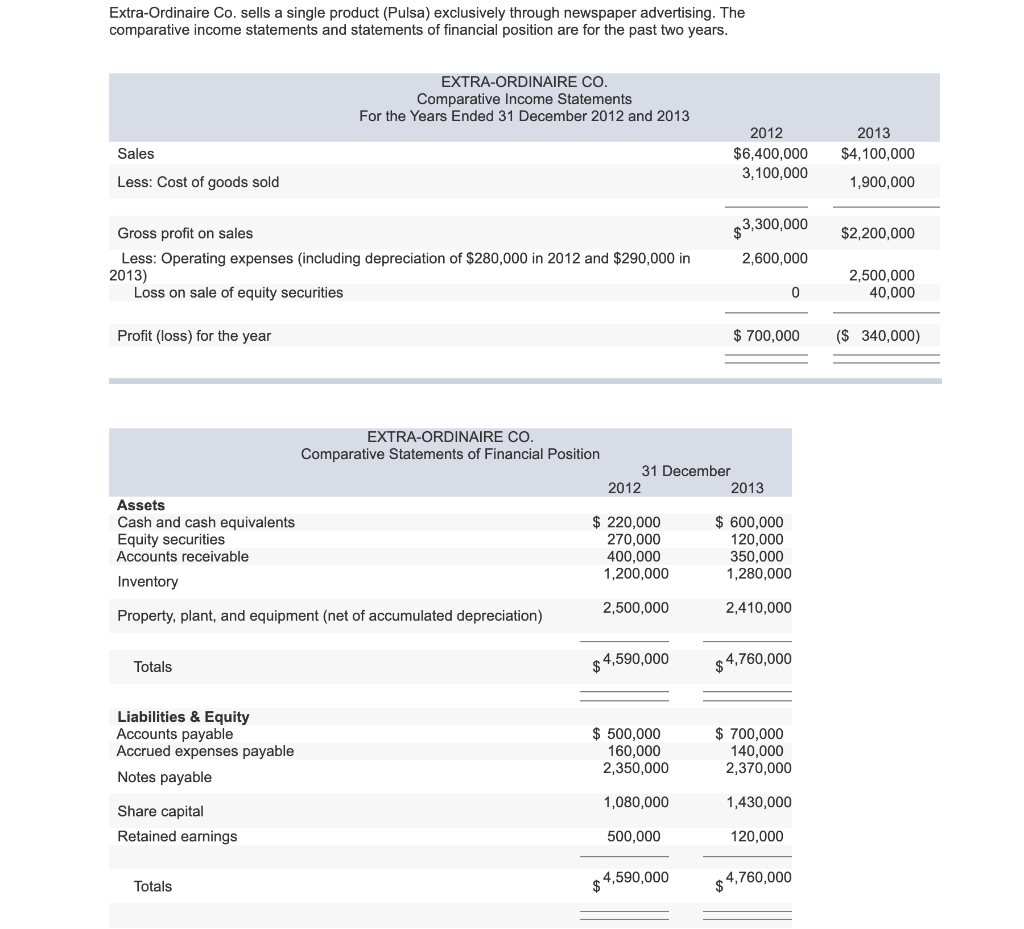

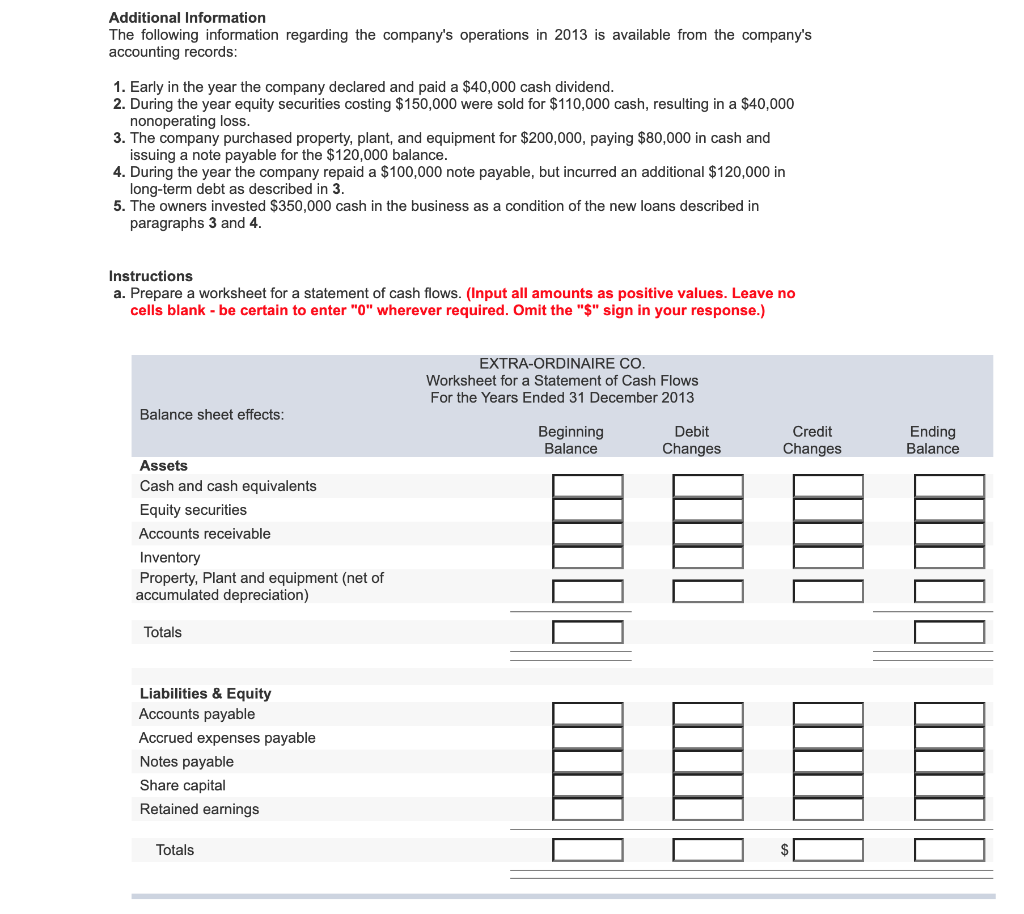

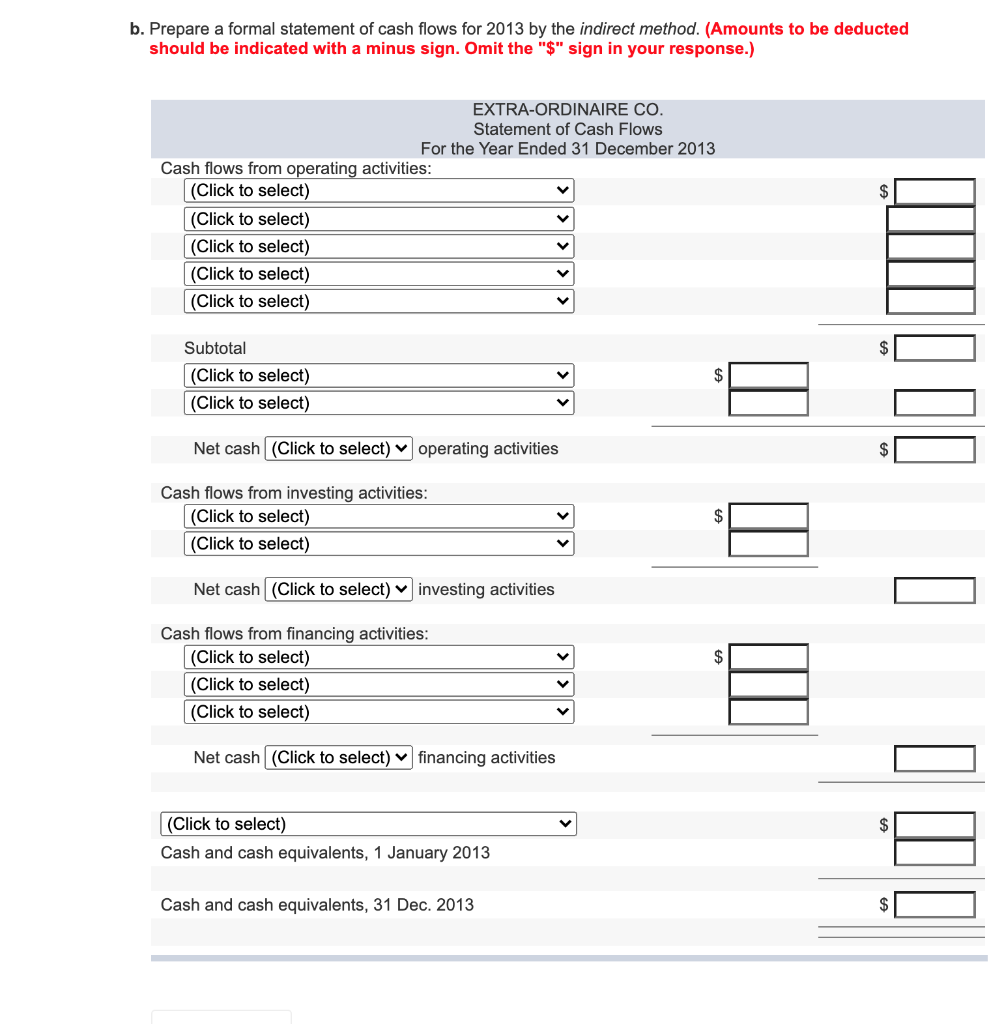

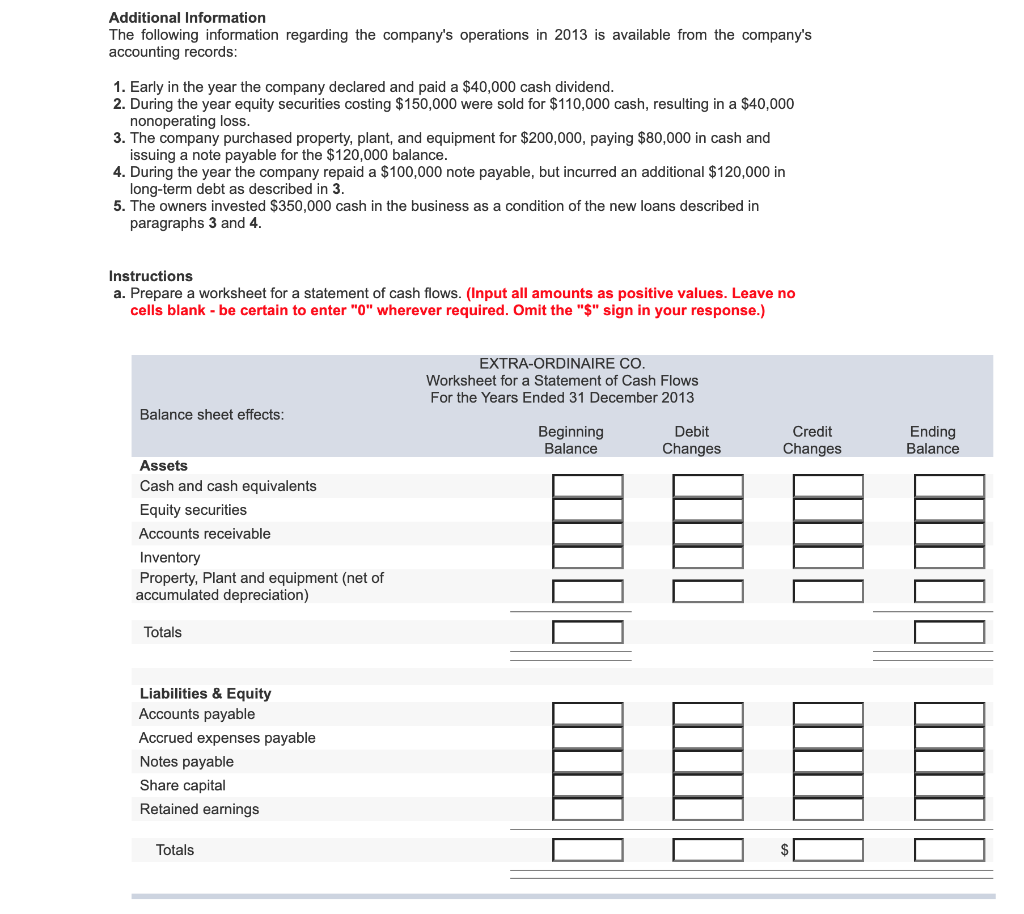

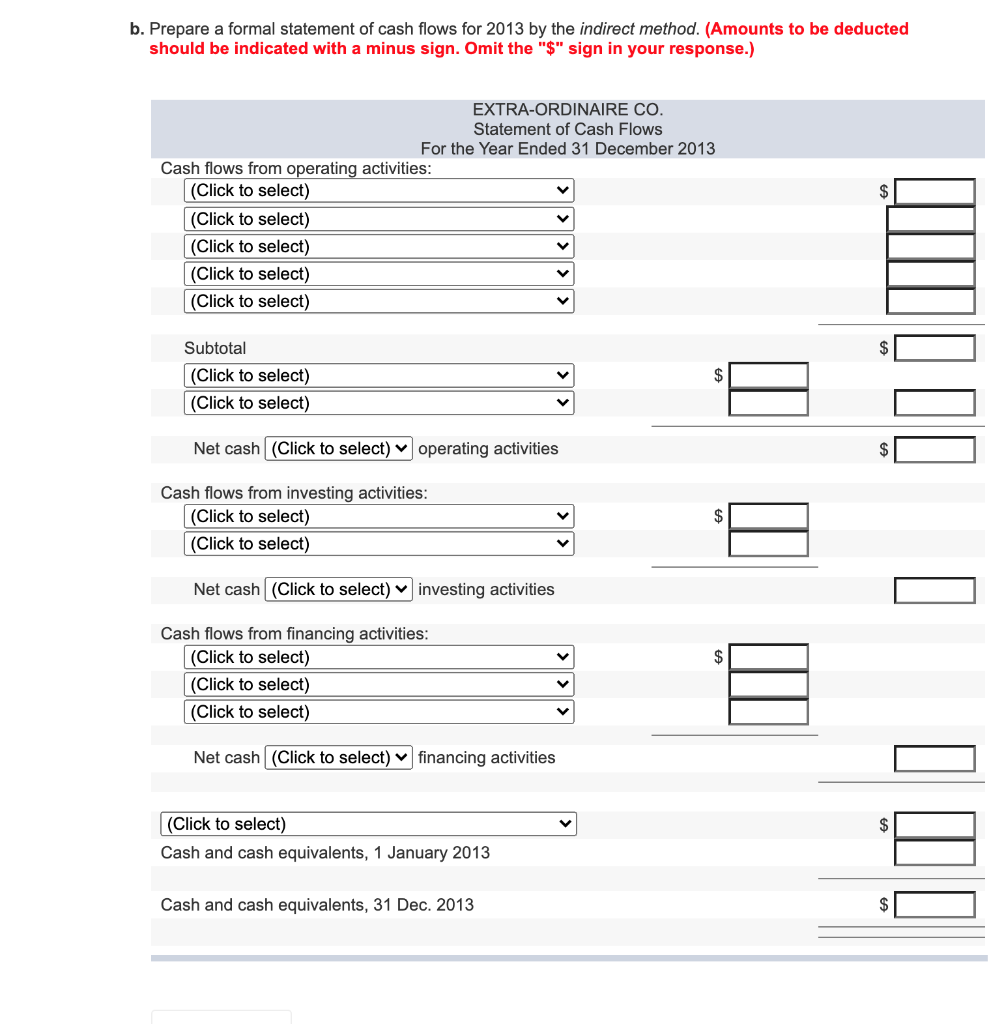

Extra-Ordinaire Co. sells a single product (Pulsa) exclusively through newspaper advertising. The comparative income statements and statements of financial position are for the past two years. EXTRA-ORDINAIRE CO. Comparative Income Statements For the Years Ended 31 December 2012 and 2013 2012 $6,400,000 3,100,000 2013 $4,100,000 Sales Less: Cost of goods sold 1,900,000 $3,300,000 $2,200,000 Gross profit on sales Less: Operating expenses (including depreciation of $280,000 in 2012 and $290,000 in 2013) Loss