//explain the solutions.

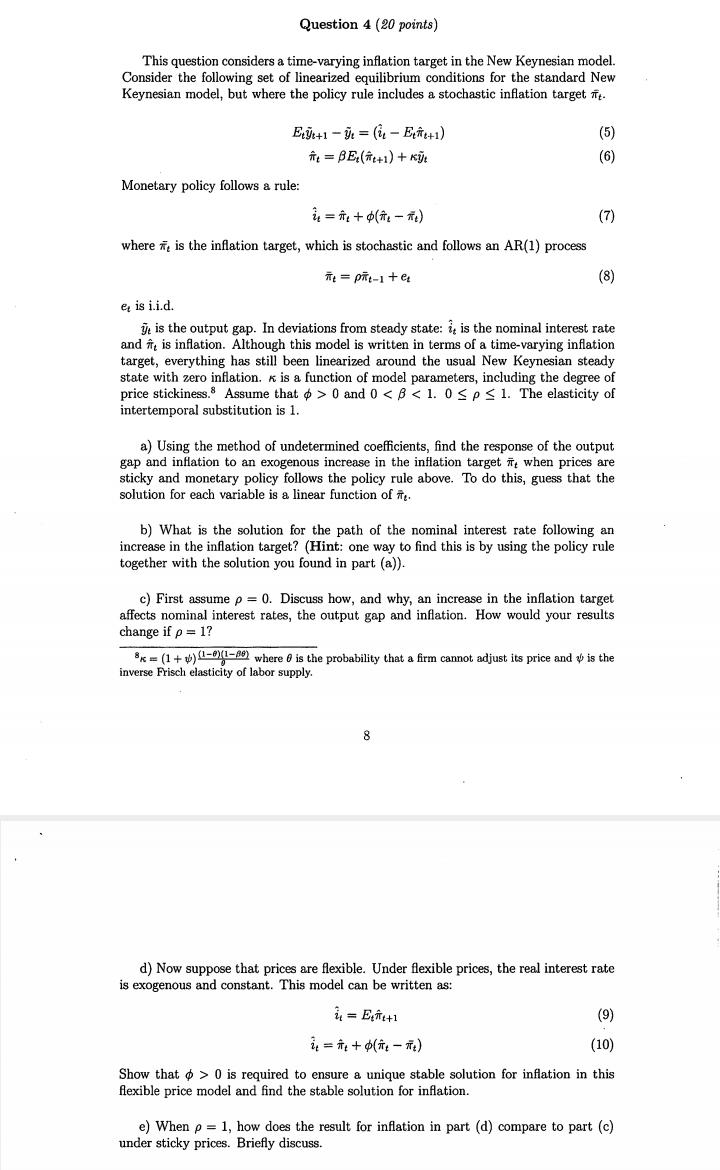

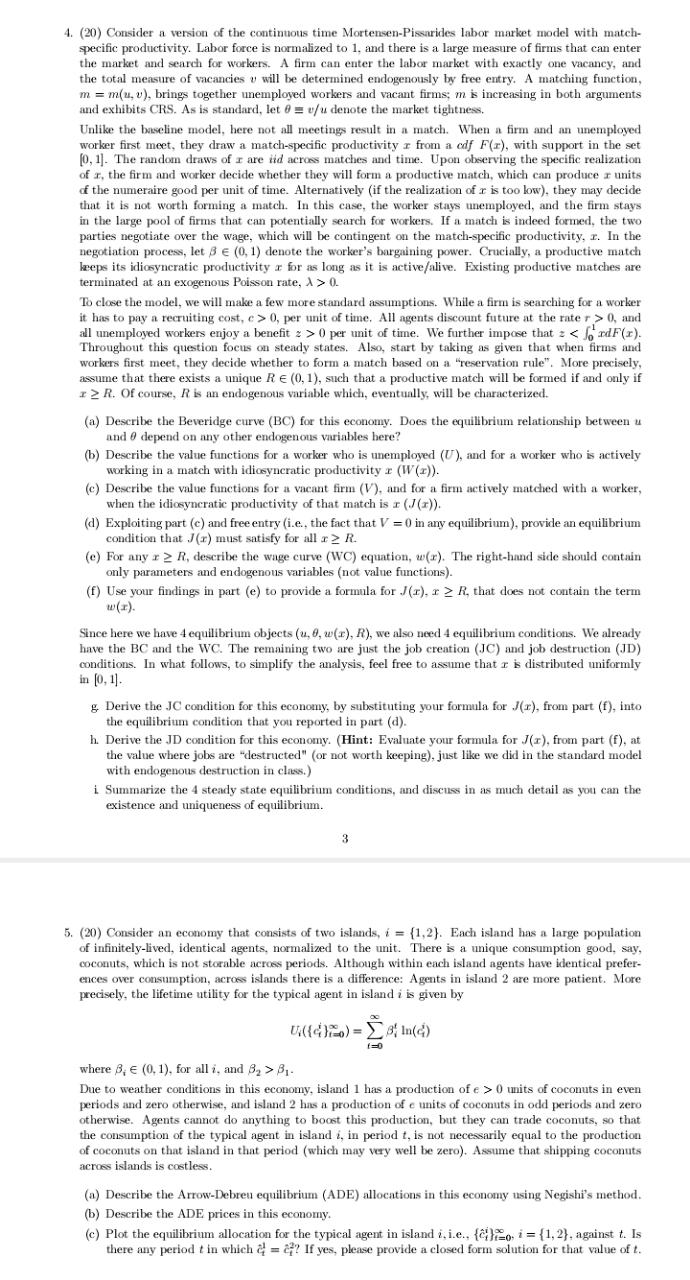

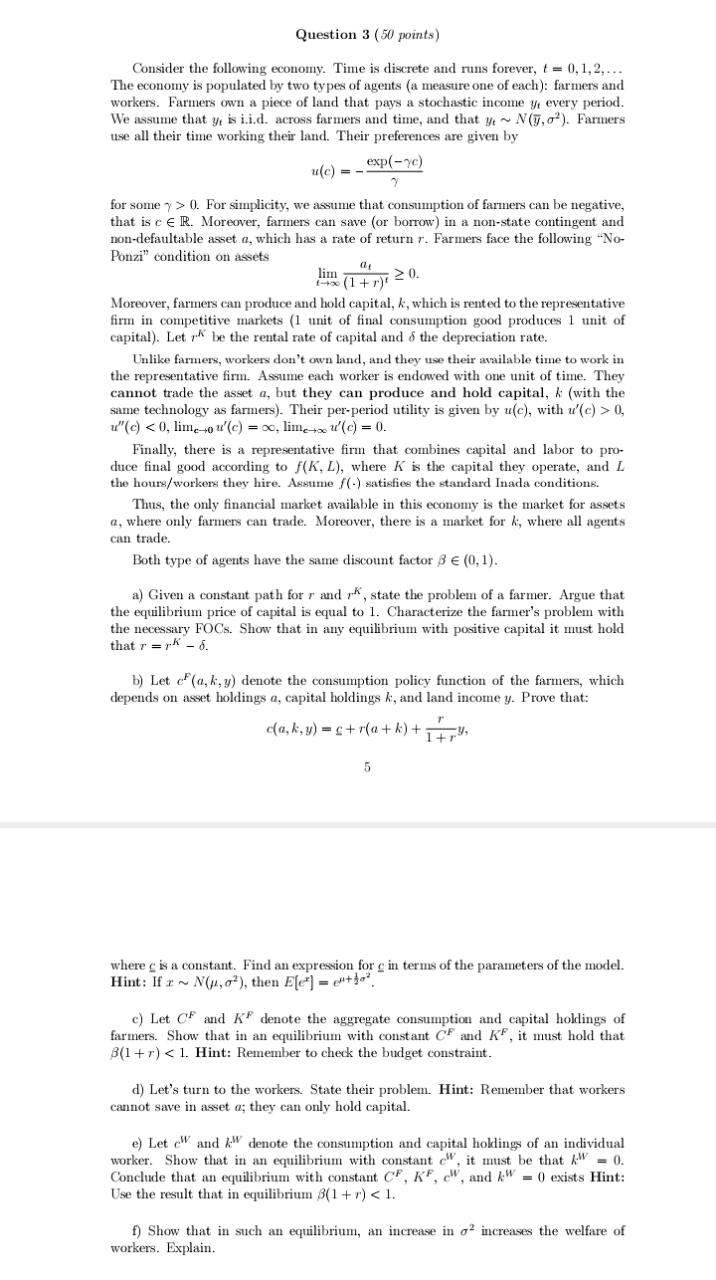

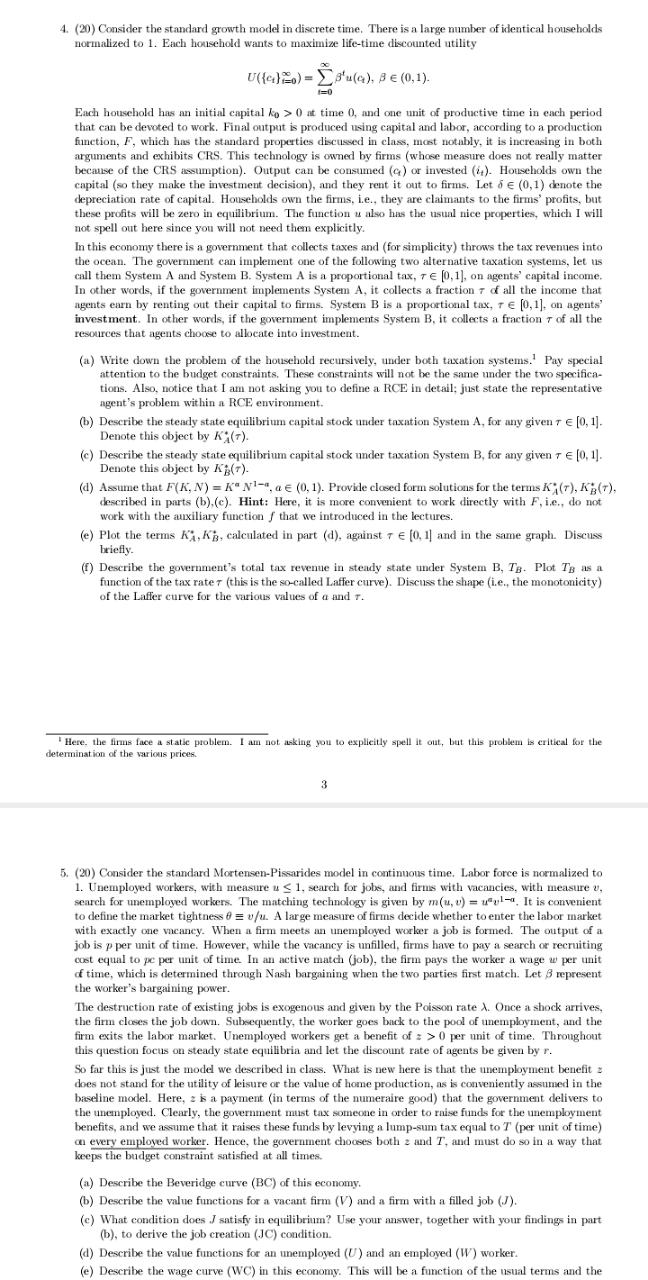

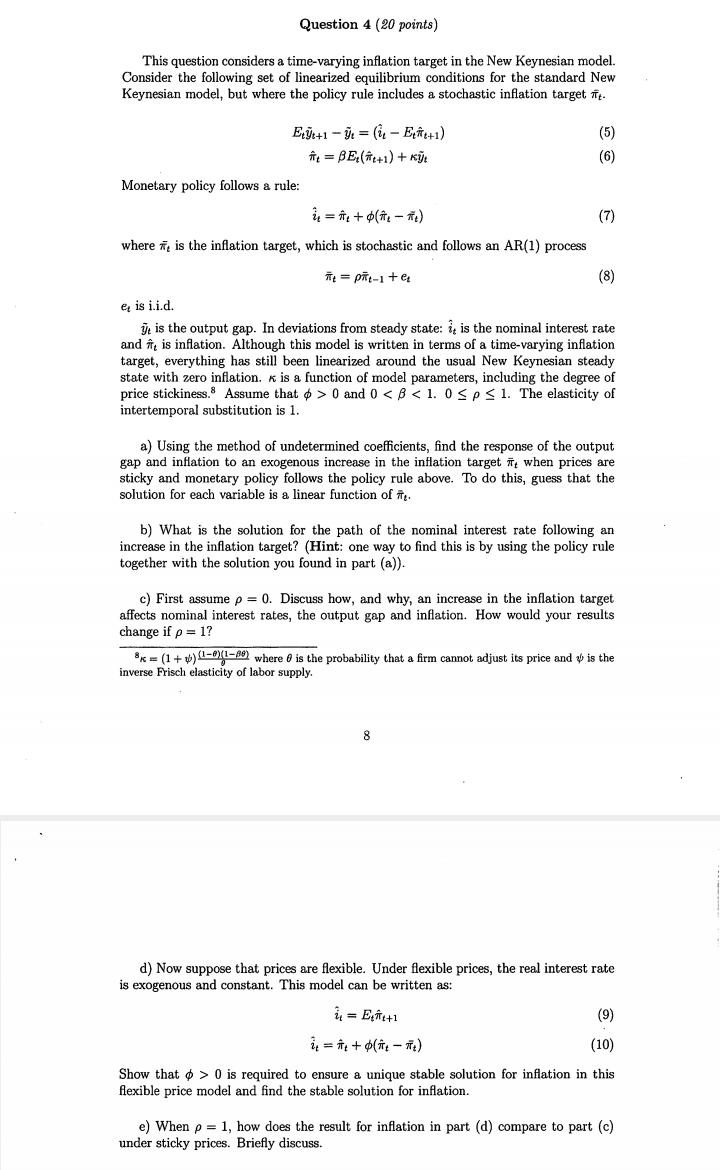

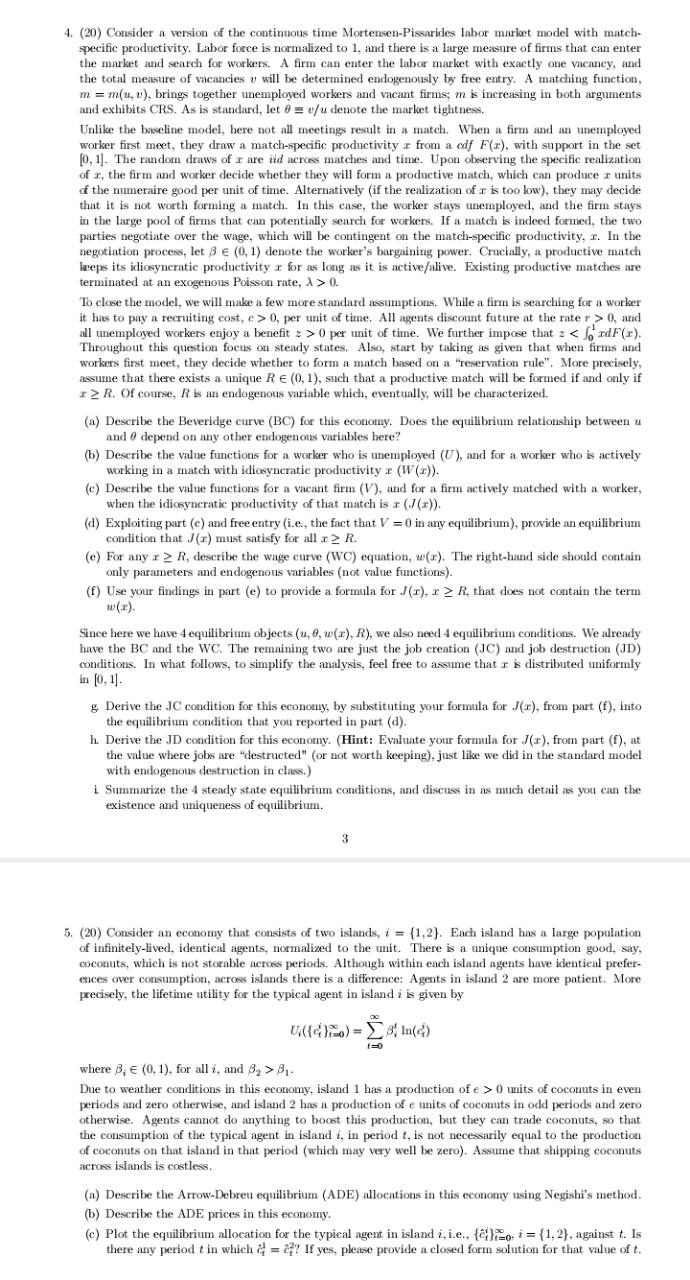

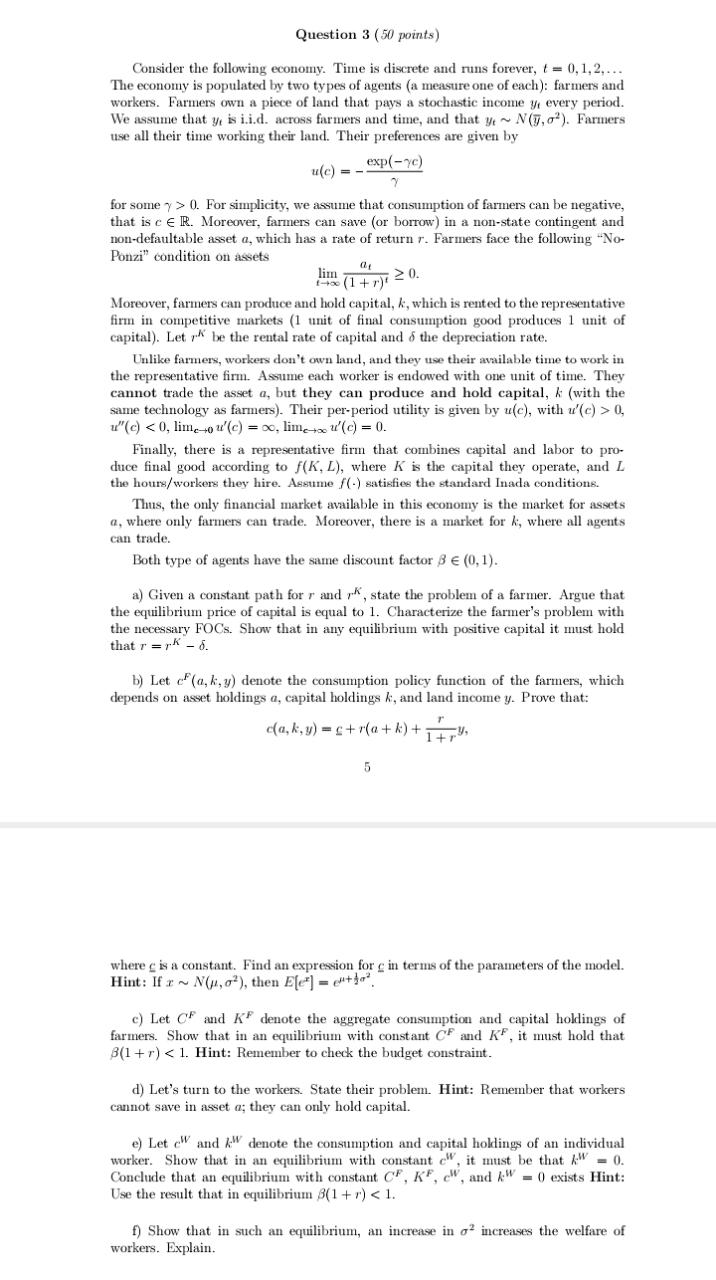

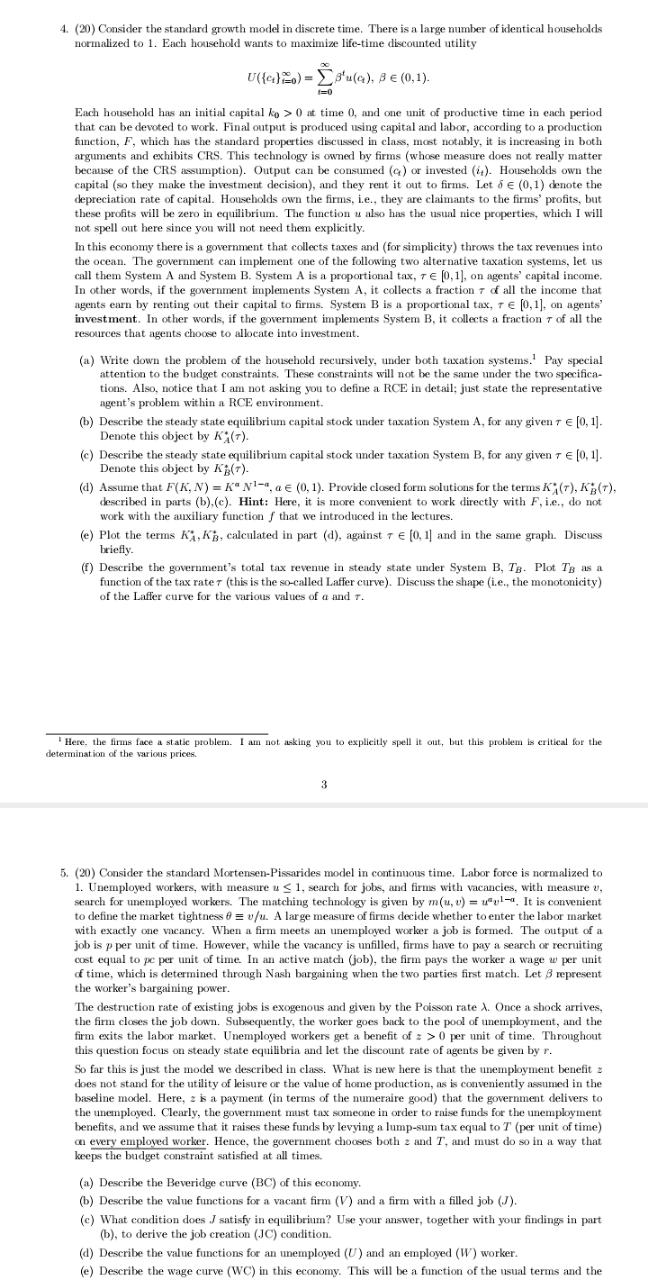

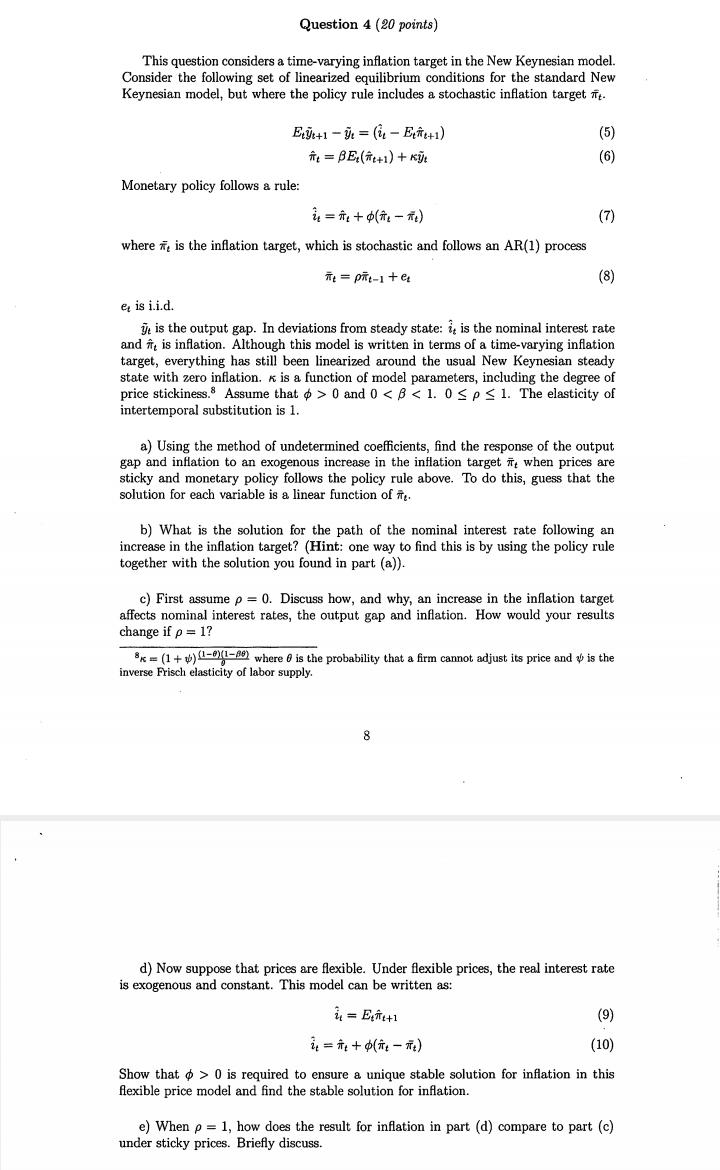

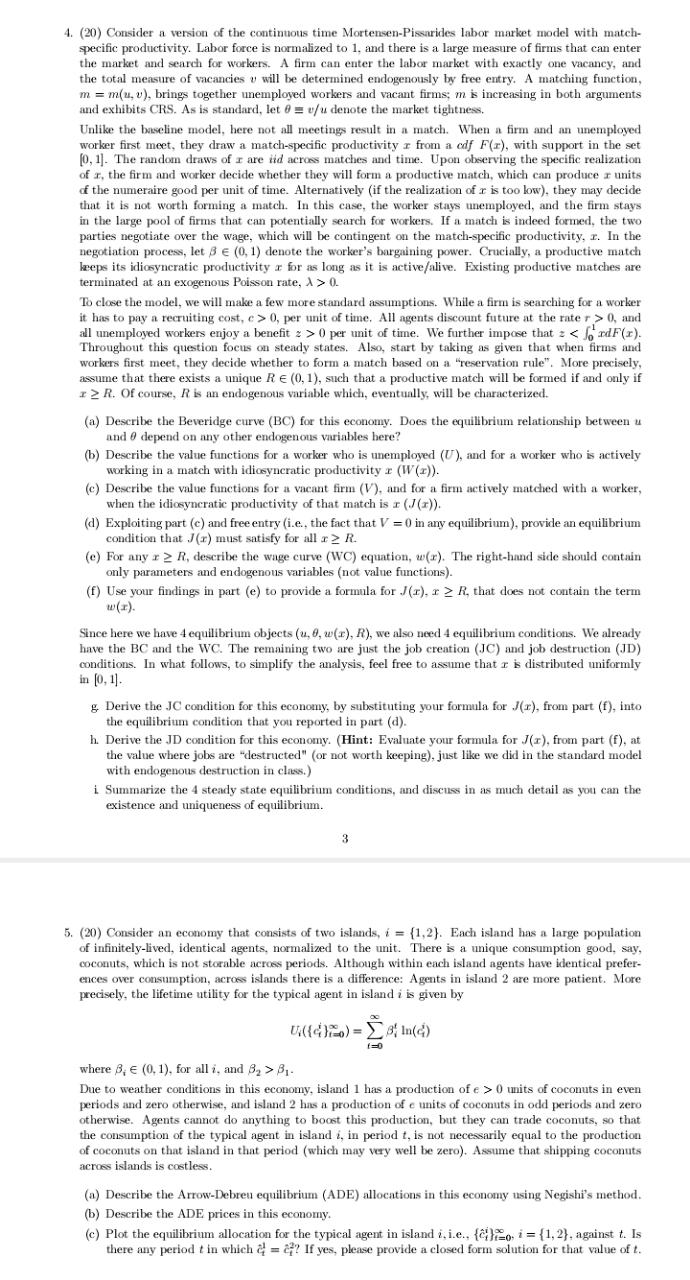

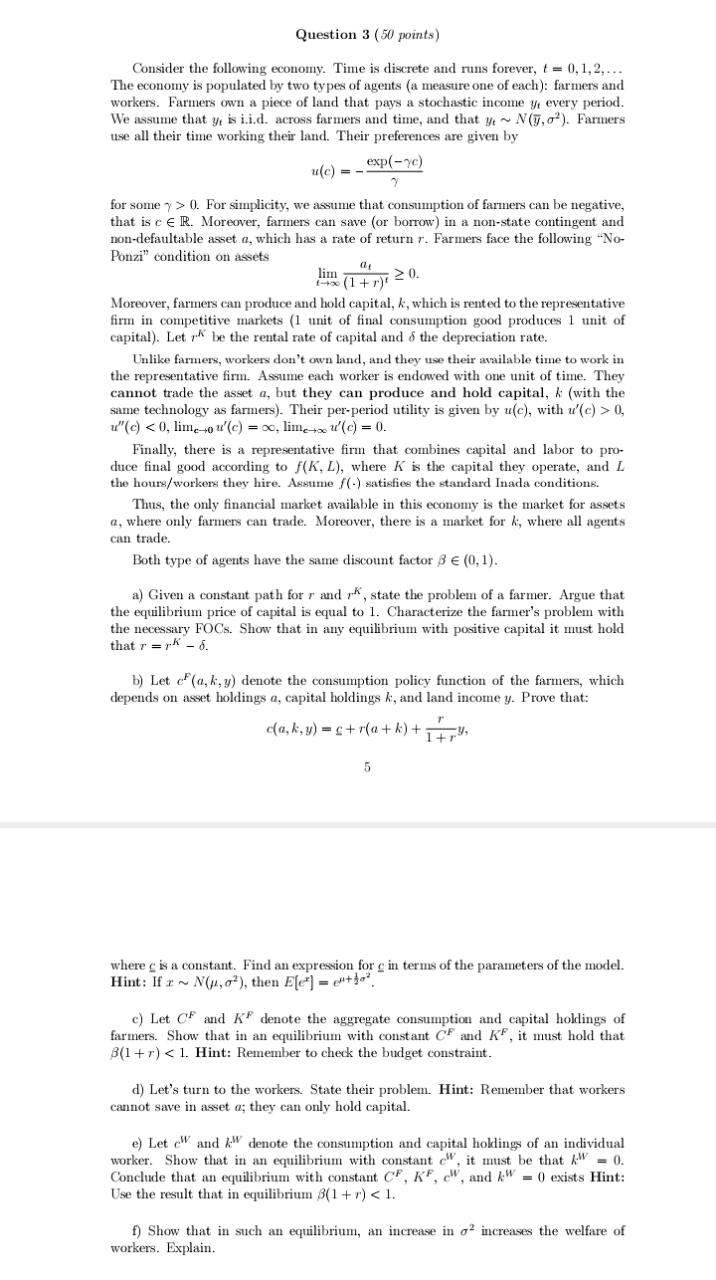

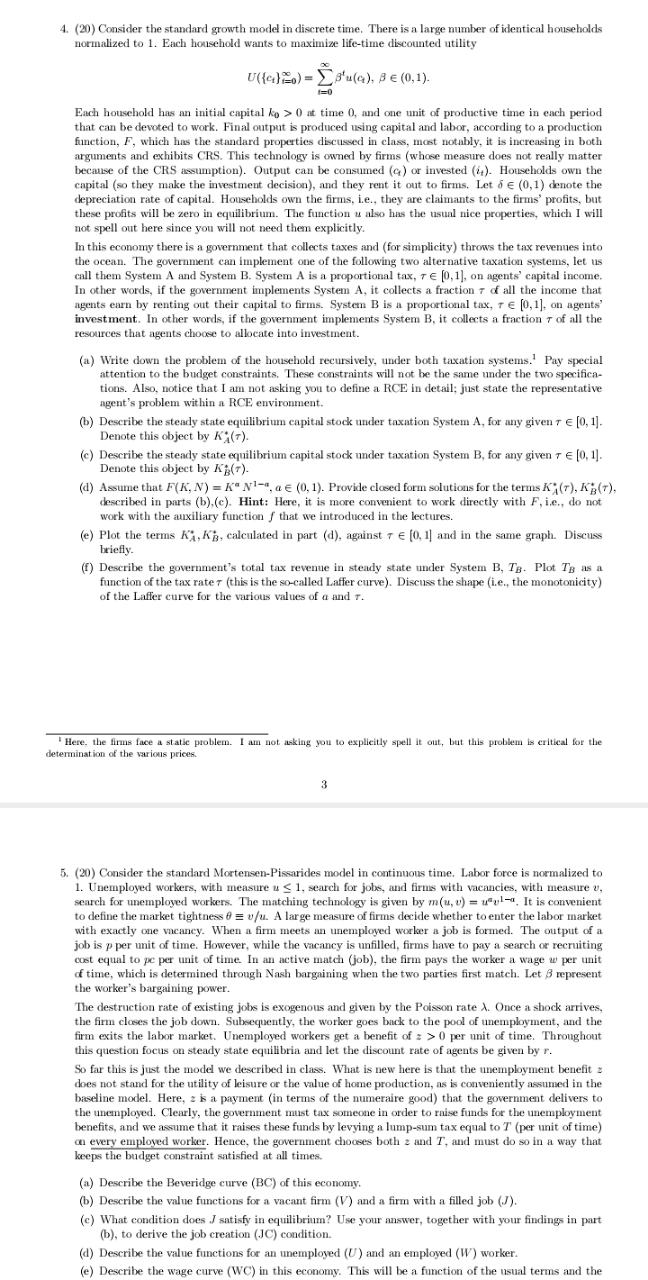

Question 4 (20 points) This question considers a time-varying inflation target in the New Keynesian model. Consider the following set of linearized equilibrium conditions for the standard New Keynesian model, but where the policy rule includes a stochastic inflation target it. (5) it = BE (# +1) + ky (6) Monetary policy follows a rule: it = it + $(it - it ) (7) where #, is the inflation target, which is stochastic and follows an AR(1) process it = pit- 1 + et (8) et is i.i.d. It is the output gap. In deviations from steady state: it is the nominal interest rate and it is inflation. Although this model is written in terms of a time-varying inflation target, everything has still been linearized around the usual New Keynesian steady state with zero inflation. 