Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain the differences between the old international audit report and the new (extended) international audit report. Note: The old report is attached with this file

Explain the differences between the old international audit report and the new (extended) international audit report.

Note:

- The old report is attached with this file

- The new extended report is attached with this file.

How To Do It:

|

| Parts of the Audit Report | Old International Audit Report | New (Extended) International Audit Report |

| | Report title |

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

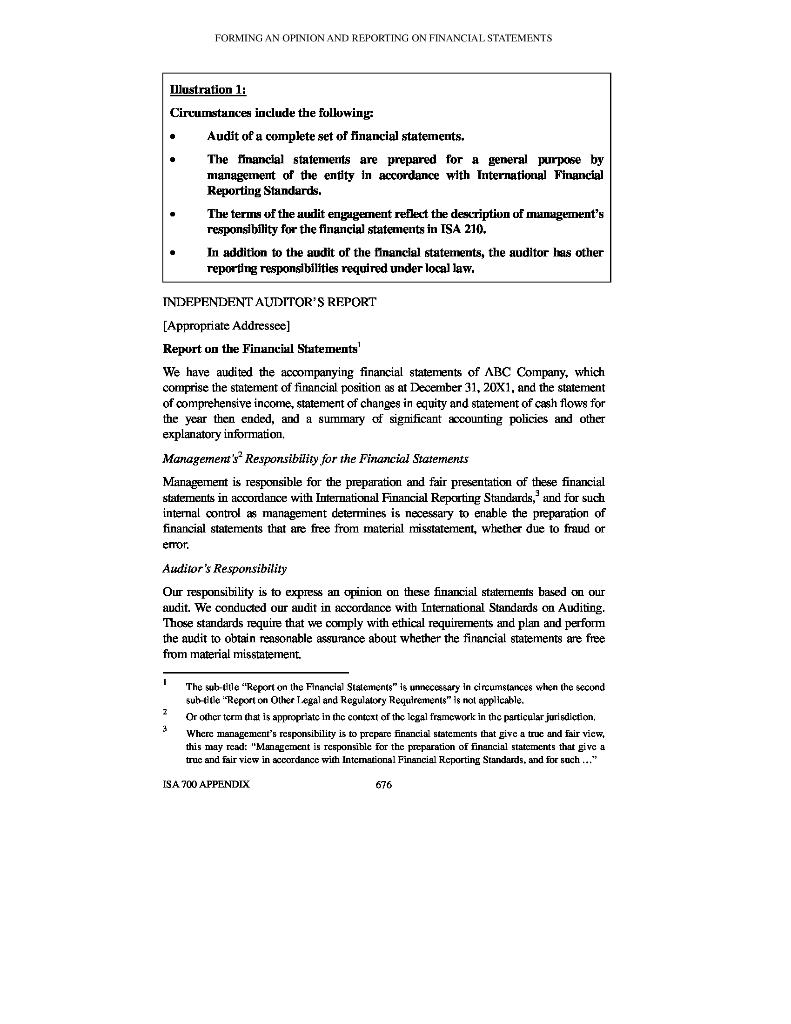

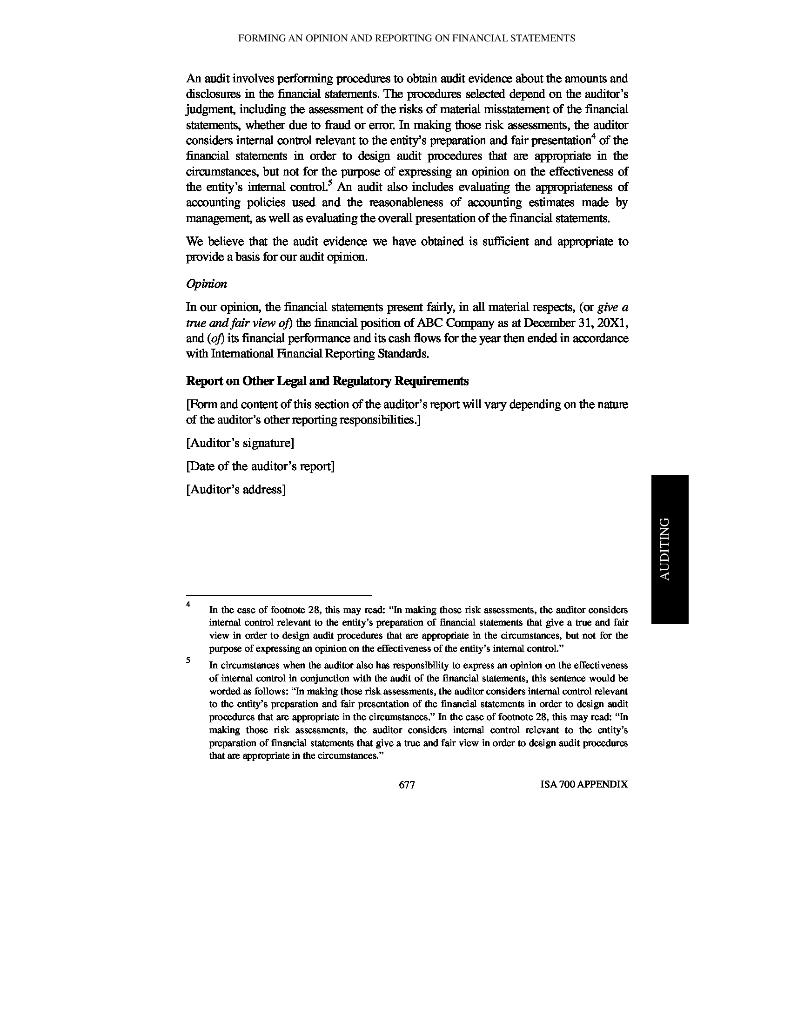

Old Report.

