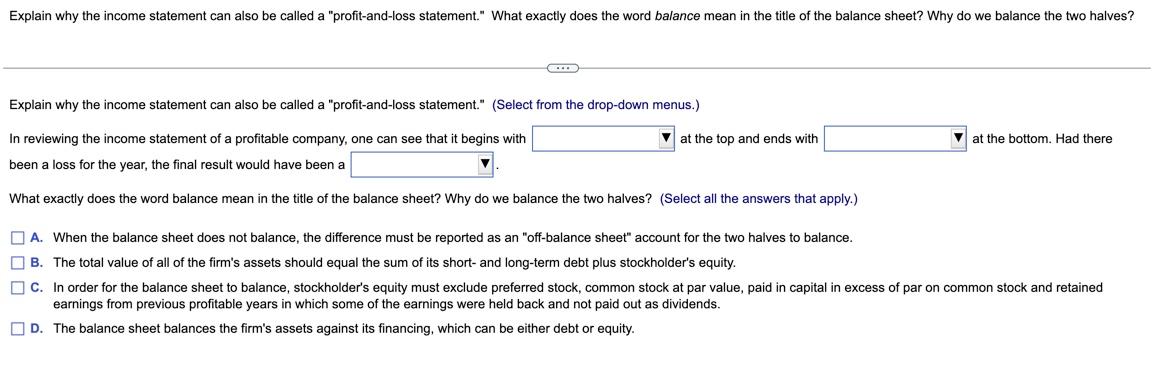

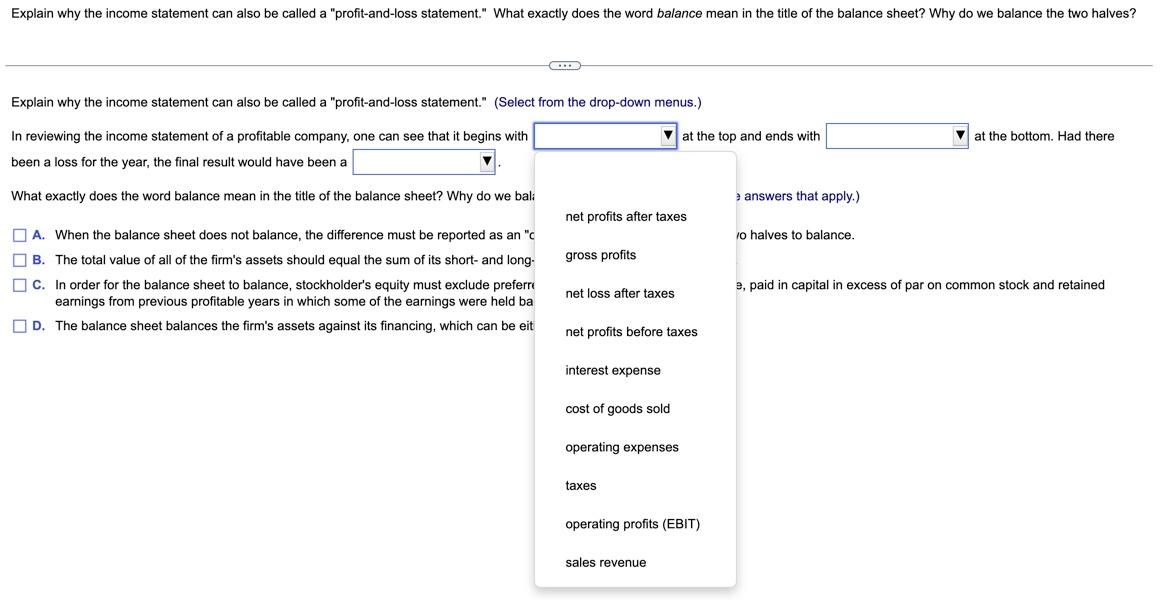

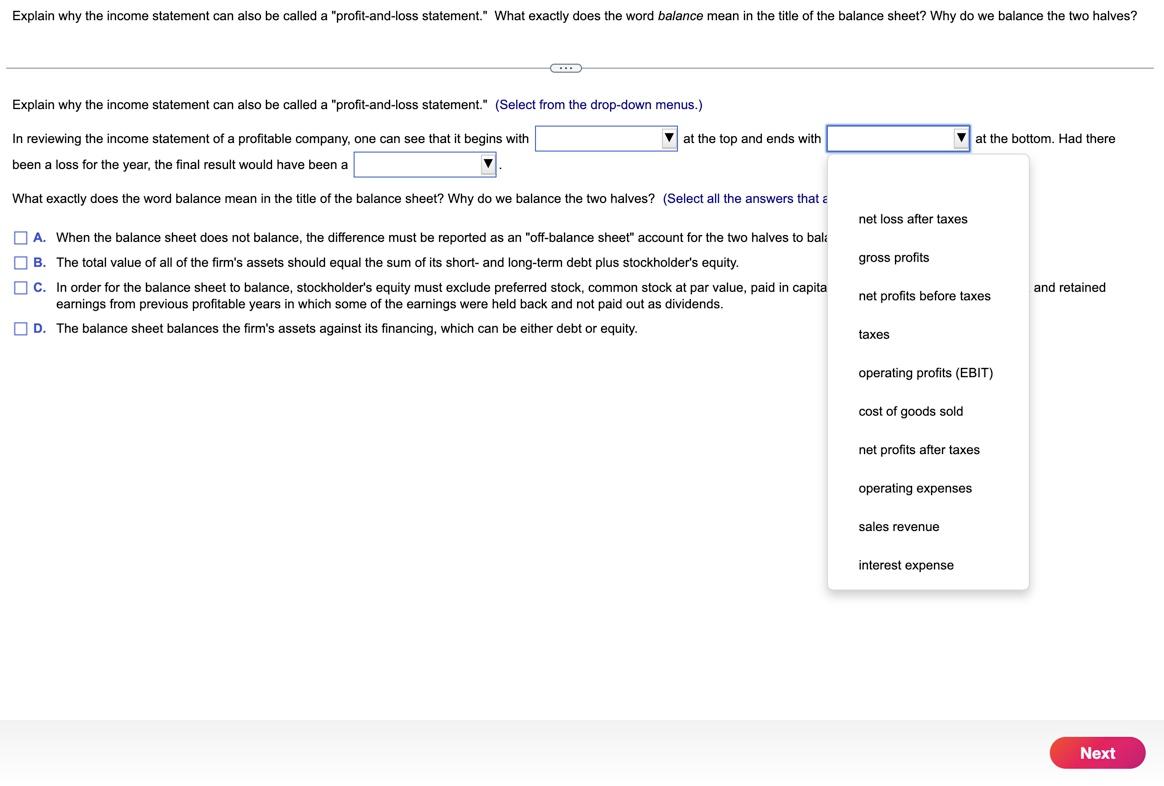

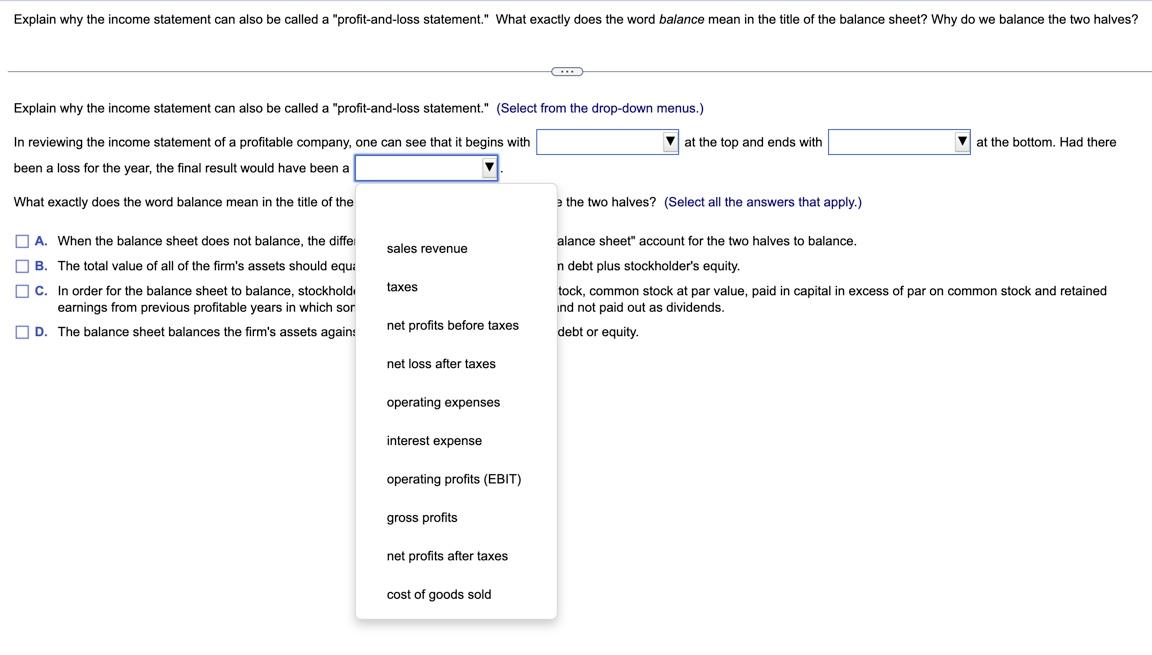

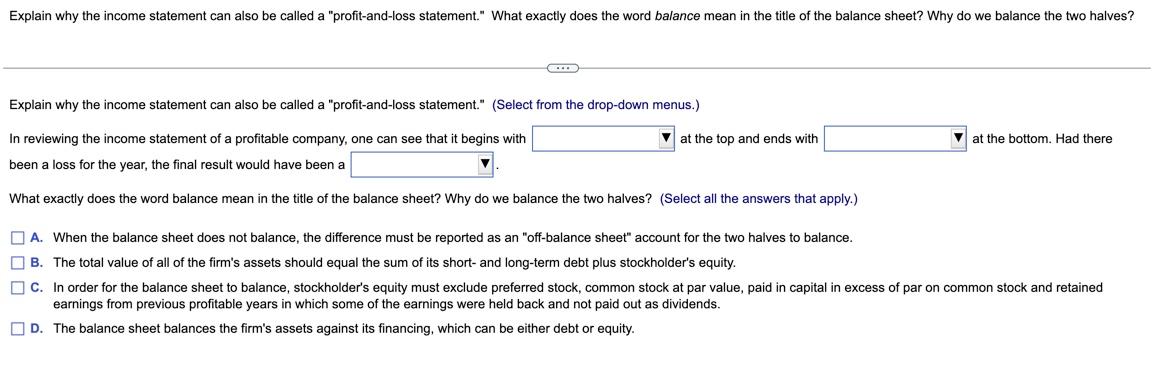

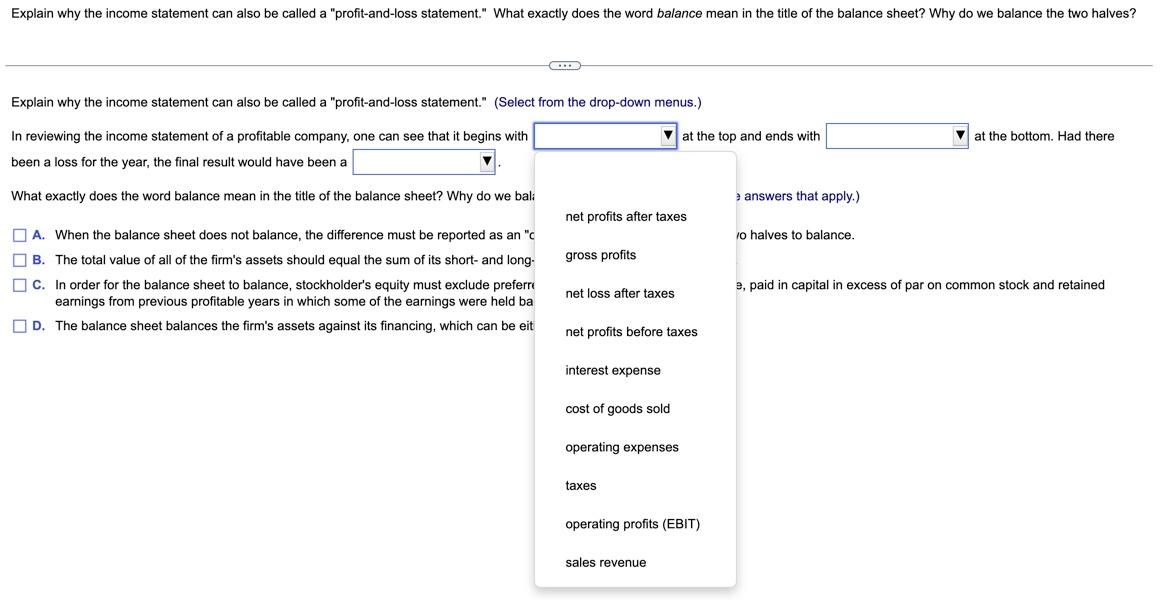

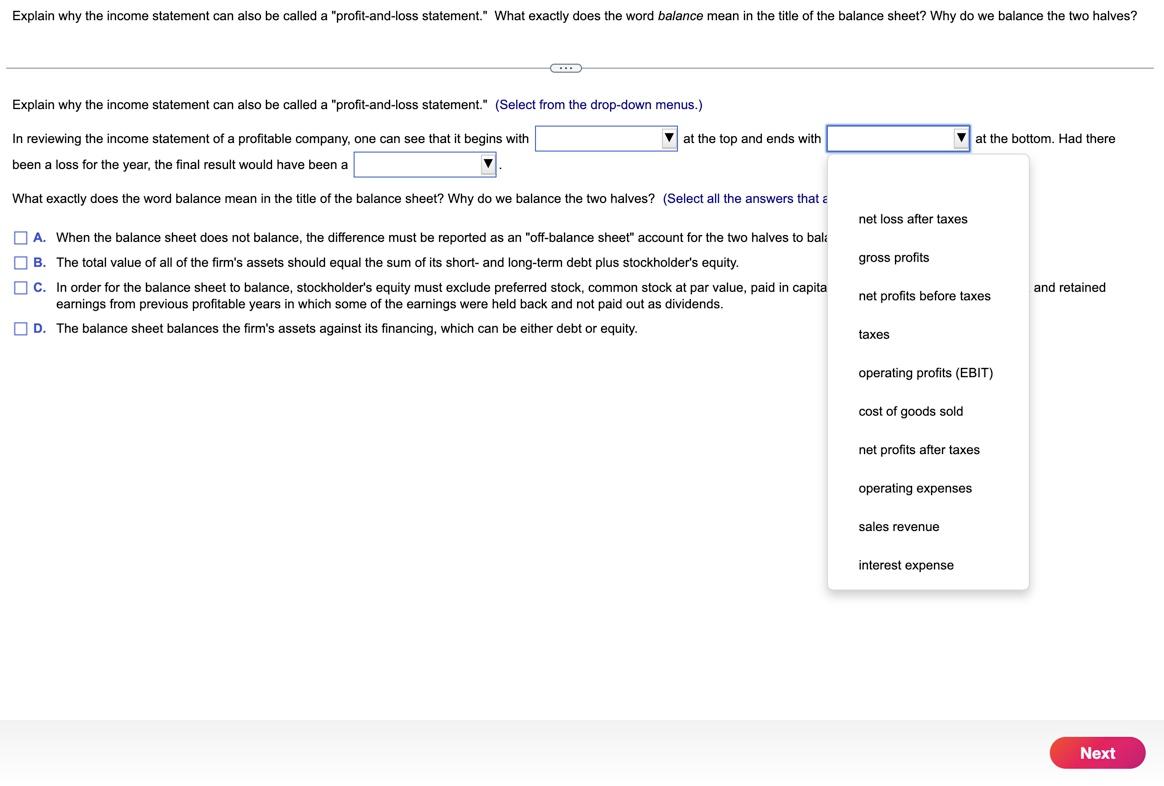

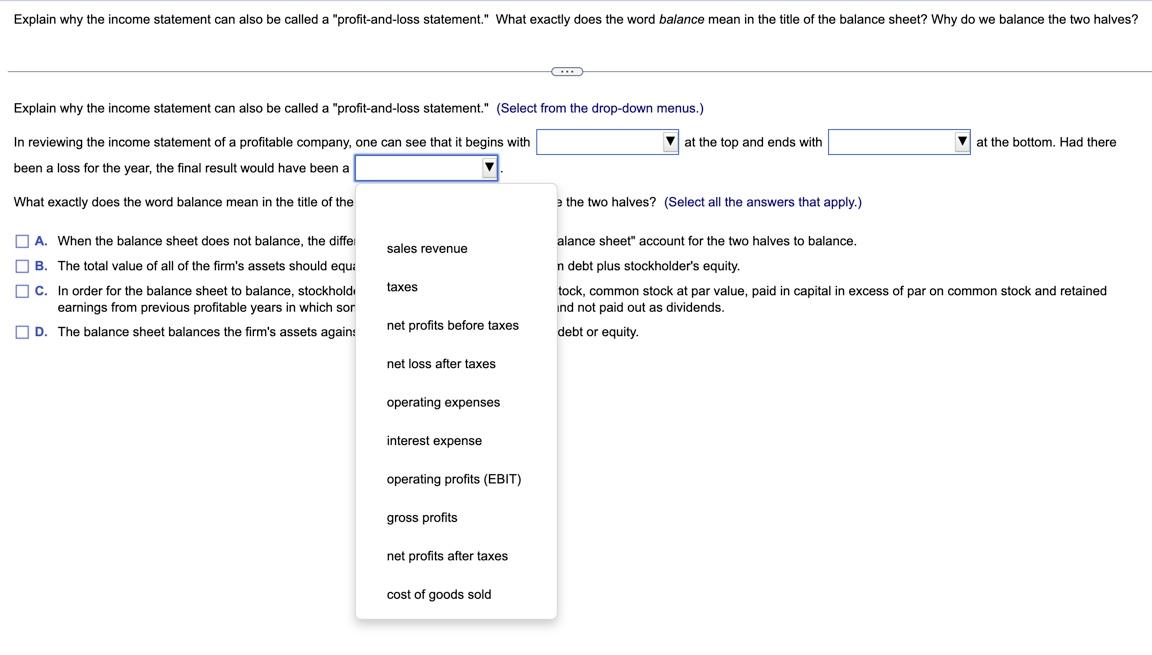

Explain why the income statement can also be called a "profit-and-loss statement." What exactly does the word balance mean in the title of the balance sheet? Why do we balance the two halves? Explain why the income statement can also be called a "profit-and-loss statement." (Select from the drop-down menus.) at the top and ends with at the bottom. Had there In reviewing the income statement of a profitable company, one can see that it begins with been a loss for the year, the final result would have been a What exactly does the word balance mean in the title of the balance sheet? Why do we balance the two halves? (Select all the answers that apply.) A. When the balance sheet does not balance, the difference must be reported as an "off-balance sheet" account for the two halves to balance. B. The total value of all of