0 and 0 0 is required to ensure a unique stable solution for inflation in this flexible price model and find the stable solution for inflation e) When p = 1, how does the result for inflation in part (d) compare to part (c) under sticky prices. Briefly discuss.4. (20) Consider a version of the continuous time Mortensen-Pissarides labor market model with match- specific productivity. Labor force is normalized to 1, and there is a large measure of firms that can enter the market and search for workers. A firm can enter the labor market with exactly one vacancy, and the total measure of vacancies v will be determined endogenously by free entry. A matching function, m = m(u, v), brings together unemployed workers and vacant firms; m is increasing in both arguments and exhibits CRS. As is standard, let 0 = v/u denote the market tightness. Unlike the baseline model, here not all meetings result in a match. When a firm and an unemployed worker first meet, they draw a match-specific productivity r from a cdf F(x), with support in the set 0, 1). The random draws of a are did across matches and time. Upon observing the specific realization of r, the firm and worker decide whether they will form a productive match, which can produce a units of the numeraire good per unit of time. Alternatively (if the realization of r is too low), they may decide that it is not worth forming a match. In this case, the worker stays unemployed, and the firm stays in the large pool of firms that can potentially search for workers. If a match is indeed formed, the two parties negotiate over the wage, which will be contingent on the match-specific productivity, r. In the negotiation process, let S E (0, 1) denote the worker's bargaining power. Crucially, a productive match keeps its idiosyncratic productivity a for as long as it is active/alive. Existing productive matches are terminated at an exogenous Poisson rate, > > 0. To close the model, we will make a few more standard assumptions. While a firm is searching for a worker it has to pay a recruiting cost, c > 0, per unit of time. All agents discount future at the rate r > 0, and all unemployed workers enjoy a benefit > > 0 per unit of time. We further impose that = 31- Due to weather conditions in this economy, island 1 has a production of e > 0 units of coconuts in even periods and zero otherwise, and island 2 has a production of e units of coconuts in odd periods and zero otherwise. Agents cannot do anything to boost this production, but they can trade coconuts, so that the consumption of the typical agent in island , in period t, is not necessarily equal to the production of coconuts on that island in that period (which may very well be zero). Assume that shipping coconuts across islands is costless. (a) Describe the Arrow-Debreu equilibrium (ADE) allocations in this economy using Negishi's method. (b) Describe