Answered step by step

Verified Expert Solution

Question

1 Approved Answer

-Extracts for preparing/producing financial statements of Partnership firm: Adjustments: 1. Closing stock is valued at OMR 12,000 2. Salaries of the Partner: (a) Adam: OMR

-Extracts for preparing/producing financial statements of Partnership firm:

Adjustments:

1. Closing stock is valued at OMR 12,000

2. Salaries of the Partner:

(a) Adam: OMR 20,000

(b) Basheer: OMR 15,000

3. Profit should be shared equally between the partners

4. Interest allowed on capital is 6% per annum

5. The current account opening balance as on 1-1-2021 was:

(a) Adam: OMR 150,000 less drawings of OMR 25,000

(b) Basheer: OMR 100,000 less drawings of OMR 25,000

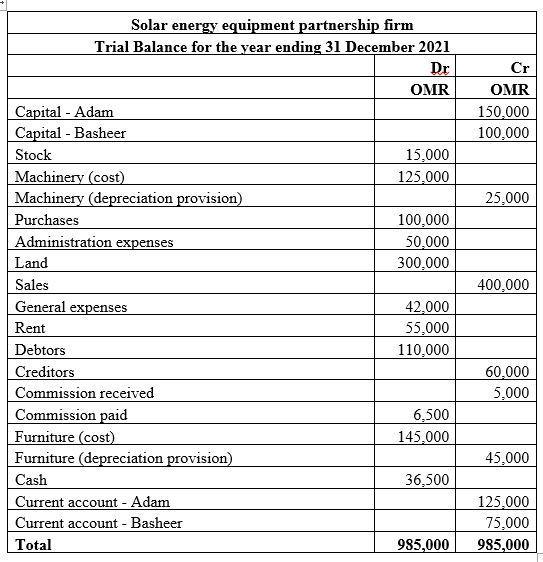

Solar energy equipment partnership firm Trial Balance for the year ending 31 December 2021 Dr OMR Capital - Adam Capital - Basheer Stock Machinery (cost) Machinery (depreciation provision) Purchases Administration expenses Land Sales General expenses Rent Debtors Creditors Commission received Commission paid Furniture (cost) Furniture (depreciation provision) Cash Current account - Adam Current account - Basheer Total 15,000 125,000 100,000 50,000 300,000 42,000 55,000 110,000 6,500 145,000 36,500 985,000 Cr OMR 150,000 100,000 25,000 400,000 60,000 5,000 45,000 125,000 75,000 985,000

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Partnership A formal agreement between t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started