Question

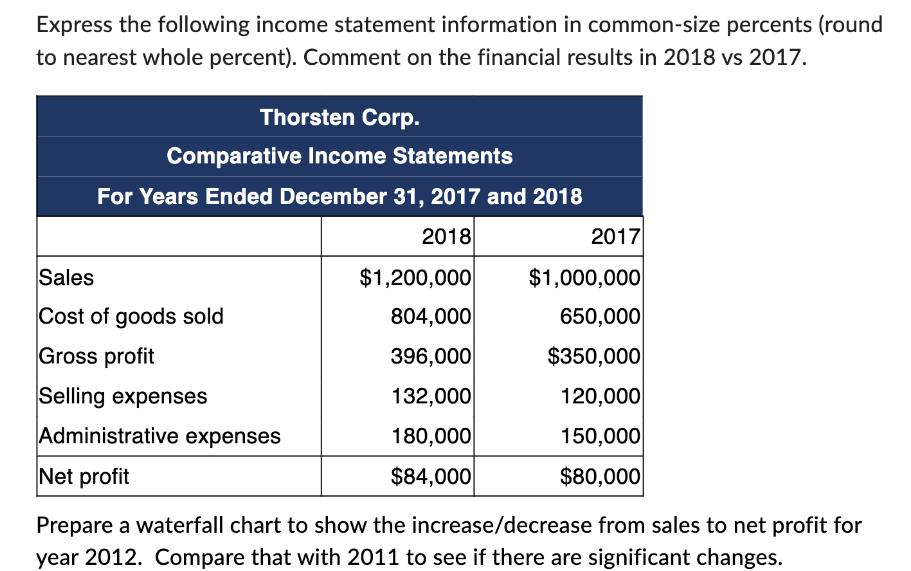

Express the following income statement information in common-size percents (round to nearest whole percent). Comment on the financial results in 2018 vs 2017. Thorsten

Express the following income statement information in common-size percents (round to nearest whole percent). Comment on the financial results in 2018 vs 2017. Thorsten Corp. Comparative Income Statements For Years Ended December 31, 2017 and 2018 2018 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Net profit $1,200,000 804,000 396,000 132,000 180,000 $84,000 2017 $1,000,000 650,000 $350,000 120,000 150,000 $80,000 Prepare a waterfall chart to show the increase/decrease from sales to net profit for year 2012. Compare that with 2011 to see if there are significant changes.

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the commonsize percentages for Thorsten Corps income statement for the years 2017 and 2018 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Information for Decisions

Authors: John J. Wild

9th edition

1259917045, 978-1259917042

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App