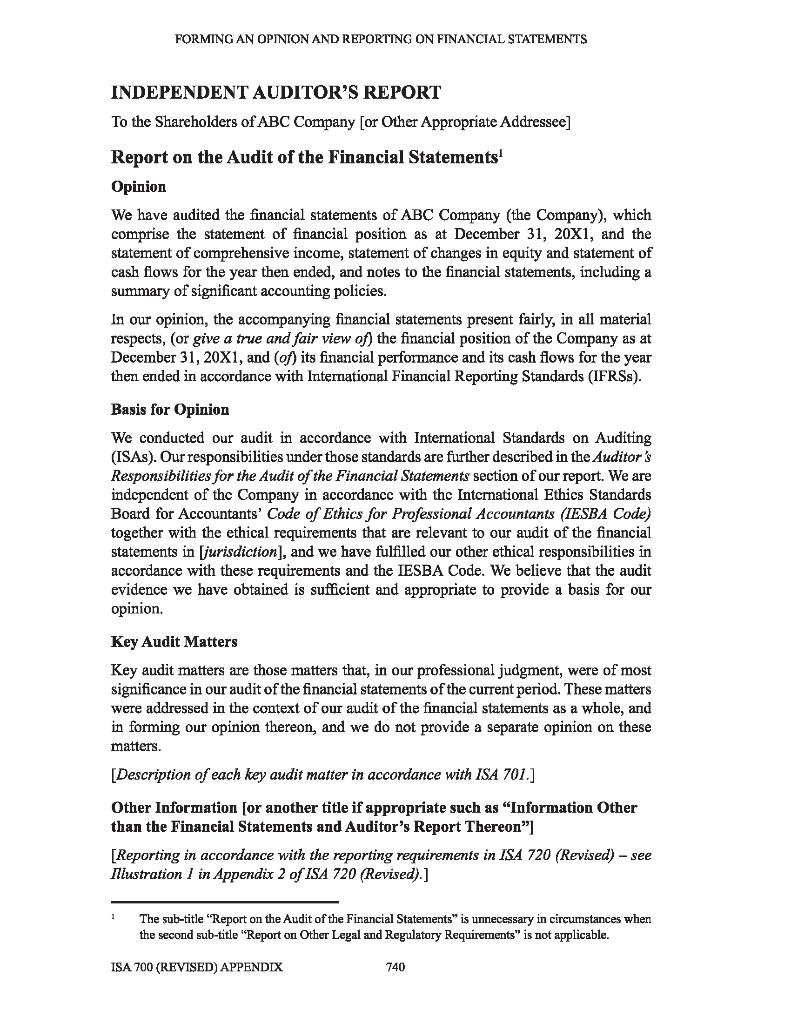

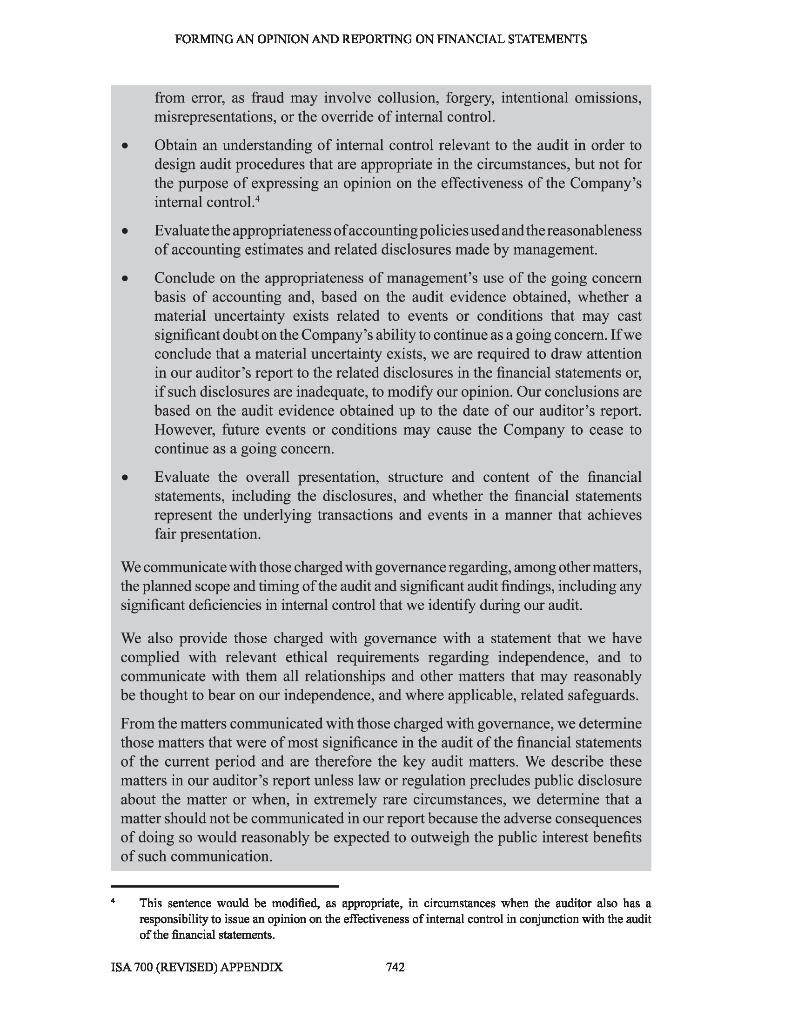

New Report.

