Answered step by step

Verified Expert Solution

Question

1 Approved Answer

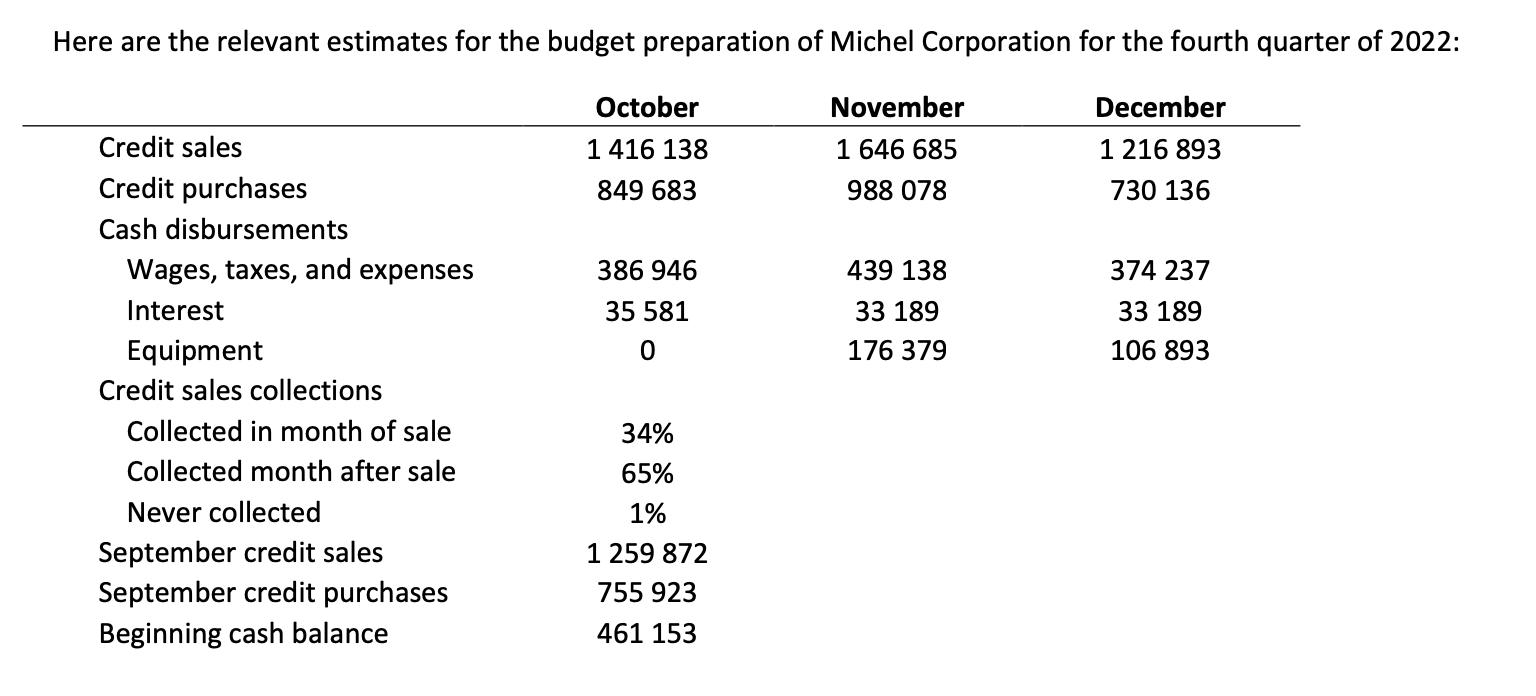

Explain the role of cash budget. 2.2 Using the below information, complete the following cash budget. Assume that all credit purchases are paid one month

Explain the role of cash budget.

2.2 Using the below information, complete the following cash budget. Assume that all credit purchases are paid one month after the purchase.

October | November | December | |

Beginning cash balance | |||

Cash receipts | |||

Cash collections from credit sales | |||

Total cash available | |||

Cash disbursements | |||

Payments for purchases | |||

Wages, taxes, and other expenses | |||

Interest and dividend payments | |||

Capital expenditures | |||

Total cash disbursements | |||

Ending cash balance |

Here are the relevant estimates for the budget preparation of Michel Corporation for the fourth quarter of 2022: Credit sales Credit purchases Cash disbursements Wages, taxes, and expenses Interest Equipment Credit sales collections Collected in month of sale Collected month after sale Never collected September credit sales September credit purchases Beginning cash balance October 1 416 138 849 683 386 946 35 581 0 34% 65% 1% 1 259 872 755 923 461 153 November 1 646 685 988 078 439 138 33 189 176 379 December 1 216 893 730 136 374 237 33 189 106 893

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Michel Corporation Explain the role of cash budget A cash budget details a companys cash inflow and outflow during a specified budget period such as a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started