Question

Explain the second question. Select one: a. Market-to-book ratio less than 1 could mean that the firm has not been successful overall in creating value

Explain the second question.

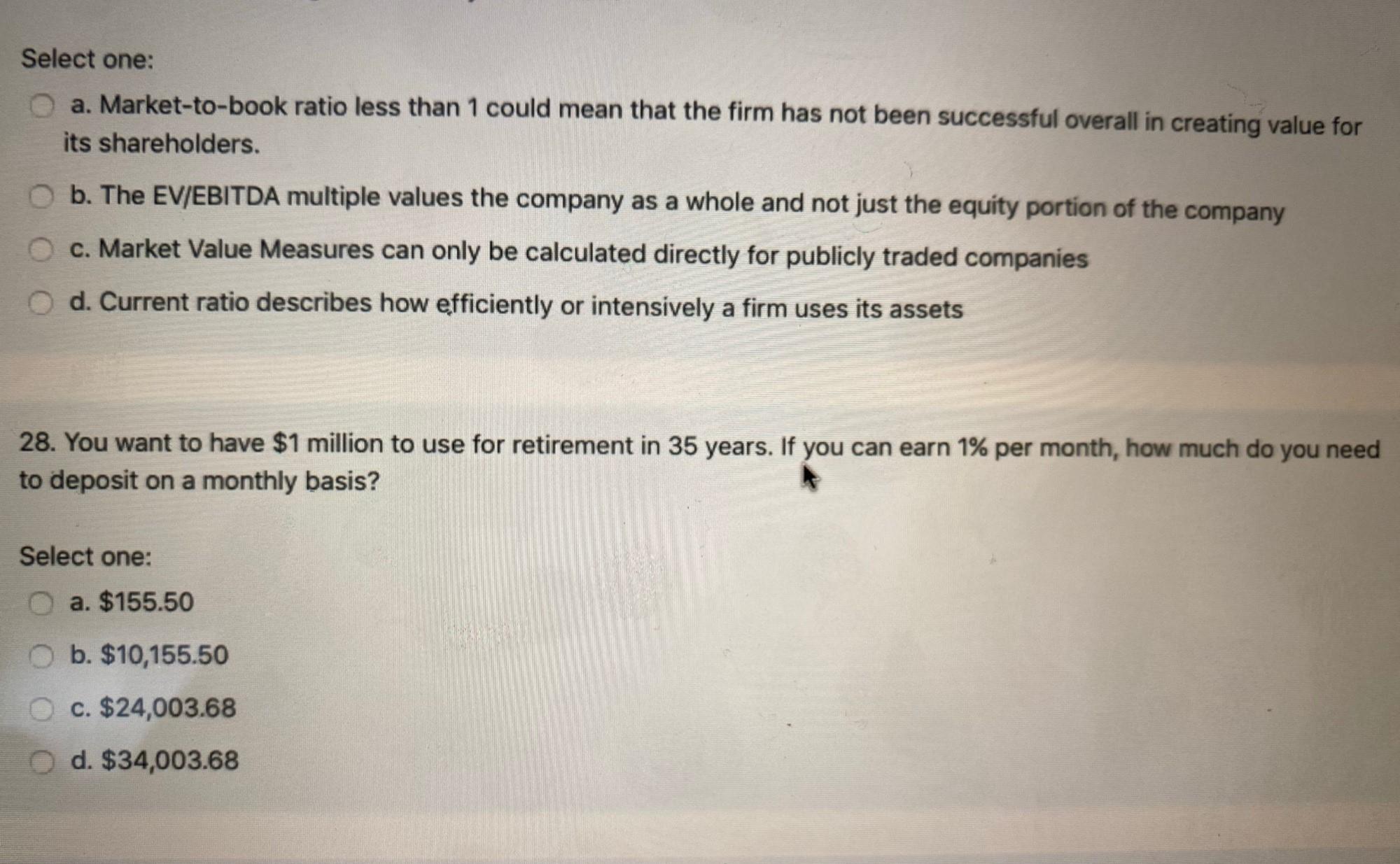

Select one: a. Market-to-book ratio less than 1 could mean that the firm has not been successful overall in creating value for its shareholders. b. The EV/EBITDA multiple values the company as a whole and not just the equity portion of the company c. Market Value Measures can only be calculated directly for publicly traded companies d. Current ratio describes how efficiently or intensively a firm uses its assets 28. You want to have $1 million to use for retirement in 35 years. If you can earn 1% per month, how much do you need to deposit on a monthly basis? Select one: a. $155.50 O b. $10,155.50 O c. $24,003.68 Od. $34,003.68

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Second question explanation The correct ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics For Business And Economics

Authors: James T. McClave, P. George Benson, Terry Sincich

13th Edition

134506596, 978-0134506593

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App