Answered step by step

Verified Expert Solution

Question

1 Approved Answer

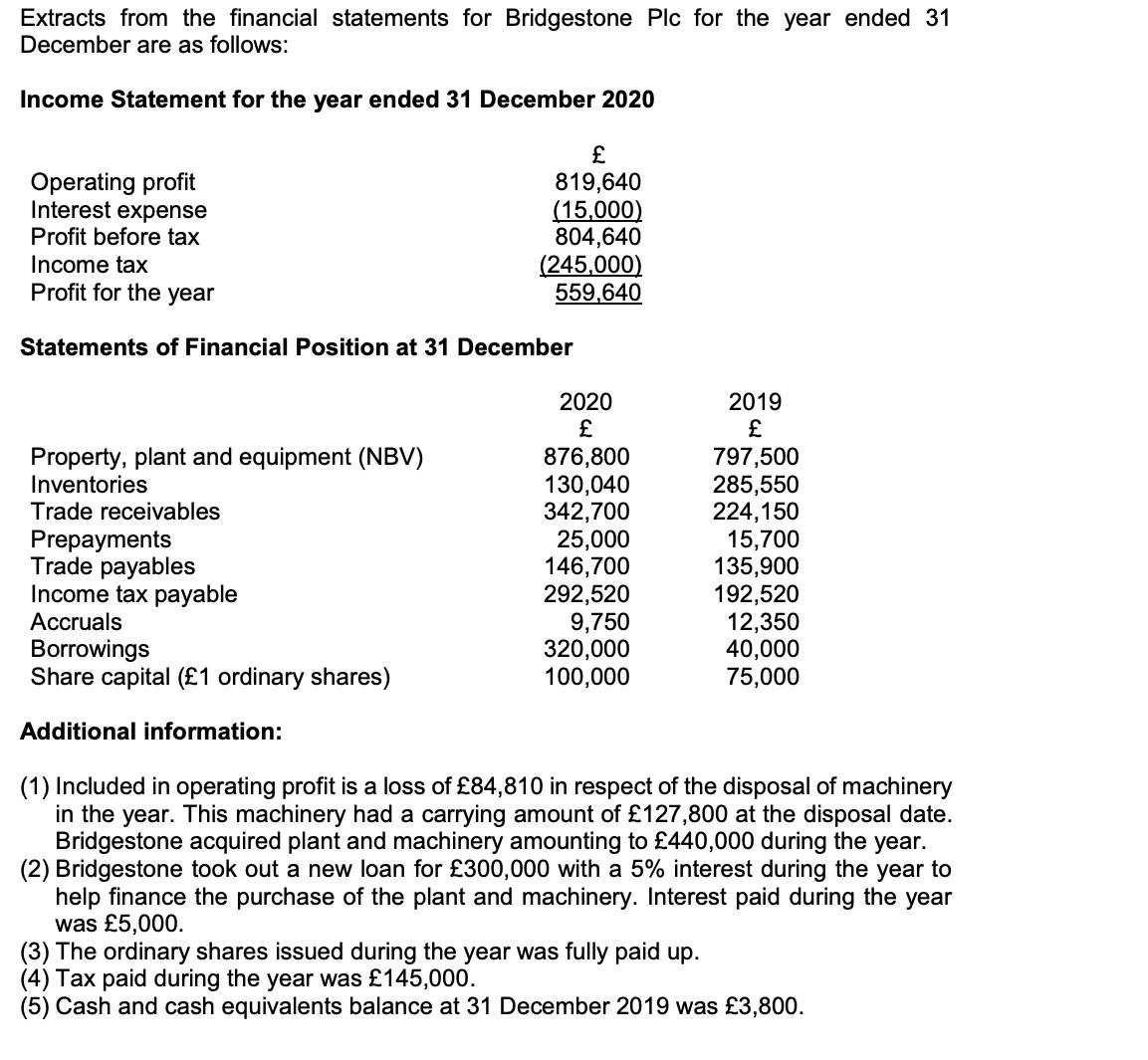

Extracts from the financial statements for Bridgestone Plc for the year ended 31 December are as follows: Income Statement for the year ended 31

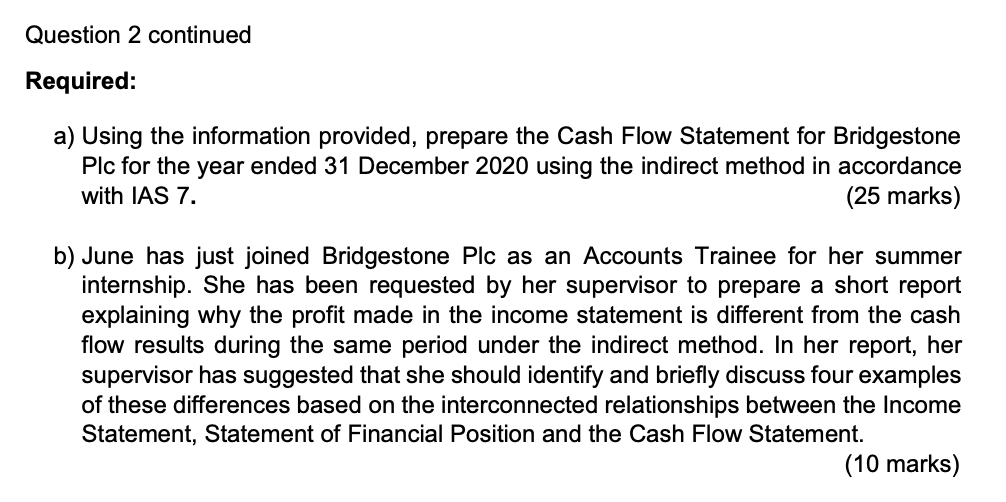

Extracts from the financial statements for Bridgestone Plc for the year ended 31 December are as follows: Income Statement for the year ended 31 December 2020 Operating profit Interest expense Profit before tax Income tax Profit for the year 819,640 (15,000) 804,640 (245,000) 559,640 Statements of Financial Position at 31 December 2020 2019 Property, plant and equipment (NBV) 876,800 797,500 Inventories 130,040 285,550 Trade receivables 342,700 224,150 Prepayments 25,000 15,700 Trade payables 146,700 135,900 Income tax payable 292,520 192,520 Accruals 9,750 12,350 Borrowings 320,000 40,000 Share capital (1 ordinary shares) 100,000 75,000 Additional information: (1) Included in operating profit is a loss of 84,810 in respect of the disposal of machinery in the year. This machinery had a carrying amount of 127,800 at the disposal date. Bridgestone acquired plant and machinery amounting to 440,000 during the year. (2) Bridgestone took out a new loan for 300,000 with a 5% interest during the year to help finance the purchase of the plant and machinery. Interest paid during the year was 5,000. (3) The ordinary shares issued during the year was fully paid up. (4) Tax paid during the year was 145,000. (5) Cash and cash equivalents balance at 31 December 2019 was 3,800. Question 2 continued Required: a) Using the information provided, prepare the Cash Flow Statement for Bridgestone Plc for the year ended 31 December 2020 using the indirect method in accordance with IAS 7. (25 marks) b) June has just joined Bridgestone Plc as an Accounts Trainee for her summer internship. She has been requested by her supervisor to prepare a short report explaining why the profit made in the income statement is different from the cash flow results during the same period under the indirect method. In her report, her supervisor has suggested that she should identify and briefly discuss four examples of these differences based on the interconnected relationships between the Income Statement, Statement of Financial Position and the Cash Flow Statement. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started