Answered step by step

Verified Expert Solution

Question

1 Approved Answer

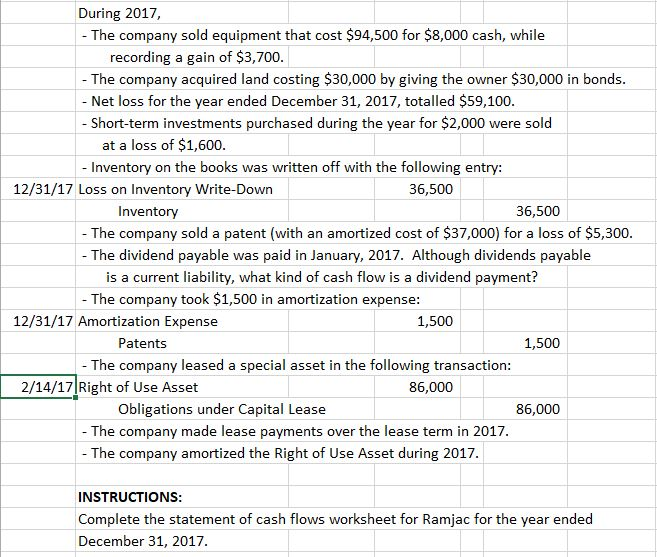

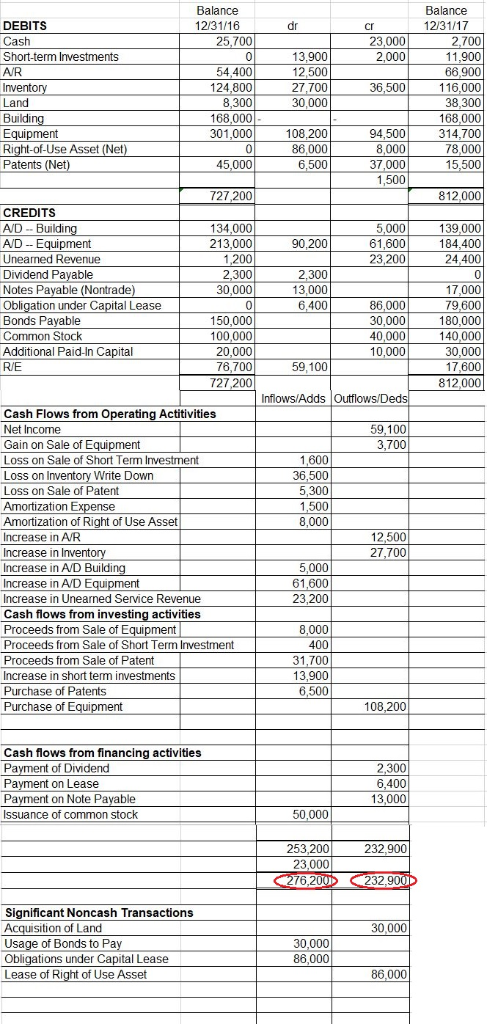

Explain the mistake in my work that made the ending numbers (circled in red) unequal. The first image presents a list of transactions that took

Explain the mistake in my work that made the ending numbers (circled in red) unequal. The first image presents a list of transactions that took place and effected the following Statement of Cash Flows. Any change in balance from the end of 2016 to the end of 2017 that could not be known from the information given in the first image was deduced by looking at the difference between the 2016 and 2017 balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started