Question

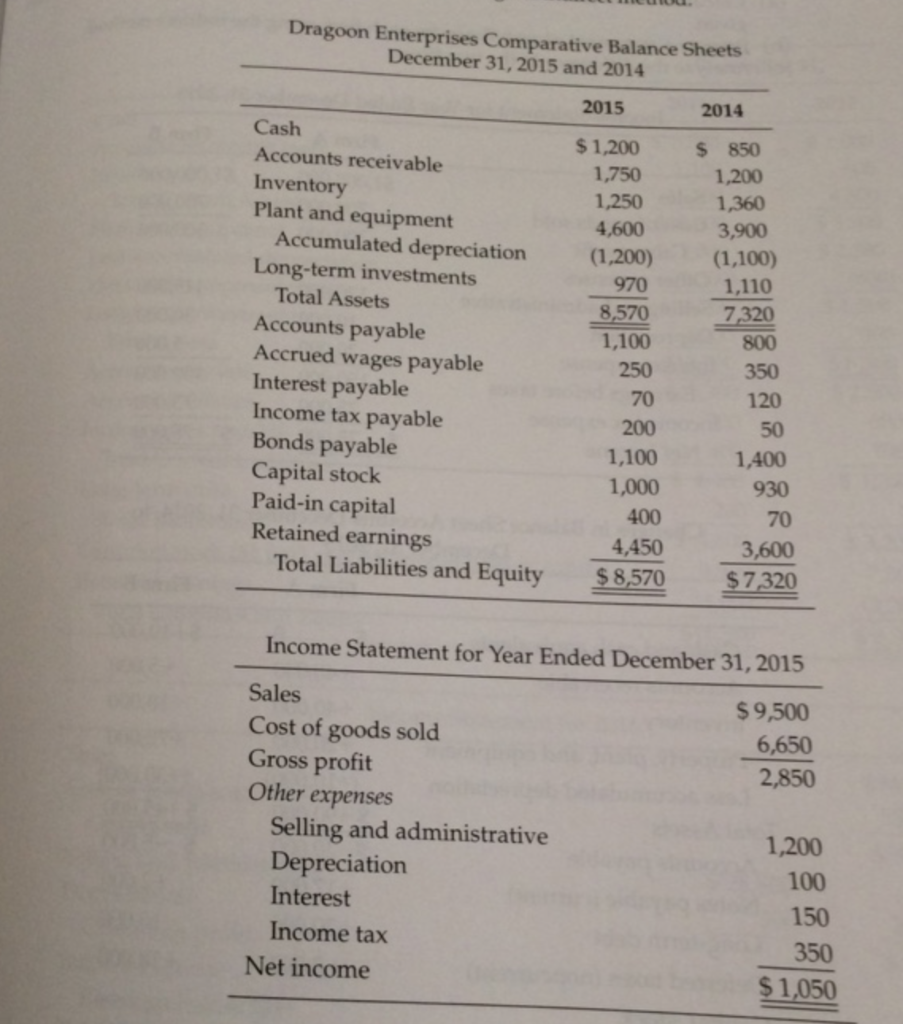

Explain the difference between net income and cash flow from operating activities for Dragoon in 2015. Analyze Dragoons cash flows for 2015. Prepare a statement

- Explain the difference between net income and cash flow from operating activities for Dragoon in 2015.

- Analyze Dragoons cash flows for 2015.

Prepare a statement of cash flows using the indirect method.

| Particulars | Amount (in $) | Amount (in $) |

| Net Income for the year | $ 1,050 | |

| Add: Provision for income tax | $ 350 | |

| Add: Provision Interest Payable | $ 150 | |

| Add: Depreciation | $ 100 | |

| Income before depreciation, interest and tax | $ 1,650 | |

| Less: Income tax Paid | $ (200) | |

| Profit after Tax | $ 1,450 | |

| Working Capital Adjustment: | ||

| Increase in accounts receivables | $ (550) | |

| Decrease in inventory | $ 110 | |

| Increase in accounts payable | $ 300 | |

| Decrease in wages payable | $ (100) | $ (240) |

| A. Cash from operating activities | $ 1,210 | |

| Purchase of plant and equipment | $ (700) | |

| Decrease In long term investment | $ 140 | |

| B. Cash from Investing Activities | $ (560) | |

| Interest paid (120 +150 70) | $ (200) | |

| Bonds Paid | $ (300) | |

| Increase in capital Stock | $ 70 | |

| Increase in Paid-in Capital | $ 330 | |

| Dividend paid | $ (200) | |

| C. Cash from Financing Activities | $ (300) | |

| Change in Cash | $ 350 | |

| Opening Balance of Cash | $ 850 | |

| Closing Balance of Cash | $ 1,200 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started