on sale of equity securities 2,600,000 2,500,000 40,000 0 Profit (loss) for the year $ 700,000 ($ 340,000) EXTRA-ORDINAIRE CO. Comparative Statements of Financial Position 31 December 2012 2013 Assets Cash and cash equivalents Equity securities Accounts receivable Inventory $ 220,000 270,000 400,000 1,200,000 $ 600,000 120,000 350,000 1,280,000 2,500,000 2,410,000 Property, plant, and equipment (net of accumulated depreciation) Totals $4,590,000 $ 4,760,000 Liabilities & Equity Accounts payable Accrued expenses payable Notes payable $ 500,000 160,000 2,350,000 $ 700,000 140,000 2,370,000 1,080,000 1,430,000 Share capital Retained earnings 500,000 120,000 4,590,000 Totals $ 4,760,000 Additional Information The following information regarding the company's operations in 2013 is available from the company's accounting records: 1. Early in the year the company declared and paid a $40,000 cash dividend. 2. During the year equity securities costing $150,000 were sold for $110,000 cash, resulting in a $40,000 nonoperating loss. 3. The company purchased property, plant, and equipment for $200,000, paying $80,000 in cash and issuing a note payable for the $120,000 balance. 4. During the year the company repaid a $100,000 note payable, but incurred an additional $120,000 in long-term debt as described in 3. 5. The owners invested $350,000 cash in the business as a condition of the new loans described in paragraphs 3 and 4. Instructions