the firm's assets should equal the sum of its short- and long-term debt plus stockholder's equity. C. In order for the balance sheet to balance, stockholder's equity must exclude preferred stock, common stock at par value, paid in capital in excess of par on common stock and retained earnings from previous profitable years in which some of the earnings were held back and not paid out as dividends. D. The balance sheet balances the firm's assets against its financing, which can be either debt or equity. Explain why the income statement can also be called a "profit-and-loss statement." What exactly does the word balance mean in the title of the balance sheet? Why do we balance the two halves? C... Explain why the income statement can also be called a "profit-and-loss statement." (Select from the drop-down menus.) at the top and ends with at the bottom. Had there In reviewing the income statement of a profitable company, one can see that it begins with been a loss for the year, the final result would have been a What exactly does the word balance mean in the title of the balance sheet? Why do we bali > answers that apply.) net profits after taxes o halves to balance. gross profits A. When the balance sheet does not balance, the difference must be reported as an "c B. The total value of all of the firm's assets should equal the sum of its short- and long- C. In order for the balance sheet to balance, stockholder's equity must exclude preferre earnings from previous profitable years in which some of the earnings were held ba D. The balance sheet balances the firm's assets against its financing, which can be eit e, paid in capital in excess of par on common stock and retained net loss after taxes net profits before taxes interest expense cost of goods sold operating expenses taxes. operating profits (EBIT) sales revenue Explain why the income statement can also be called a "profit-and-loss statement." What exactly does the word balance mean in the title of the balance sheet? Why do we balance the two halves? O Explain why the income statement can also be called a "profit-and-loss statement." (Select from the drop-down menus.) at the top and ends with at the bottom. Had there In reviewing the income statement of a profitable company, one can see that it begins with been loss for the year, the