the ADE prices in this economy. (c) Plot the equilibrium allocation for the typical agent in island , i.e., (C!)fen, i = {1, 2), against t. Is there any period t in which & = 4? If yes, please provide a closed form solution for that value of t.Question 3 (50 points) Consider the following economy. Time is discrete and runs forever, t = 0, 1, 2,... The economy is populated by two types of agents (a measure one of each): farmers and workers. Farmers own a piece of land that pays a stochastic income y, every period. We assume that y, is i.i.d. across farmers and time, and that y ~ N (7, o'). Farmers use all their time working their land. Their preferences are given by u(c) = _ exp(-yc) for some y > 0. For simplicity, we assume that consumption of farmers can be negative, that is c E R. Moreover, farmers can save (or borrow) in a non-state contingent and non-defaultable asset a, which has a rate of return r. Farmers face the following "No- Ponzi" condition on assets 1 +3 (1 + r)' 7 20. Moreover, farmers can produce and hold capital, k, which is rented to the representative firm in competitive markets (1 unit of final consumption good produces 1 unit of capital). Let r" be the rental rate of capital and o the depreciation rate. Unlike farmers, workers don't own land, and they use their available time to work in the representative firm. Assume each worker is endowed with one unit of time. They cannot trade the asset a, but they can produce and hold capital, k (with the same technology as farmers). Their per-period utility is given by u(c), with u'(c) > 0, u"(c) 0 at time 0, and one unit of productive time in each period that can be devoted to work. Final output is produced using capital and labor, according to a production function, F, which has the standard properties discussed in class, most notably, it is increasing in both arguments and exhibits CRS. This technology is owned by firms (whose measure does not really matter because of the CRS assumption). Output can be consumed ( ) or invested (4). Households own the capital (so they make the investment decision), and they rent it out to firms, Let o e (0,1) denote the depreciation rate of capital. Households own the firms, i.e., they are claimants to the firms' profits, but these profits will be zero in equilibrium. The function u also has the usual nice properties, which I will not spell out here since you will not need them explicitly. In this economy there is a government that collects taxes and (for simplicity) throws the tax revenues into the ocean. The government can implement one of the following two alternative taxation systems, let us call them System A and System B. System A is a proportional tax, 7 6 [0, 1], on agents' capital income. In other words, if the government