a. Prepare a worksheet for a statement of cash flows. (Input all amounts as positive values. Leave no cells blank - be certain to enter "0" wherever required. Omit the "$" sign in your response.) EXTRA-ORDINAIRE CO. Worksheet for a Statement of Cash Flows For the Years Ended 31 December 2013 Balance sheet effects: Beginning Balance Debit Changes Credit Changes Ending Balance Assets Cash and cash equivalents Equity securities Accounts receivable Inventory Property, plant and equipment (net of accumulated depreciation) Totals Liabilities & Equity Accounts payable Accrued expenses payable Notes payable Share capital Retained earnings Totals b. Prepare a formal statement of cash flows for 2013 by the indirect method. (Amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your response.) $ EXTRA-ORDINAIRE CO. Statement of Cash Flows For the Year Ended 31 December 2013 Cash flows from operating activities: (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) Subtotal $ $ (Click to select) (Click to select) Net cash (Click to select) v operating activities Cash flows from investing activities: (Click to select) (Click to select) $ Net cash (Click to select) investing activities $ Cash flows from financing activities: (Click to select) (Click to select) (Click to select) Net cash (Click to select) v financing activities $ (Click to select) Cash and cash equivalents, 1 January 2013 Cash and cash equivalents, 31 Dec. 2013