welfare? Who might support the policy? Who might oppose it? d. Suppose that the fall in price is attributable not to technological advance but to a $100 per television subsidy from the Japanese government to Japanese industry. How would this affect your analysis