Question

The following internal benchmarks and bank covenants: 1). Current Ratio must remain above 2.5x at month end 2). Minimum Cash Balance must be above $10,000

The following internal benchmarks and bank covenants:

1). Current Ratio must remain above 2.5x at month end

2). Minimum Cash Balance must be above $10,000 at month end

Explain the reasoning behind each choice made :

1); A supplier has sent an email proposing the following deal to you:

1A: To buy the usual 500 units on account for $1,250; or

1B: To buy the usual 500 units but with cash and receive a 20% discount

Select one: A or B

2): The Company has the opportunity to make a huge (and rare) sale:

2A: To sell the unit for $10,000 but the customer wants to pay only 20% cash and the remaining 80% on account; or

2B: To sell the unit for $5,000 cash

Note: The inventory had cost the Company $1,250.

Select one: A or B

3): A repeat VIP customer has approached the Company requesting an express order:

3A: The Company's supplier will only rush the order with a 30% markup paid in full with cash. This will cost the Company $15,000 and the customer cannot pay until next month when the unit is delivered (note: revenue criteria not met until delivered). They are offering $50,000 cash for all the trouble; or

3B: Kindly reject the VIP customer's offer risking the business relationship altogether.

Select one: A or B

4): A replacement part for an employee's laptop was purchased for $1,200 cash. This is expected to extend the useful life of the laptop by an additional 3 years. You are conflicted by your coworkers' opinions but must choose one of the following:

4A: To agree with Bob who believes this purchase is an asset as it extends the life of the laptop

4B: To agree with Amy who believes its an expense as the amount is nominal

Select one: A or B

5): An invoice was received for repair work done last week costing $3,500:

5A: To pay the invoice within 3 days of receipt taking advantage of the 2% discount available

5B: To delay payment of the invoice until next month, when due, however, no discount will be applied

Select one: A or B

Prepare journal entries for each question.

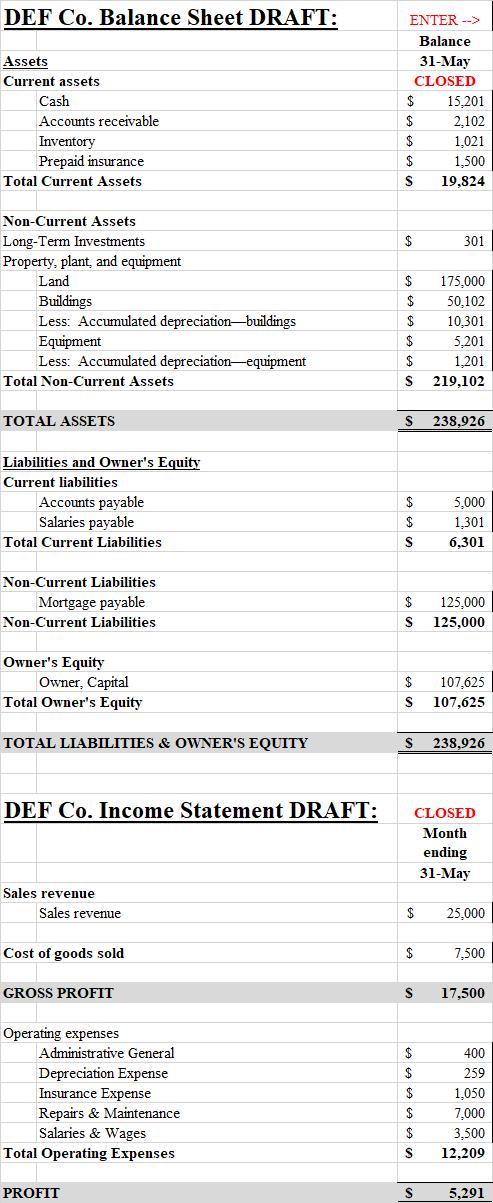

DEF Co. Balance Sheet DRAFT: Assets Current assets Cash Accounts receivable Inventory Prepaid insurance Total Current Assets Non-Current Assets Long-Term Investments Property, plant, and equipment Land Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated depreciation-equipment Total Non-Current Assets TOTAL ASSETS Liabilities and Owner's Equity Current liabilities Accounts payable Salaries payable Total Current Liabilities Non-Current Liabilities Mortgage payable Non-Current Liabilities Owner's Equity Owner, Capital Total Owner's Equity TOTAL LIABILITIES & OWNER'S EQUITY DEF Co. Income Statement DRAFT: Sales revenue Sales revenue Cost of goods sold GROSS PROFIT Operating expenses Administrative General Depreciation Expense Insurance Expense Repairs & Maintenance Salaries & Wages Total Operating Expenses PROFIT ENTER --> Balance 31-May CLOSED $ $ $ $ S $ $ $ $ $ $ S S $ $ S $ $ S 15,201 2,102 1,021 1,500 19,824 $ 125,000 S 125,000 301 $ 107,625 S 107,625 $ $ $ 175,000 50,102 10,301 S 238,926 $ $ S 5,201 1,201 219,102 S 238,926 CLOSED Month ending 31-May 5,000 1.301 6,301 25,000 7,500 17,500 400 259 1,050 7,000 3,500 12,209 5,291

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Option B should be selected as it offers a 20 discount for paying with cash This will decrease the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started