Explained i. Details

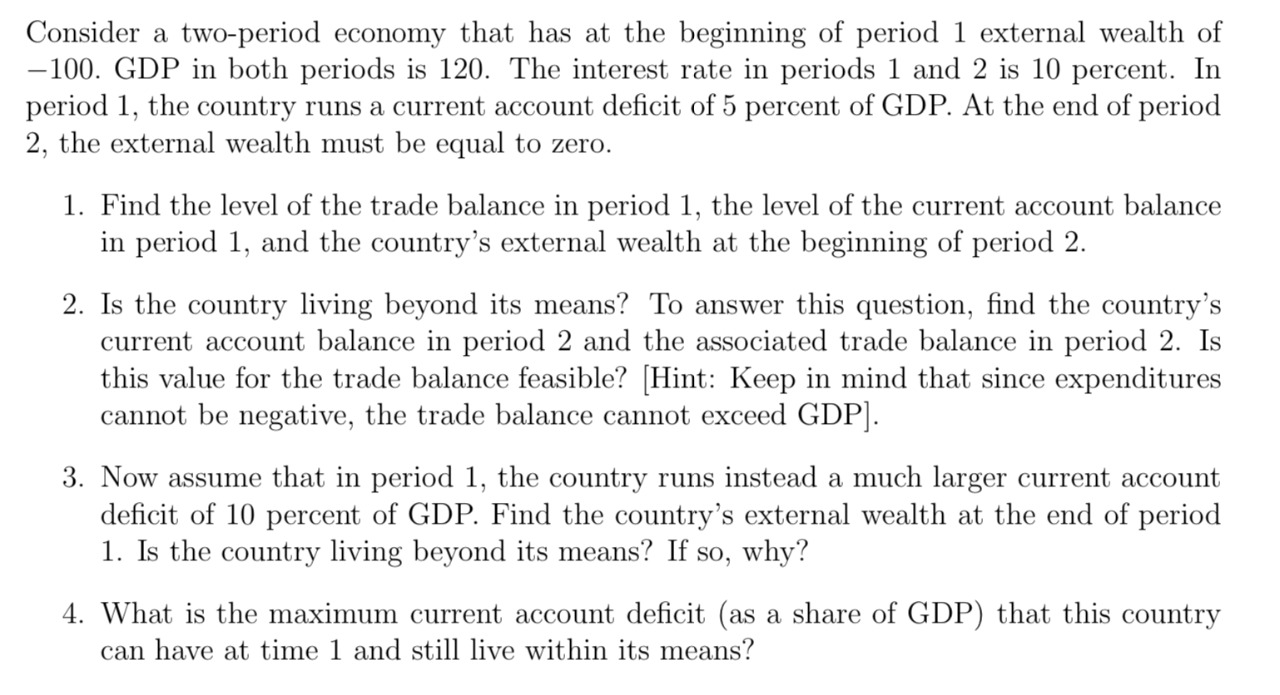

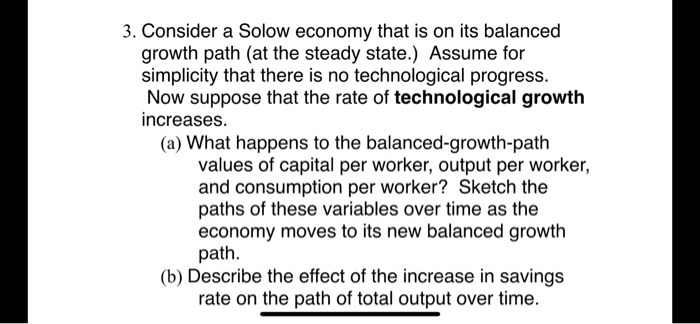

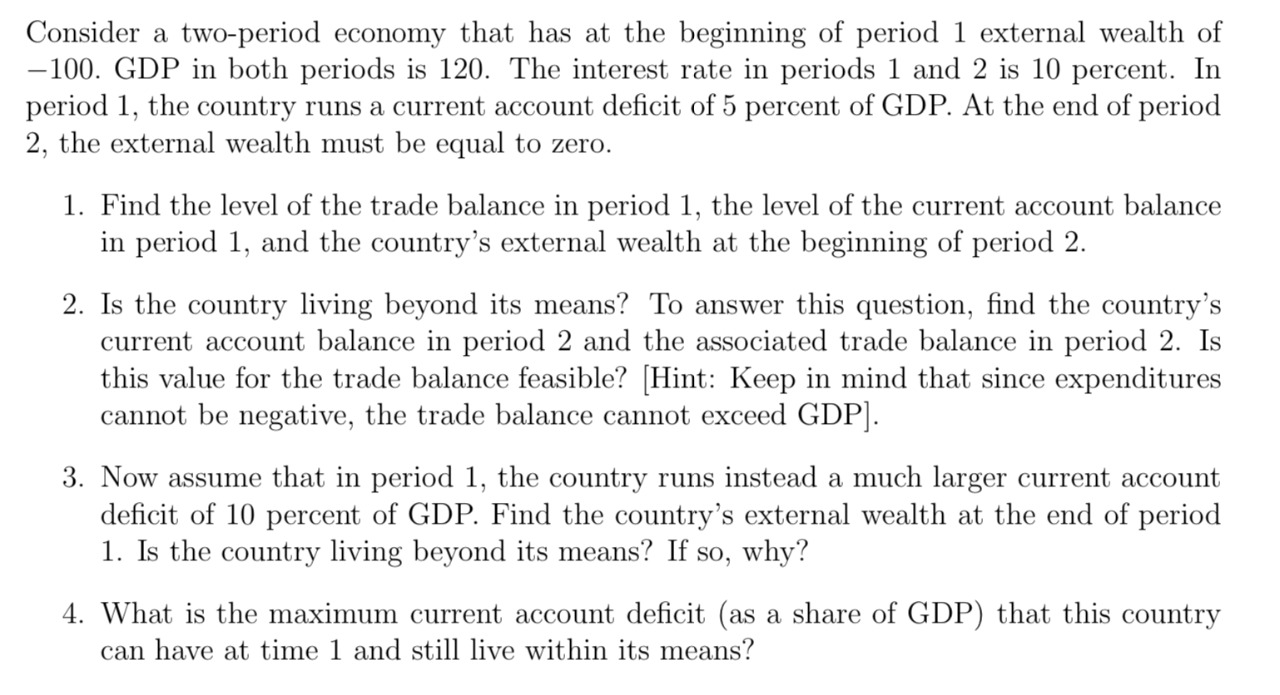

Consider a two-period economy that has at the beginning of period 1 external wealth of 100. GDP in both periods is 120. The interest rate in periods 1 and 2 is 10 percent. In period 1, the country runs a current account decit of 5 percent of GDP. At the end of period 2, the external wealth must be equal to zero. 1. Find the level of the trade balance in period 1, the level of the current account balance in period 1, and the country's external wealth at the beginning of period 2. 2. Is the country living beyond its means? To answer this question, nd the country's current account balance in period 2 and the associated trade balance in period 2. Is this value for the trade balance feasible? [Hintz Keep in mind that since expenditures cannot be negative, the trade balance cannot exceed GDP]. 3. Now assume that in period 1, the country runs instead a much larger current account decit of 10 percent of GDP. Find the country's external wealth at the end of period 1. Is the country living beyond its means? If so, why? 4. What is the maximum current account decit (as a share of GDP) that this country can have at time 1 and still live within its means? 3. Consider a Solow economy that is on its balanced growth path (at the steady state.) Assume for simplicity that there is no technological progress. Now suppose that the rate of technological growth increases. (a) What happens to the balanced-growth-path values of capital per worker, output per worker, and consumption per worker? Sketch the paths of these variables over time as the economy moves to its new balanced growth path. (b) Describe the effect of the increase in savings rate on the path of total output over time.3. Consider a Solow economy that is on its balanced growth path (at the steady state.) Assume for simplicity that there is no technological progress. Now suppose that the rate of technological growth increases. (a) What happens to the balanced-growth-path values of capital per worker, output per worker, and consumption per worker? Sketch the paths of these variables over time as the economy moves to its new balanced growth path. (b) Describe the effect of the increase in savings rate on the