Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain the differences in the valuation process of a matured company and bank. (6 marks) b) Company BBB is one of Country B's largest

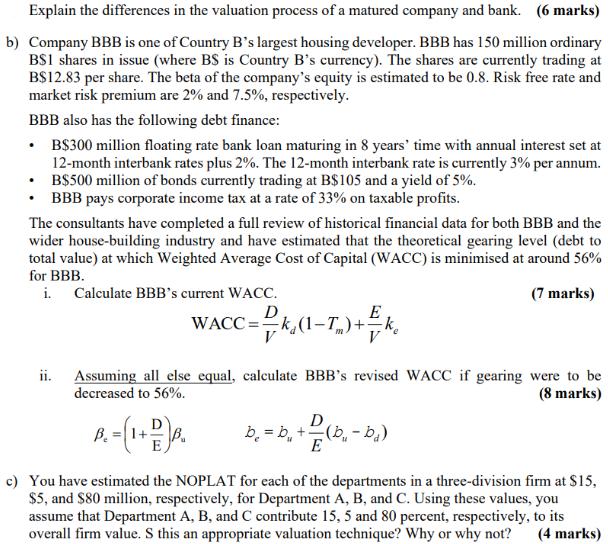

Explain the differences in the valuation process of a matured company and bank. (6 marks) b) Company BBB is one of Country B's largest housing developer. BBB has 150 million ordinary BSI shares in issue (where BS is Country B's currency). The shares are currently trading at B$12.83 per share. The beta of the company's equity is estimated to be 0.8. Risk free rate and market risk premium are 2% and 7.5%, respectively. BBB also has the following debt finance: B$300 million floating rate bank loan maturing in 8 years' time with annual interest set at 12-month interbank rates plus 2%. The 12-month interbank rate is currently 3% per annum. B$500 million of bonds currently trading at B$105 and a yield of 5%. BBB pays corporate income tax at a rate of 33% on taxable profits. . The consultants have completed a full review of historical financial data for both BBB and the wider house-building industry and have estimated that the theoretical gearing level (debt to total value) at which Weighted Average Cost of Capital (WACC) is minimised at around 56% for BBB. i. (7 marks) ii. Calculate BBB's current WACC. D E c= /k (1-T) + / k V WACC= Assuming all else equal, calculate BBB's revised WACC if gearing were to be decreased to 56%. (8 marks) B. =(1+D) B b = b + D E (b-b) c) You have estimated the NOPLAT for each of the departments in a three-division firm at $15, $5, and $80 million, respectively, for Department A, B, and C. Using these values, you assume that Department A, B, and C contribute 15, 5 and 80 percent, respectively, to its overall firm value. S this an appropriate valuation technique? Why or why not? (4 marks)

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The key differences in the valuation process of a mature company versus a bank are Mature companie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started