Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain your answer in details. Question 24 A company wishes to borrow 6.4 million to invest in a project. There is a 55% probability that

Explain your answer in details.

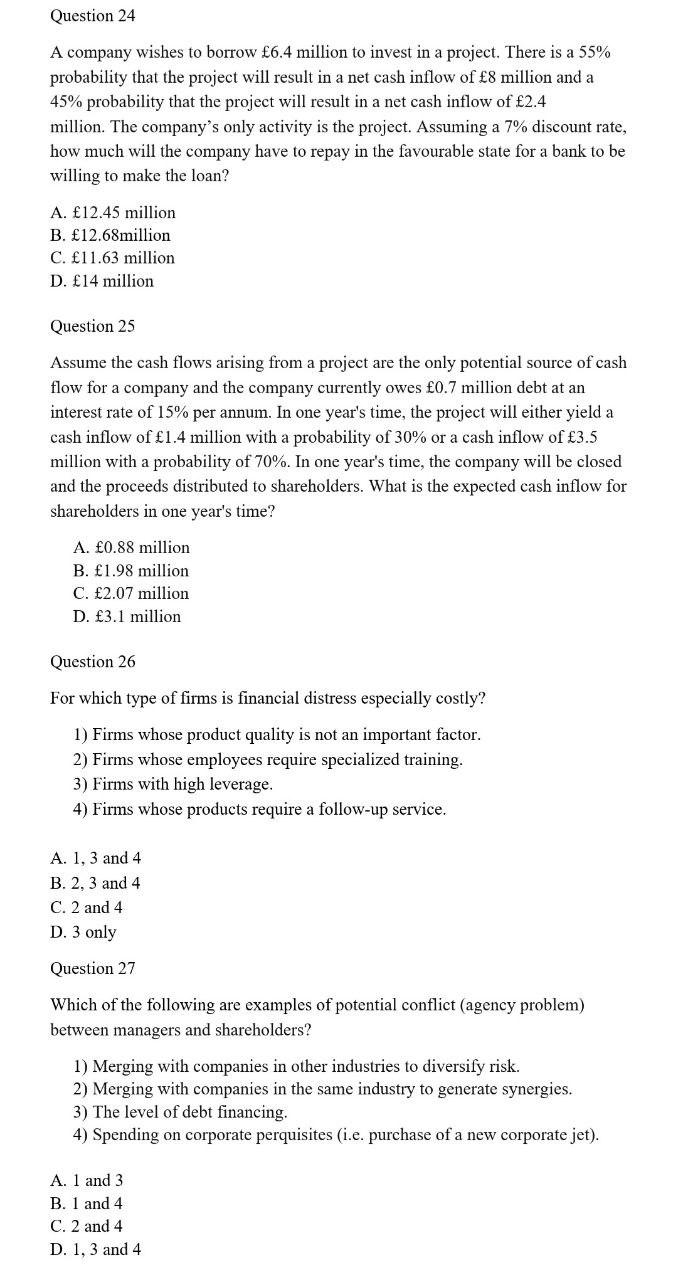

Question 24 A company wishes to borrow 6.4 million to invest in a project. There is a 55% probability that the project will result in a net cash inflow of 8 million and a 45% probability that the project will result in a net cash inflow of 2.4 million. The company's only activity is the project. Assuming a 7\% discount rate, how much will the company have to repay in the favourable state for a bank to be willing to make the loan? A. 12.45 million B. 12.68 million C. 11.63 million D. 14 million Question 25 Assume the cash flows arising from a project are the only potential source of cash flow for a company and the company currently owes 0.7 million debt at an interest rate of 15% per annum. In one year's time, the project will either yield a cash inflow of 1.4 million with a probability of 30% or a cash inflow of 3.5 million with a probability of 70%. In one year's time, the company will be closed and the proceeds distributed to shareholders. What is the expected cash inflow for shareholders in one year's time? A. 0.88 million B. 1.98 million C. 2.07 million D. 3.1 million Question 26 For which type of firms is financial distress especially costly? 1) Firms whose product quality is not an important factor. 2) Firms whose employees require specialized training. 3) Firms with high leverage. 4) Firms whose products require a follow-up service. A. 1,3 and 4 B. 2,3 and 4 C. 2 and 4 D. 3 only Question 27 Which of the following are examples of potential conflict (agency problem) between managers and shareholders? 1) Merging with companies in other industries to diversify risk. 2) Merging with companies in the same industry to generate synergies. 3) The level of debt financing. 4) Spending on corporate perquisites (i.e. purchase of a new corporate jet). A. 1 and 3 B. 1 and 4 C. 2 and 4 D. 1,3 and 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started