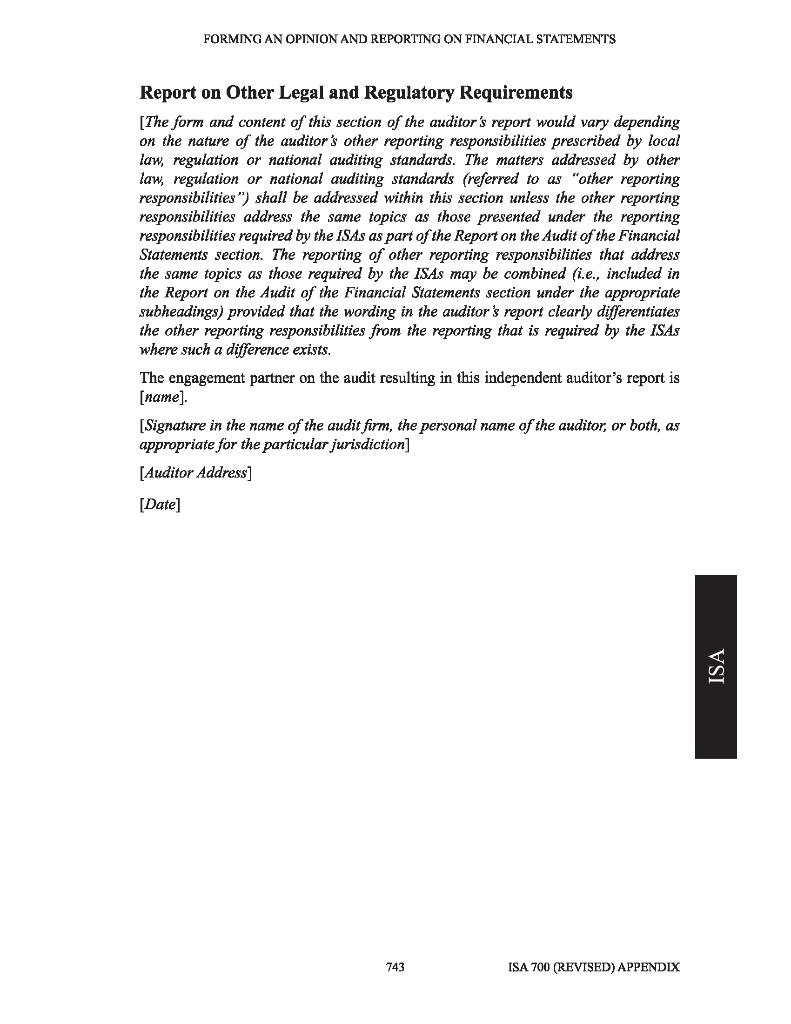

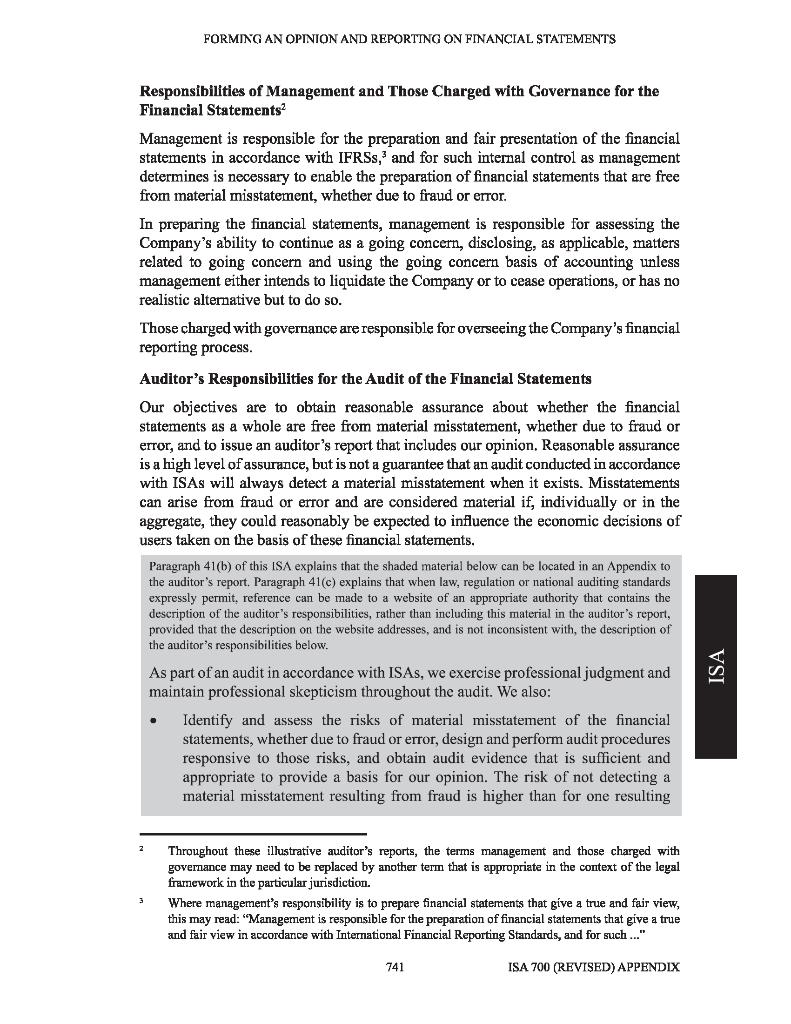

FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS Hlustration 1: Circumstances include the following: Audit of a complete set of financial statements. The financial statements are prepared for a general purpose by management of the entity in accordance with International Financial Reporting Standards. The terms of the audit engagement reflect the description of management's responsibility for the financial statements in ISA 210. In addition to the audit of the financial statements, the auditor has other reporting responsibilities required under local law. INDEPENDENT AUDITOR'S REPORT [Appropriate Addressee] Report on the Financial Statements' We have audited the accompanying financial statements of ABC Company, which comprise the statement of financial position as at December 31, 20X1, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, and a surnmary of significant accounting policies and other explanatory information Management's? Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with International Financial Reporting Standards, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor's Responsibility Our responsibility is to express an opinion on these financial staternents based on our audit. We conducted our audit in accordance with International Standards on Auditing, Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. 1 2 The subtitle "Report on the Financial Statements" is unnecessary in circumstances when the second subtitle Report on Other legal and Regulatory Requirements" is not applicable. or other term that is appropriate in the context of the legal framework in the particular jurisdiction, Where management's responsibility is to prepare financial statements that give a true and fair view, this may rcad: "Management is responsible for the preparation of financial statements that give a true and fair view in accordance with Intcmational Financial Reporting Standards, and for soch..." 3 ISA 700 APPENDIX 676 FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation the . financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management , as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion, Opinion In our opinion, the financial statements present fairly, in all material respects, (or give a true and fair view of the financial position of ABC Company as at December 31, 20X1, and (of its financial performance and its cash flows for the year then ended accordance with Intemational Financial Reporting Standards. Report on Other Legal and Regulatory Requirements Form and content of this section of the auditor's report will vary depending on the nature of the auditor's other reporting responsibilities.] [Auditor's signature] [Date of the auditor's report] [Auditor's address] AUDITING 5 In the care of footnotc 28, this may read: "In making those risk assessments, the auditor considers interal control relevant to the entity's preparation of financial statements that give a true and fair view in order to design audit procedures that are appropriate in the circumstances, but not for the purpose expressing an opinion on the effectiveness of the entity's internal control." In circumstances when the auditor also has responsibility lo express an opinion on the electiveness v inlemal control in conjunction with the audit of the financial slatements, this sentence would be worded as follows: 'In making those risk assessments, the auditor considers internal control relevant to the cntity's preparation and fair prcscntation of the financial statements in order to design sodit procedurcs that are appropriate in the circumstanccs." In the case of footnote 28, this may read: "In making those risk assaments, the auditor considers internal control relevant to the entity's preparation of financial statements that give a true and fair view in order to design sodit procedures that are appropriate in the circumstances." 677 ISA 700 APPENDIX FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS INDEPENDENT AUDITOR'S REPORT To the Shareholders of ABC Company (or Other Appropriate Addressee) Report on the Audit of the Financial Statements! Opinion We have audited the financial statements of ABC Company (the Company), which comprise the statement of financial position as at December 31, 20x1, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies. In our opinion, the accompanying financial statements present fairly, in all material respects, (or give a true and fair view of) the financial position of the Company as at December 31, 20X1, and (of) its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRSs). Basis for Opinion We conducted our audit in accordance with International Standards on Auditing (ISAS). Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Company in accordance with the International Ethics Standards Board for Accountants' Code of Ethics for Professional Accountants (IESBA Code) together with the ethical requirements that are relevant to our audit of the financial statements in (jurisdiction], and we have fulfilled our other ethical responsibilities in accordance with these requirements and the IESBA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Key Audit Matters Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current period. These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. [Description of each key audit matter in accordance with ISA 701.] Other Information for another title if appropriate such as "Information Other than the Financial Statements and Auditor's Report Thereon") [Reporting in accordance with the reporting requirements in ISA 720 (Revised) - see Nilustration Appendix 2 of ISA 720 (Revised).] 1 The sub-title "Report on the Audit of the Financial Statements" is unnecessary in circumstances when the second sub-title "Report on Other Legal and Regulatory Requirements" is not applicable. ISA 700 (REVISED) APPENDIX 740 FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS . . . from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control." Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. Conclude on the appropriateness of management's use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company's ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor's report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor's report. However, future events or conditions may cause the Company to cease to continue as a going concern. Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation. We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards. From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor's report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication. 4 This sentence would be modified, as appropriate, in circunstances when the auditor also has a responsibility to issue an opinion on the effectiveness of internal control in conjunction with the audit of the financial statements. ISA 700 (REVISED) APPENDIX 742 FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS Report on Other Legal and Regulatory Requirements [The form and content of this section of the auditor's report would vary depending on the nature of the auditor's other reporting responsibilities prescribed by local law, regulation or national auditing standards. The matters addressed by other law, regulation or national auditing standards (referred to as "other reporting responsibilities ") shall be addressed within this section unless the other reporting responsibilities address the same topics as those presented under the reporting responsibilities required by the ISAs as part of the Report on the Audit of the Financial Statements section. The reporting of other reporting responsibilities that address the same topics as those required by the ISAs may be combined (i.e., included in the Report on the Audit of the Financial Statements section under the appropriate subheadings) provided that the wording in the auditor's report clearly differentiates the other reporting responsibilities from the reporting that is required by the ISAs where such a difference exists. The engagement partner on the audit resulting in this independent auditor's report is [name]. [Signature in the name of the audit firm, the personal name of the auditor, or both, as appropriate for the particular jurisdiction] [Auditor Address] [Date] | ISA 743 ISA 700 (REVISED) APPENDIX FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS Responsibilities of Management and Those Charged with Governance for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with IFRSs, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is responsible for assessing the Company's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Company's financial reporting process. Auditor's Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion, Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. Paragraph 41(b) of this ISA explains that the shaded material below can be located in an Appendix to the auditor's report. Paragraph 41(c) explains that when law, regulation or national auditing standards expressly permit, reference can be made to a website of an appropriate authority that contains the description of the auditor's responsibilities, rather than including this material in the auditor's report, provided that the description on the website addresses, and is not inconsistent with the description of the auditor's responsibilities below. As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also: Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting ISA . 2 Throughout these illustrative auditor's reports, the terms management and those charged with govemance may need to be replaced by another term that is appropriate in the context of the legal framework in the particular jurisdiction. Where management's responsibility is to prepare financial statements that give a true and fair view, this may read: Management is responsible for the preparation of financial statements that give a true and fair view in accordar.ce with International Financial Reporting Standards, and for such ..." 