explanation for question 2 multiple choice

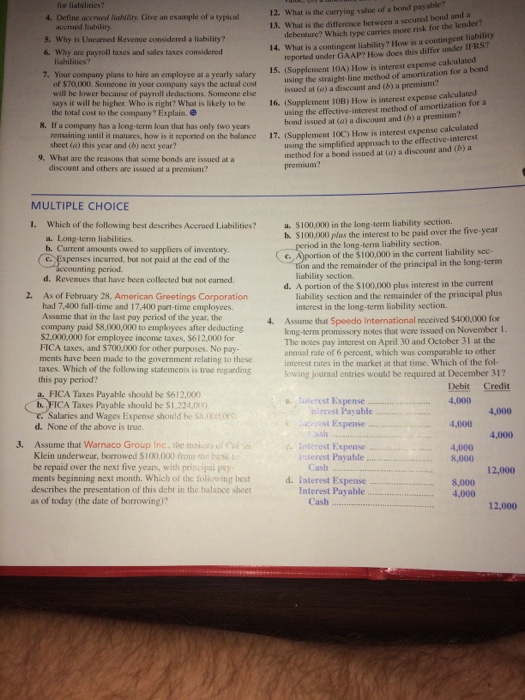

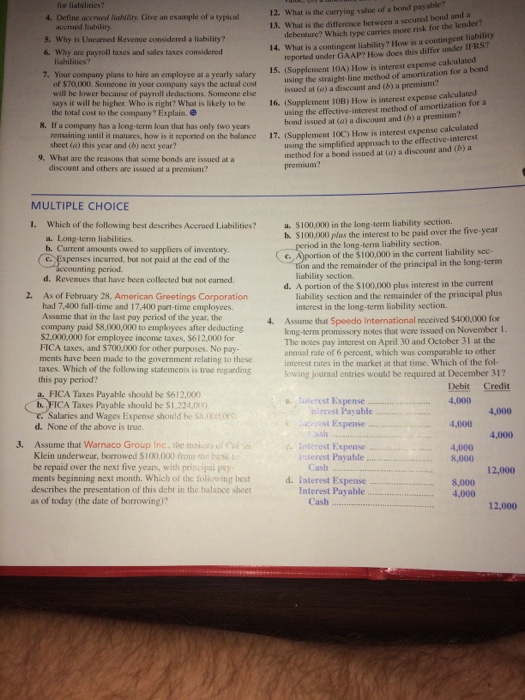

Define accrued liability. Give an example of a typical accrued liability. Why is Unearned Revenue considered a liability? Why is Unearned Revenue considered a liability? Why are poyroll taxes and sales taxes considered liabilities? Your company plans to hire an employee at a yearly salary of $70,000. Someone in your company says the actual cost will be lower because of payroll deductions. Someone else says it will be higher. Who is right? What is likely to be the total cost to the company? Explain. If a company has a long-term loan that has only two years remaining until it matures, how is it reported on the balance sheet (a) this year and (b) next year? What is the carrying value of a bond payable? What is the difference between a secured bond and a debenture? Which type carries more risk for the lender? What is a contingent liability? How is a contingent liability reported under GAAP? How does this differ under IFRS? (Supplement 10A) How is interest expense calculated using the straight-line method of amortization for a bond issued at (a) a discount and (b) a premium? (Supplement 10B) How is interest expense calculated using the effective-interest method of amortization for a bond issued at (a) a discount and (b) a premium? (Supplement 10C) How is interest expense calculated using the simplified approach to the effective-interest method for a bond issued at (a) a discount and (b) a premium? Which of the following best describes Accrued Liabilities? a. Long-term liabilities. b. Current amounts owed to suppliers of inventory. c. Expenses incurred, but not paid at the end of the accounting period. d. Revenues that have been collected but not earned. As of February 28. American Gratings Corporation had 7.400 full-time and 17.400 part-time employees Assume that in the last pay period of the year, the company paid $8,000,000 to employees after deducting $2,000,000 for employee income taxes. $612,000 for FICA taxes, and $700,00 for other purposes. No payments have been made to the government relating hi these taxes. Which the following statement is true regarding this pay period? a. FICA Taxes Payable should be $612,000. b. FICA Taxes Payable should be $1, 224,000 c. Salaries and Wage Expense should be $8, 45,000. d. None of the above is true. Assume that Warnaco Group Inc. the major of Cal Klein underwear, borrowed $100,000 from the bank to be repaid over the next five years, with principal payments beginning next month. Which of the following best describes the presentation of this debt in the balance sheet as of today (the date of borrowing)? a. $100,000 in the long-term liability section. b. $100,000 plus the interest to be paid over the five-year period in the long-term liability section. c. A portion of the $100,000 in the current liability section and the remainder of the principal in the long-term liability section. d. A portion of the $100,000 plus interest in the current liability section and the remainder of the principal plus interest in the long-term liability section. Assume the Speedo international received $400,000 for long-term promissory notes that were issued on November 1. The notes pay interest on April 30 and October 31 at the annual rate of 6 percent, which was comparable to other interest rates in the market at that time. Which of the following journal entries would be required at December 31

explanation for question 2 multiple choice

explanation for question 2 multiple choice