final result would have been a What exactly does the word balance mean in the title of the balance sheet? Why do we balance the two halves? (Select all the answers that a A. When the balance sheet does not balance, the difference must be reported as an "off-balance sheet" account for the two halves to bala B. The total value of all of the firm's assets should equal the sum of its short- and long-term debt plus stockholder's equity. C. and retained In order for the balance sheet to balance, stockholder's equity must exclude preferred stock, common stock at par value, paid in capita earnings from previous profitable years in which some of the earnings were held back and not paid out as dividends. D. The balance sheet balances the firm's assets against its financing, which can be either debt or equity. net loss after taxes. gross profits net profits before taxes taxes operating profits (EBIT) cost of goods sold net profits after taxes operating expenses sales revenue interest expense Next Explain why the income statement can also be called a "profit-and-loss statement." What exactly does the word balance mean in the title of the balance sheet? Why do we balance the two halves? CCIDE Explain why the income statement can also be called a "profit-and-loss statement." (Select from the drop-down menus.) at the top and ends with at the bottom. Had there In reviewing the income statement of a profitable company, one can see that it begins with been a loss for the year, the final result would have been al What exactly does the word balance mean in the title of the e the two halves? (Select all the answers that apply.) sales revenue alance sheet" account for the two halves to balance. n debt plus stockholder's equity. A. When the balance sheet does not balance, the diffe B. The total value of all of the firm's assets should equa C. In order for the balance sheet to balance, stockhold earnings from previous profitable years in which sor D. The balance sheet balances the firm's assets agains taxes tock, common stock at par value, paid in capital in excess of par on common stock and retained ind not paid out as dividends. net profits before taxes debt or equity. net loss after taxes operating expenses interest expense operating profits (EBIT) gross profits net profits after taxes cost of goods sold