Answered step by step

Verified Expert Solution

Question

1 Approved Answer

explain this formula and give me an example Risk-adjusted returns [ S I_{p}=frac{R_{p}-R_{f}}{sigma_{p}} ] Vhere ( S I_{p}= ) Sharpe index/ratio ( R_{p}= ) return

explain this formula and give me an example

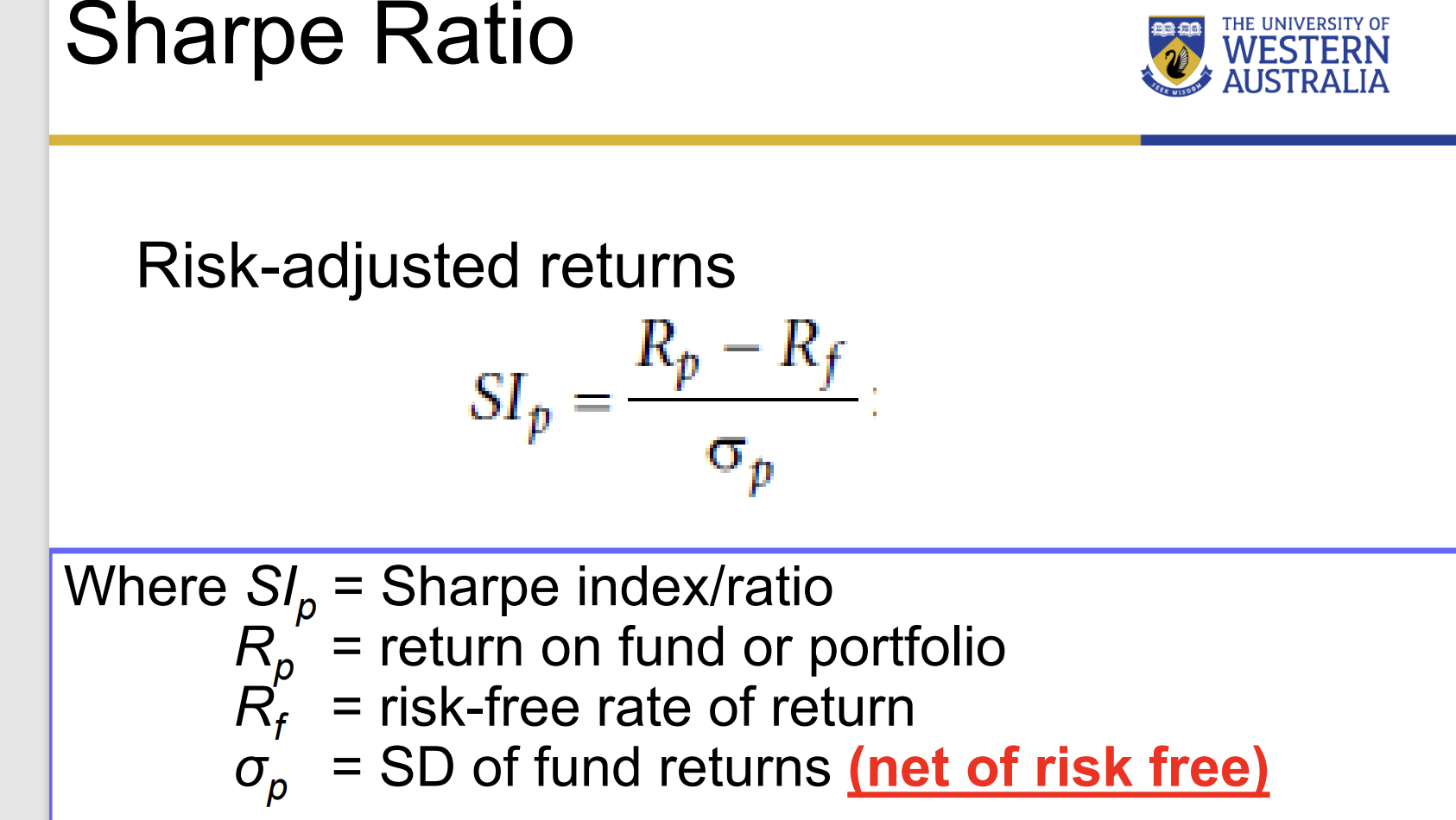

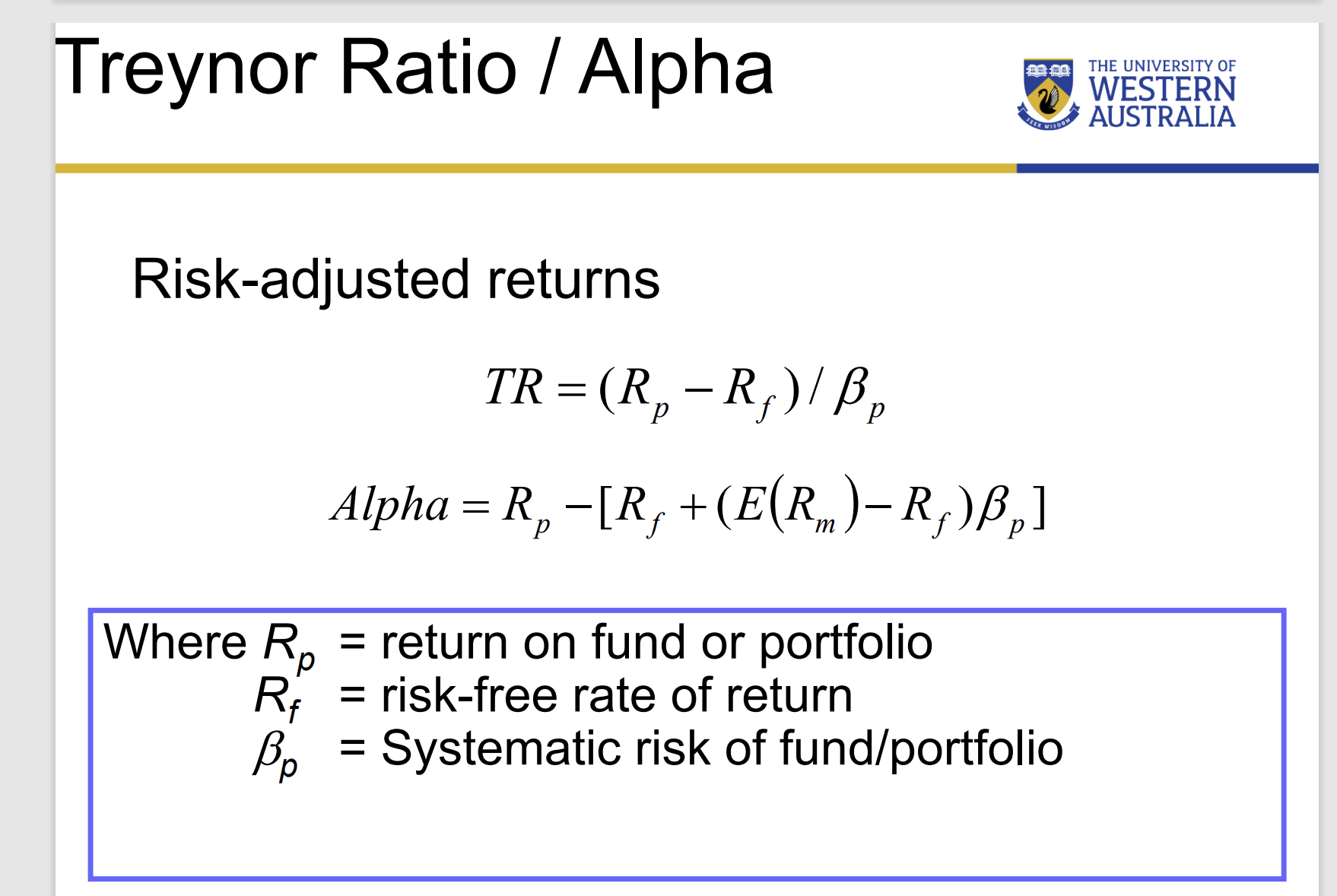

Risk-adjusted returns \\[ S I_{p}=\\frac{R_{p}-R_{f}}{\\sigma_{p}} \\] Vhere \\( S I_{p}= \\) Sharpe index/ratio \\( R_{p}= \\) return on fund or portfolio \\( R_{f}^{p}= \\) risk-free rate of return \\( \\sigma_{p}=\\mathrm{SD} \\) of fund returns \\( \\underline{\\text { (net of risk free) }} \\) Risk-adjusted returns \\[ \\begin{array}{c} T R=\\left(R_{p}-R_{f}\ ight) / \\beta_{p} \\\\ \\text { Alpha }=R_{p}-\\left[R_{f}+\\left(E\\left(R_{m}\ ight)-R_{f}\ ight) \\beta_{p}\ ight] \\end{array} \\] Where \\( R_{p}= \\) return on fund or portfolio \\( R_{f}= \\) risk-free rate of return \\( \\beta_{p}= \\) Systematic risk of fund/portfolio

Risk-adjusted returns \\[ S I_{p}=\\frac{R_{p}-R_{f}}{\\sigma_{p}} \\] Vhere \\( S I_{p}= \\) Sharpe index/ratio \\( R_{p}= \\) return on fund or portfolio \\( R_{f}^{p}= \\) risk-free rate of return \\( \\sigma_{p}=\\mathrm{SD} \\) of fund returns \\( \\underline{\\text { (net of risk free) }} \\) Risk-adjusted returns \\[ \\begin{array}{c} T R=\\left(R_{p}-R_{f}\ ight) / \\beta_{p} \\\\ \\text { Alpha }=R_{p}-\\left[R_{f}+\\left(E\\left(R_{m}\ ight)-R_{f}\ ight) \\beta_{p}\ ight] \\end{array} \\] Where \\( R_{p}= \\) return on fund or portfolio \\( R_{f}= \\) risk-free rate of return \\( \\beta_{p}= \\) Systematic risk of fund/portfolio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started