implements System A, it collects a fraction 7 of all the income that agents earn by renting out their capital to firms. System B is a proportional tax, re [0, 1], on agents' investment. In other words, if the government implements System B. it collects a fraction 7 of all the resources that agents choose to allocate into investment. (a) Write down the problem of the household recursively, under both taxation systems.' Pay special attention to the budget constraints. These constraints will not be the same under the two specifica- tions. Also, notice that I am not asking you to define a RCE in detail; just state the representative agent's problem within a RCE environment. (b) Describe the steady state equilibrium capital stock under taxation System A, for any given 7 e [0, 1]. Denote this object by Ki(7). (c) Describe the steady state equilibrium capital stock under taxation System B, for any given 7 e [0, 1]. Denote this object by K;(T). (d) Assume that F(K, N) = K" NI-", a E (0, 1). Provide closed form solutions for the terms Kj(7), K;(7), described in parts (b),(c). Hint: Here, it is more convenient to work directly with F, i.e., do not work with the auxiliary function f that we introduced in the lectures. (e) Plot the terms KA, Kj, calculated in part (d), against 7 6 [0, 1) and in the same graph. Discuss briefly. (f) Describe the government's total tax revenue in steady state under System B, Tg. Plot To as a function of the tax rate 7 (this is the so-called Laffer curve). Discuss the shape (i.e., the monotonicity) of the Laffer curve for the various values of a and r. Here. the firms face a static problem. I am not asking you to explicitly spell it out, but this problem is critical for the determination of the various prices. 5. (20) Consider the standard Mortensen-Pissarides model in continuous time. Labor force is normalized to 1. Unemployed workers, with measure u - 1, search for jobs, and firms with vacancies, with measure v, search for unemployed workers. The matching technology is given by m(u, v) = up -, It is convenient to define the market tightness o = /u. A large measure of firms decide whether to enter the labor market with exactly one vacancy. When a firm meets an unemployed worker a job is formed. The output of a job is p per unit of time. However, while the vacancy is unfilled, firms have to pay a search or recruiting cost equal to pe per unit of time. In an active match (job), the firm pays the worker a wage w per unit of time, which is determined through Nash bargaining when the two parties first match. Let S represent the worker's bargaining power. The destruction rate of existing jobs is exogenous and given by the Poisson rate X. Once a shock arrives, the firm closes the job down. Subsequently, the worker goes back to the pool of unemployment, and the firm exits the labor market. Unemployed workers get a benefit of > > 0 per unit of time. Throughout this question focus on steady state equilibria and let the discount rate of agents be given by r. So far this is just the model we described in class. What is new here is that the unemployment benefit : does not stand for the utility of leisure or the value of home production, as is conveniently assumed in the baseline model. Here, z is a payment (in terms of the numeraire good) that the government delivers to the unemployed. Clearly, the government must tax someone in order to raise funds for the unemployment benefits, and we assume that it raises these funds by levying a lump-sum tax equal to T (per unit of time) on every employed worker. Hence, the government chooses both z and 7, and must do so in a way that keeps the budget constraint satisfied at all times. (a) Describe the Beveridge curve (BC) of this economy. (b) Describe the value functions for a vacant firm (V) and a firm with a filled job (J). (c) What condition does / satisfy in equilibrium? Use your answer, together with your findings in part (b), to derive the job creation (JC) condition. (d) Describe the value functions for an unemployed (U) and an employed (W) worker. (e) Describe the wage curve (WC) in this economy. This will be a function of the usual terms and the