path of total output over time.53. Assume the spot rates for year 1, year 2 and year 3 are 3.5%, 4% and 4.5%, respectively. There are a 3-year zero coupon bond and a 3-year coupon bond that pays a 5% coupon annually. (a) What are the YTMs of the bonds? (b) Calculate all 1-year forward rates. (c) Calculate the realized returns of the two bonds over the next year if the yield curve does not change. (In year 1 the 1-year spot rate is 3.5%, the 2-year spot rate is 4% and the 3-year spot rate is 4.5%.) 54. A pension plan is obligated to make disbursements of $1 million, $2 million and $1 million at the end of each of the next three years, respectively. Find the durations of the plan's obligations if the interest rate is 10% annually. 55. A local bank has the following balance sheet: Asset Liability Loans $100 million | Deposits $90 million Equity $10 million The duration of the loans is 4 years and the duration of the deposits is 2 years. (a) What is the duration of the bank's equity? How would you interpret the duration of the equity? (b) Suppose that the yield curve moves from 6% to 6.5%. What is the change in the bank's equity value? The term structure is flat at 6%. A bond has 10 years to maturity, face value $100, and annual coupon rate 5%. Interest rates are expressed as EARs. 56. (a) Compute the bond price. (b) Compute the bond's duration and modified duration. (c) Suppose the term structure moves up to 7% (still staying flat). What is the bond's new price' (d) Compute the approximate price change using duration, and compare it to the actual price change. 57. Suppose Microsoft, which has billions invested in short-term debt securities, undertakes the following two-step transaction on Dec. 30, 2009. (1) Sell $1 billion market value of 6-month U.S. Treasury bills yielding 4% (6 month spot rate). (2) Buy $1 billion of 10- year Treasury notes. The notes have a 5.5% coupon and are trading at par. Microsoft does not need the $1 billion for its operations and will hold the notes to maturity. Fall 2008 Page 24 of 66 (a) What is the impact of this two-step transaction on Microsoft's earnings for the first 6 months of 2010? (b) What is the transaction's NPV? Briefly explain your answers. 