Explain the differences between the short run and the long run in economics.

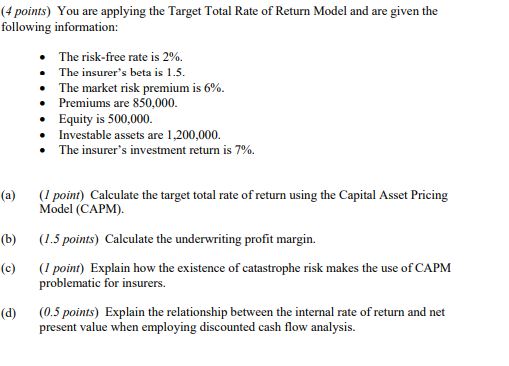

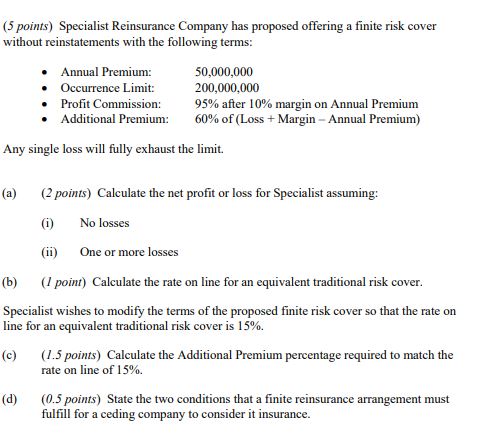

(4 points) You are applying the Target Total Rate of Return Model and are given the following information: The risk-free rate is 2%. The insurer's beta is 1.5. The market risk premium is 6%. Premiums are 850,000. Equity is 500,000. Investable assets are 1,200,000. The insurer's investment return is 7%. (a) (/ point) Calculate the target total rate of return using the Capital Asset Pricing Model (CAPM). (b) (1.5 points) Calculate the underwriting profit margin. (c) (/ point) Explain how the existence of catastrophe risk makes the use of CAPM problematic for insurers. (d) (0.5 points) Explain the relationship between the internal rate of return and net present value when employing discounted cash flow analysis.(5 points) Specialist Reinsurance Company has proposed offering a finite risk cover without reinstatements with the following terms: Annual Premium: 50.000,000 Occurrence Limit: 200,000,000 . Profit Commission: 95% after 10% margin on Annual Premium Additional Premium: 60% of (Loss + Margin - Annual Premium) Any single loss will fully exhaust the limit. (a) (2 points) Calculate the net profit or loss for Specialist assuming: (i) No losses (ii) One or more losses (b) (/ point) Calculate the rate on line for an equivalent traditional risk cover. Specialist wishes to modify the terms of the proposed finite risk cover so that the rate on line for an equivalent traditional risk cover is 15%. (9) (1.5 points) Calculate the Additional Premium percentage required to match the rate on line of 15%. (d) (0.5 points) State the two conditions that a finite reinsurance arrangement must fulfill for a ceding company to consider it insurance.Explain what the AD curve represents and what are the five factors that cause the AD to shift. Discuss how to use quantitative easing to stimulate aggregate demand. Discuss the drawbacks of the monetary policv and the fiscal policv. Discuss in detail the steps in the evaluation process. Describe the characteristics of quality,r evaluations. Discuss in detail the six steps involved in the consulting process. Discuss the advantages and disadvantages of internal evaluators. Discuss the advantages and disadvantages of external evaluators