Question

Explores Olympus Optical's strategic response to major losses in its camera business. Key to Olympus's recovery were its extensive product planning process, a quality improvement

Explores Olympus Optical's strategic response to major losses in its camera business. Key to Olympus's recovery were its extensive product planning process, a quality improvement program, and an aggressive cost-reduction program. In particular, the case details Olympus's target costing system, which enabled the firm to design high-quality products at low cost.

Keywords: Cost control, Cost systems, Product design, Product development

Learning Objective

• Application of Target costing to short life cycle products

• Impact of consumer preferences on firms costing and competitive strategies and pricing methods.

• Managing the interaction between price, quality, and functionality of products

Assignment Questions

- Evaluate Olympus’ current strategy

- How important are profit (P), quality (Q) and functionality (F) to the industry and the firm?

- Why did the firm shift the responsibility of product planning from R&D to marketing?

- Evaluate the firm’s decision to place multiple products in each price point.

- Evaluate how the firm’s target costing system functions.

- What changes would you make to the firm’s current target costing system and strategy?

- How does Olympus’ target costing system differ from Nissan’s and Komatsu’s systems?

- How does Olympus reduce the cost of a camera? Is this process sustainable?

- How can Olympus reduce unnecessary expenses and control production costs?

- Describe Olympus’ new cost reduction effort.

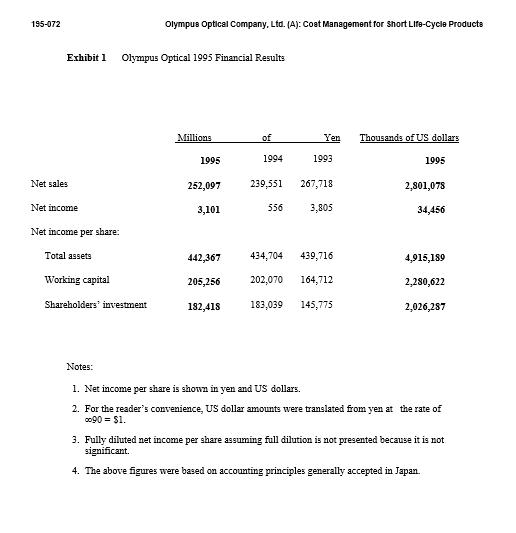

Olympus Optical Company, Ltd. (A): Cost Management for Short Life-Cycle Products Introduction Olympus, which consisted of Olympus Optical Company, Ltd. and its subsidiaries and affiliates, manufactured and sold opto-electronic equipment and other related products. The firm's major product lines included cameras, video camcorders, microscopes, endoscopes, and clinical analyzers. Olympus also produced microcassette tape recorders, laser-optical pickup systems, and industrial lenses. Olympus was founded in 1919 as Takachiho Seisakusho, a producer of microscopes. The brand name Olympus was first used in 1921 and became the firm's name in 1949. The first Olympus camera was developed in 1936, and by 1990 Olympus was the world's fourth-largest camera manufacturer. Olympus had six divisions plus a headquarters facility. Four divisions - consumer products, scientific equipment, endoscopes, and diagnostics were responsible for generating revenues (Exhibit 1 shows 1995 financial results). The other two divisions were responsible for corporate research and production engineering, respectively. Headquarters was responsible for corporate planning, general affairs, personnel and accounting and finance. The consumer products division manufactured and sold 35mm cameras, video camcorders, and microcassette tape recorders. In 1995, the division employed 3,900 people (29% of the total Olympus work force) and generated revenues of #73 billion (29% of group revenues). Cameras were by far the firm's most important consumer product, accounting for #62.8 billion in revenues. Cameras were sold worldwide, with approximately 70% sold outside of Japan. The consumer products division consisted of six departments: division planning, quality assurance, marketing, product development, production, and overseas manufacturing. Responsibility for the division's production facilities was centered at the Tatsuno plant, which opened in 1981 and was the firm's main camera production facility. Tatsuno was responsible for trial production of experimental products, introductory production of new products, and, to a limited degree, camera and lens production. Five other domestic manufacturing facilities reported to Tatsuno, These facilities were all located in Japan and were responsible This case was prepared by Professor Robin Cooper of the Peter F. Drucker School of Management at the Claremont Graduate School as the basis for class discussion rather than to illustrate either effective or ineffective handling of an administrative situation. The assistance of Professor Begine Slagmulder of the University of Ghent and of Ms. May Muda KPMG Peat Marwick, is gratefully acknowledged Copyright 1994 by the President and Fellows of Harvard College. To order copies or request permission to reproduce materials, call 1-800-545-7685 or write Harvard Business School Publishing, Boston, MA 02163. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means- electronic, mechanical, photocopying, recording, or otherwise without the permission of Harvard Business School.

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the assignment questions based on the case study of Olympus Optical Company Ltd Question 1 Evaluate Olympus current strategy Olympus current strategy is to reconstruct its came...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started