58. The Treasury bond maturing on August 15, 2017 traded at a closing ask price of 133:16 (i.e., $133 16/32) on August 31, 2007. The coupon rate is 8.875%, paid semi-annually. The yield to maturity was 4.63% (with semi-annual compounding). (a) Explain in detail how this yield to maturity was calculated. (b) Discount the bond's cash flows, using the yield to maturity. Can you replicate the ask price? (The replication should be close but won't be exact.) Show your calculations.Question 2 (50 points) This question considers the macroeconomic effects of a collapse in consumer demand in the New Keynesian model. There are a continuum of identical households. The representative household makes consumption (C) and labor supply (N) decisions to maximize lifetime expected utility: (1) 1=0 subject to their budget constraint: C+ + Be = we Ne + (1 + 2-1) P. (2) where we is the real wage, N, is hours worked, B, are real bond holdings at the end of period t, it-1 is the nominal interest rate paid between t - 1 and t, P is the price of the final consumption good and D, are real profits from firms that are distributed lump sum. As usual, 0 0 and o > 0. Z, is a household preference shock, which is a way of generating shocks to demand. The production side of the model is the standard New Keynesian environment. Monopolistically competitive intermediate goods firms produce an intermediate good using labor. Intermediate goods firms face a probability that they cannot adjust their price each period (the Calvo pricing mechanism). Intermediate goods are aggregated into a final (homogeneous) consumption good by final goods firms. The production side of the economy, when aggregated and linearized, can be described by the following set of linearized equilibrium conditions (the production function, the optimal hiring condition for labor and the dynamic evolution of prices): ye = mu (3) wit = met (4 ) At = BE,(14+1) + Amic, (5) The resource constraint is: yt = C (6) Monetary policy follows a simple Taylor Rule: 4 = 0.#: (7) The (linearized) preference shock follows an AR(1) process: 2 = pz-1 + et (8) is i.i.d. In percentage deviations from steady state: me, is real marginal cost, & is consumption, w, is the real wage, it is hours worked, y, is output. In deviations from 3 steady state: 4, is the nominal interest rate, if, is inflation. A is a function of model parameters, including the degree of price stickiness.' Assume that o, > 1, 0