741 ISA 700 (REVISED) APPENDIX FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS Hlustration 1: Circumstances include the following: Audit of a complete set of financial statements. The financial statements are prepared for a general purpose by management of the entity in accordance with International Financial Reporting Standards. The terms of the audit engagement reflect the description of management's responsibility for the financial statements in ISA 210. In addition to the audit of the financial statements, the auditor has other reporting responsibilities required under local law. INDEPENDENT AUDITOR'S REPORT [Appropriate Addressee] Report on the Financial Statements' We have audited the accompanying financial statements of ABC Company, which comprise the statement of financial position as at December 31, 20X1, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, and a surnmary of significant accounting policies and other explanatory information Management's? Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with International Financial Reporting Standards, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor's Responsibility Our responsibility is to express an opinion on these financial staternents based on our audit. We conducted our audit in accordance with International Standards on Auditing, Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. 1 2 The subtitle "Report on the Financial Statements" is unnecessary in circumstances when the second subtitle Report on Other legal and Regulatory Requirements" is not applicable. or other term that is appropriate in the context of the legal framework in the particular jurisdiction, Where management's responsibility is to prepare financial statements that give a true and fair view, this may rcad: "Management is responsible for the preparation of financial statements that give a true and fair view in accordance with Intcmational Financial Reporting Standards, and for soch..." 3 ISA 700 APPENDIX 676 FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation the . financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management , as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion, Opinion In our opinion, the financial statements present fairly, in all material respects, (or give a true and fair view of the financial position of ABC Company as at December 31, 20X1, and (of its financial performance and its cash flows for the year then ended accordance with Intemational Financial Reporting Standards. Report on Other Legal and Regulatory Requirements Form and content of this section of the auditor's report will vary depending on the nature of the auditor's other reporting responsibilities.] [Auditor's signature] [Date of the auditor's report] [Auditor's address] AUDITING 5 In the care of footnotc 28, this may read: "In making those risk assessments, the auditor considers interal control relevant to the entity's preparation of financial statements that give a true and fair view in order to design audit procedures that are appropriate in the circumstances, but not for the purpose expressing an opinion on the effectiveness of the entity's internal control." In circumstances when the auditor also has responsibility lo express an opinion on the electiveness v inlemal control in conjunction with the audit of the financial slatements, this sentence would be worded as follows: 'In making those risk assessments, the auditor considers internal control relevant to the cntity's preparation and fair prcscntation of the financial statements in order to design sodit procedurcs that are appropriate in the circumstanccs." In the case of footnote 28, this may read: "In making those risk assaments, the auditor considers internal control relevant to the entity's preparation of financial statements that give a true and fair view in order to design sodit procedures that are appropriate in the circumstances." 677 ISA 700 APPENDIX FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS INDEPENDENT AUDITOR'S REPORT To the Shareholders of ABC Company (or Other Appropriate Addressee) Report on the Audit of the Financial Statements! Opinion We have audited the financial statements of ABC Company (the Company), which comprise the statement of financial position as at December 31, 20x1, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies. In our opinion, the accompanying financial statements present fairly, in all material respects, (or give a true and fair view of) the financial position of the Company as at December 31, 20X1, and (of) its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRSs). Basis for Opinion We conducted our audit in accordance with International Standards on Auditing (ISAS). Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Company in accordance with the International Ethics Standards Board for Accountants' Code of Ethics for Professional Accountants (IESBA Code) together with the ethical requirements that are relevant to our audit of the financial statements in (jurisdiction], and we have fulfilled our other ethical responsibilities in accordance with these requirements and the IESBA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Key Audit Matters Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current period. These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. [Description of each key audit matter in accordance with ISA 701.] Other Information for another title if appropriate such as "Information Other than the Financial Statements and Auditor's Report Thereon") [Reporting in accordance with the reporting requirements in ISA 720 (Revised) - see Nilustration Appendix 2 of ISA 720 (Revised).] 1 The sub-title "Report on the Audit of the Financial Statements" is unnecessary in circumstances when the second sub-title "Report on Other Legal and Regulatory Requirements" is not applicable. ISA 700 (REVISED) APPENDIX 740 FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS . . . from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control." Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. Conclude on the appropriateness of management's use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company's ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor's report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor's report. However, future events or conditions may cause the Company to cease to continue as a going concern. Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation. We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards. From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor's report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication. 4 This sentence would be modified, as appropriate, in circunstances when the auditor also has a responsibility to issue an opinion on the effectiveness of internal control in conjunction with the audit of the financial statements. ISA 700 (REVISED) APPENDIX 742 FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS Report on Other Legal and Regulatory Requirements [The form and content of this section of the auditor's report would vary depending on the nature of the auditor's other reporting responsibilities prescribed by local law, regulation or national auditing standards. The matters addressed by other law, regulation or national auditing standards (referred to as "other reporting responsibilities ") shall be addressed within this section unless the other reporting responsibilities address the same topics as those presented under the reporting responsibilities required by the ISAs as part of the Report on the Audit of the Financial Statements section. The reporting of other reporting responsibilities that address the same topics as those required by the ISAs may be combined (i.e., included in the Report on the Audit of the Financial Statements section under the appropriate subheadings) provided that the wording in the auditor's report clearly differentiates the other reporting responsibilities from the reporting that is required by the ISAs where such a difference exists. The engagement partner on the audit resulting in this independent auditor's report is [name]. [Signature in the name of the audit firm, the personal name of the auditor, or both, as appropriate for the particular jurisdiction] [Auditor Address] [Date] | ISA 743 ISA 700 (REVISED) APPENDIX FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS Responsibilities of Management and Those Charged with Governance for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with IFRSs, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is responsible for assessing the Company's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Company's financial reporting process. Auditor's Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion, Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. Paragraph 41(b) of this ISA explains that the shaded material below can be located in an Appendix to the auditor's report. Paragraph 41(c) explains that when law, regulation or national auditing standards expressly permit, reference can be made to a website of an appropriate authority that contains the description of the auditor's responsibilities, rather than including this material in the auditor's report, provided that the description on the website addresses, and is not inconsistent with the description of the auditor's responsibilities below. As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also: Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting ISA . 2 Throughout these illustrative auditor's reports, the terms management and those charged with govemance may need to be replaced by another term that is appropriate in the context of the legal framework in the particular jurisdiction. Where management's responsibility is to prepare financial statements that give a true and fair view, this may read: Management is responsible for the preparation of financial statements that give a true and fair view in accordar.ce with International Financial Reporting Standards, and for such ..." 741 ISA 700 (REVISED) APPENDIX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started