Question

Explain the trends of Carter's Inc. performance based on the horizontal (% growth) balance sheet. What areas are improving, and which are deteriorating? Explain the

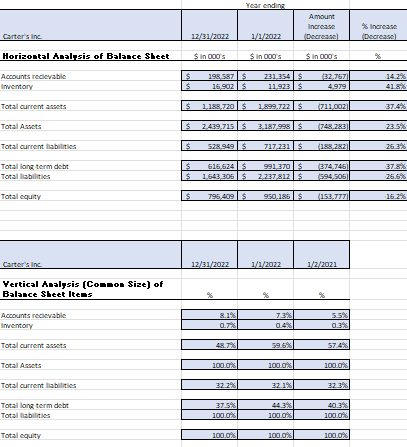

Explain the trends of Carter's Inc. performance based on the horizontal (% growth) balance sheet. What areas are improving, and which are deteriorating?

Explain the trends of Carter's Inc. based on the vertical (common size) balance sheet. What areas are improving, and which are deteriorating?

Describe Carter's Inc. financial health with respect to each of the six Red Flags in Financial Statement Analysis Earnings problems

Decreased cash flow

Too much debt

Inability to collect receivables

Buildup of inventory

Trends of sales, inventory, and receivables

Carter's Inc. 12/31/2022 Year ending 1/1/2022 Amount Increase (Decrease) % Increase (Decrease) Horizontal Analysis of Balance Sheet $ in 000's $ in 000's $ in 000's Accounts recievable $ 198,587 $ 231,354 $ (32,767) 14.2% Inventory $ 16,902 $ 11,923 $ 4,979 41.8% Total current assets 1,188,720 $ 1,899,722 $ (711,002) 37.4% Total Assets 10 2,439,715 $ 3,187,998 $ (748,283) 23.5% Total current liabilities $ 528,949 $ 717,231 $ (188,282) 26.3% Total long term debt $ 616,624 $ 991,370 $ (374,746) 37.8% Total liabilities $ 1,643,306 $ 2,237,812 $ (594,506) 26.6% Total equity $ 796,409 $ 950,186 $ (153,777) 16.2% Carter's Inc. Vertical Analysis (Common Size) of 12/31/2022 1/1/2022 1/2/2021 Balance Sheet Items Accounts recievable 8.1% 7.3% 5.5% Inventory 0.7% 0.4% 0.3% Total current assets 48.7% 59.6% 57.4% Total Assets 100.0% 100.0% 100.0% Total current liabilities 32.2% 32.1% 32.3% Total long term debt 37.5% 44.3% 40.3% Total liabilities 100.0% 100.0% 100.0% Total equity 100.0% 100.0% 100.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started