Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain your answers in details. A company for which financial distress is likely may have difficulty 1) Selling to customers who require a low price

Explain your answers in details.

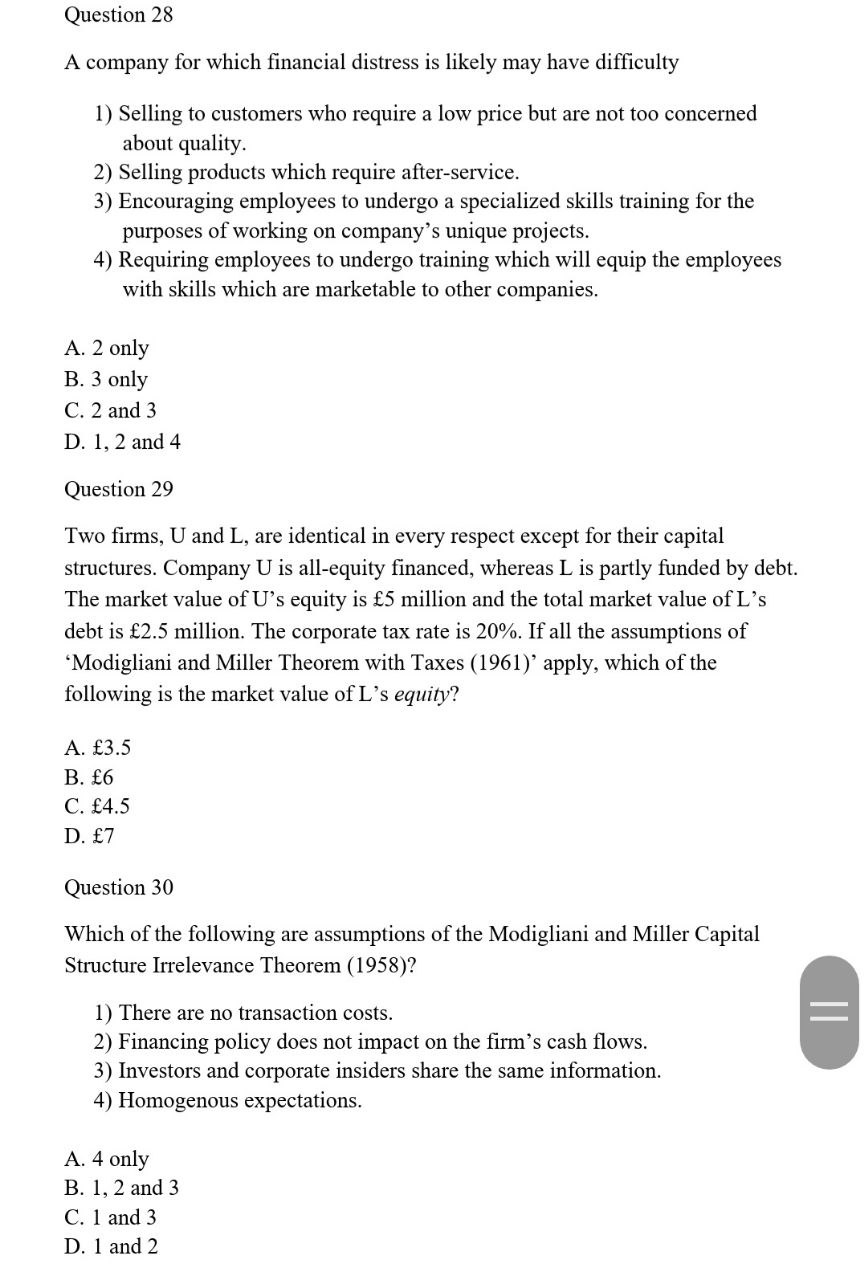

A company for which financial distress is likely may have difficulty 1) Selling to customers who require a low price but are not too concerned about quality. 2) Selling products which require after-service. 3) Encouraging employees to undergo a specialized skills training for the purposes of working on company's unique projects. 4) Requiring employees to undergo training which will equip the employees with skills which are marketable to other companies. A. 2 only B. 3 only C. 2 and 3 D. 1, 2 and 4 Question 29 Two firms, U and L, are identical in every respect except for their capital structures. Company U is all-equity financed, whereas L is partly funded by debt. The market value of U's equity is 5 million and the total market value of L's debt is 2.5 million. The corporate tax rate is 20%. If all the assumptions of 'Modigliani and Miller Theorem with Taxes (1961)' apply, which of the following is the market value of L's equity? A. 3.5 B. 6 C. 4.5 D. 7 Question 30 Which of the following are assumptions of the Modigliani and Miller Capital Structure Irrelevance Theorem (1958)? 1) There are no transaction costs. 2) Financing policy does not impact on the firm's cash flows. 3) Investors and corporate insiders share the same information. 4) Homogenous expectations. A. 4 only B. 1,2 and 3 C. 1 and 3 D. 1 and 2

A company for which financial distress is likely may have difficulty 1) Selling to customers who require a low price but are not too concerned about quality. 2) Selling products which require after-service. 3) Encouraging employees to undergo a specialized skills training for the purposes of working on company's unique projects. 4) Requiring employees to undergo training which will equip the employees with skills which are marketable to other companies. A. 2 only B. 3 only C. 2 and 3 D. 1, 2 and 4 Question 29 Two firms, U and L, are identical in every respect except for their capital structures. Company U is all-equity financed, whereas L is partly funded by debt. The market value of U's equity is 5 million and the total market value of L's debt is 2.5 million. The corporate tax rate is 20%. If all the assumptions of 'Modigliani and Miller Theorem with Taxes (1961)' apply, which of the following is the market value of L's equity? A. 3.5 B. 6 C. 4.5 D. 7 Question 30 Which of the following are assumptions of the Modigliani and Miller Capital Structure Irrelevance Theorem (1958)? 1) There are no transaction costs. 2) Financing policy does not impact on the firm's cash flows. 3) Investors and corporate insiders share the same information. 4) Homogenous expectations. A. 4 only B. 1,2 and 3 C. 1 and 3 D. 1 and 2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started