Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Extra Credit Ch.7 Homework Question 1 of 2 View Policies < > 15/30 == Show Attempt History Current Attempt in Progress Crane Company of

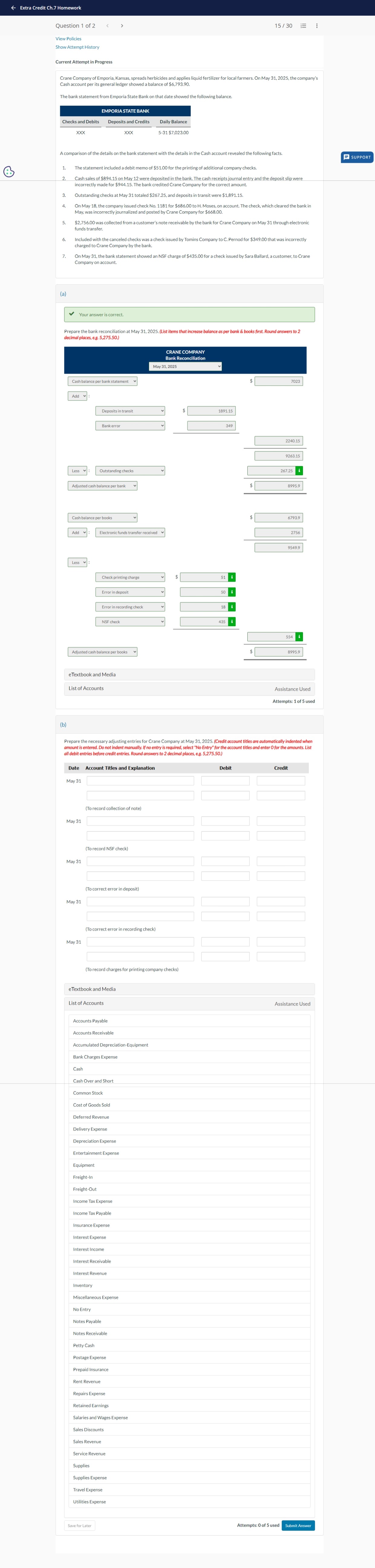

Extra Credit Ch.7 Homework Question 1 of 2 View Policies < > 15/30 == Show Attempt History Current Attempt in Progress Crane Company of Emporia, Kansas, spreads herbicides and applies liquid fertilizer for local farmers. On May 31, 2025, the company's Cash account per its general ledger showed a balance of $6,793.90. The bank statement from Emporia State Bank on that date showed the following balance. EMPORIA STATE BANK Checks and Debits Deposits and Credits Daily Balance XXX XXX 5-31 $7,023.00 A comparison of the details on the bank statement with the details in the Cash account revealed the following facts. 6 1. The statement included a debit memo of $51.00 for the printing of additional company checks. 2. Cash sales of $894.15 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $944.15. The bank credited Crane Company for the correct amount. 3. Outstanding checks at May 31 totaled $267.25, and deposits in transit were $1,891.15. 4. On May 18, the company issued check No. 1181 for $686.00 to H. Moses, on account. The check, which cleared the bank in May, was incorrectly journalized and posted by Crane Company for $668.00. 5. $2,756.00 was collected from a customer's note receivable by the bank for Crane Company on May 31 through electronic funds transfer. 6. 7. (a) Included with the canceled checks was a check issued by Tomins Company to C. Pernod for $349.00 that was incorrectly charged to Crane Company by the bank. On May 31, the bank statement showed an NSF charge of $435.00 for a check issued by Sara Ballard, a customer, to Crane Company on account. Your answer is correct. Prepare the bank reconciliation at May 31, 2025. (List items that increase balance as per bank & books first. Round answers to 2 decimal places, e.g. 5,275.50.) (b) Cash balance per bank statement Add : Less CRANE COMPANY Bank Reconciliation May 31, 2025 Deposits in transit $ 1891.15 Bank error Outstanding checks Adjusted cash balance per bank Cash balance per books Add : Electronic funds transfer received Less Check printing charge $ 51 Error in deposit Error in recording check NSF check Adjusted cash balance per books eTextbook and Media List of Accounts 50 18 435 349 7023 2240.15 9263.15 267.25 8995.9 $ 6793.9 2756 9549.9 554 $ 8995.9 Assistance Used Attempts: 1 of 5 used Prepare the necessary adjusting entries for Crane Company at May 31, 2025. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Round answers to 2 decimal places, e.g. 5,275.50.) Date Account Titles and Explanation May 31 May 31 (To record collection of note) (To record NSF check) May 31 May 31 May 31 (To correct error in deposit) (To correct error in recording check) (To record charges for printing company checks) eTextbook and Media List of Accounts Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Bank Charges Expense Cash Cash Over and Short Common Stock Cost of Goods Sold Deferred Revenue Delivery Expense Depreciation Expense Entertainment Expense Equipment Freight-In Freight-Out Income Tax Expense Income Tax Payable Insurance Expense Interest Expense Interest Income Interest Receivable Interest Revenue Inventory Miscellaneous Expense No Entry Notes Payable Notes Receivable Petty Cash Postage Expense Prepaid Insurance Rent Revenue Repairs Expense Retained Earnings Salaries and Wages Expense Sales Discounts Sales Revenue Service Revenue Supplies Supplies Expense Travel Expense Utilities Expense Save for Later Debit Credit Assistance Used Attempts: 0 of 5 used Submit Answer SUPPORT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started