Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain the classification of the leases for machinery A and machinery B in accordance with MFRS 117 Leases b. Prepare the Statement of Financial

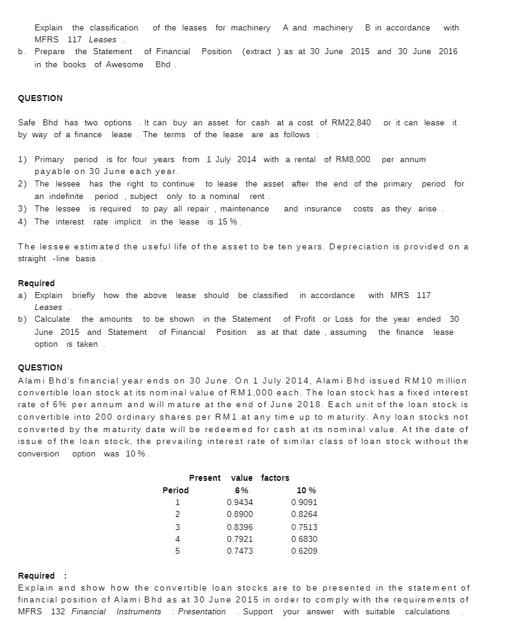

Explain the classification of the leases for machinery A and machinery B in accordance with MFRS 117 Leases b. Prepare the Statement of Financial Position (extract) as at 30 June 2015 and 30 June 2016 in the books of Awesome Bhd. QUESTION Safe Bhd has two options. It can buy an asset for cash at a cost of RM22,840 by way of a finance lease. The terms of the lease are as follows 1) Primary period is for four years from 1 July 2014 with a rental of RM8,000 per annum payable on 30 June each year 2) The lessee has the right to continue to lease the asset after the end of the primary period for an indefinite period subject only to a nominal rent 3) The lessee is required to pay all repair, maintenance and insurance costs as they arise 4) The interest rate implicit in the lease is 15% The lessee estimated the useful life of the asset to be ten years. Depreciation is provided on al straight line basis Required a) Explain briefly how the above lease should be classified in accordance with MRS 117 Leases b) Calculate the amounts to be shown in the Statement of Profit or Loss for the year ended 30 June 2015 and Statement of Financial Position as at that date assuming the finance lease option is taken QUESTION Alami Bhd's financial year ends on 30 June. On 1 July 2014, Alami Bhd issued RM10 million convertible loan stock at its nominal value of RM1,000 each. The loan stock has a fixed interest rate of 6% per annum and will mature at the end of June 2018. Each unit of the loan stock is convertible into 200 ordinary shares per RM1 at any time up to maturity. Any loan stocks not converted by the maturity date will be redeemed for cash at its nominal value. At the date of issue of the loan stock, the prevailing interest rate of similar class of loan stock without the conversion option was 10%. Period 1 2 3 4 5 or it can lease it Present value factors 6% 0.9434 0.8900 0.8396 0.7921 0.7473 10 % 0.9091 0.8264 0.7513 0.6830 0.6209 Required: Explain and show how the convertible loan stocks are to be presented in the statement of financial position of Alami Bhd as at 30 June 2015 in order to comply with the requirements of MFRS 132 Financial Instruments Presentation Support your answer with suitable calculations

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 a Classification of the Lease According to MRS 117 Leases leases are classified as either finance leases or operating leases based on the substance of the transaction rather than its ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started