Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EXTREMELY URGENT!!!!!!!! Question 2 [30 points] Stake Technology Inc.'s balance sheet and income statement are as follows: Stake Technology Inc. Stake Technology Inc. Comparative Balance

EXTREMELY URGENT!!!!!!!!

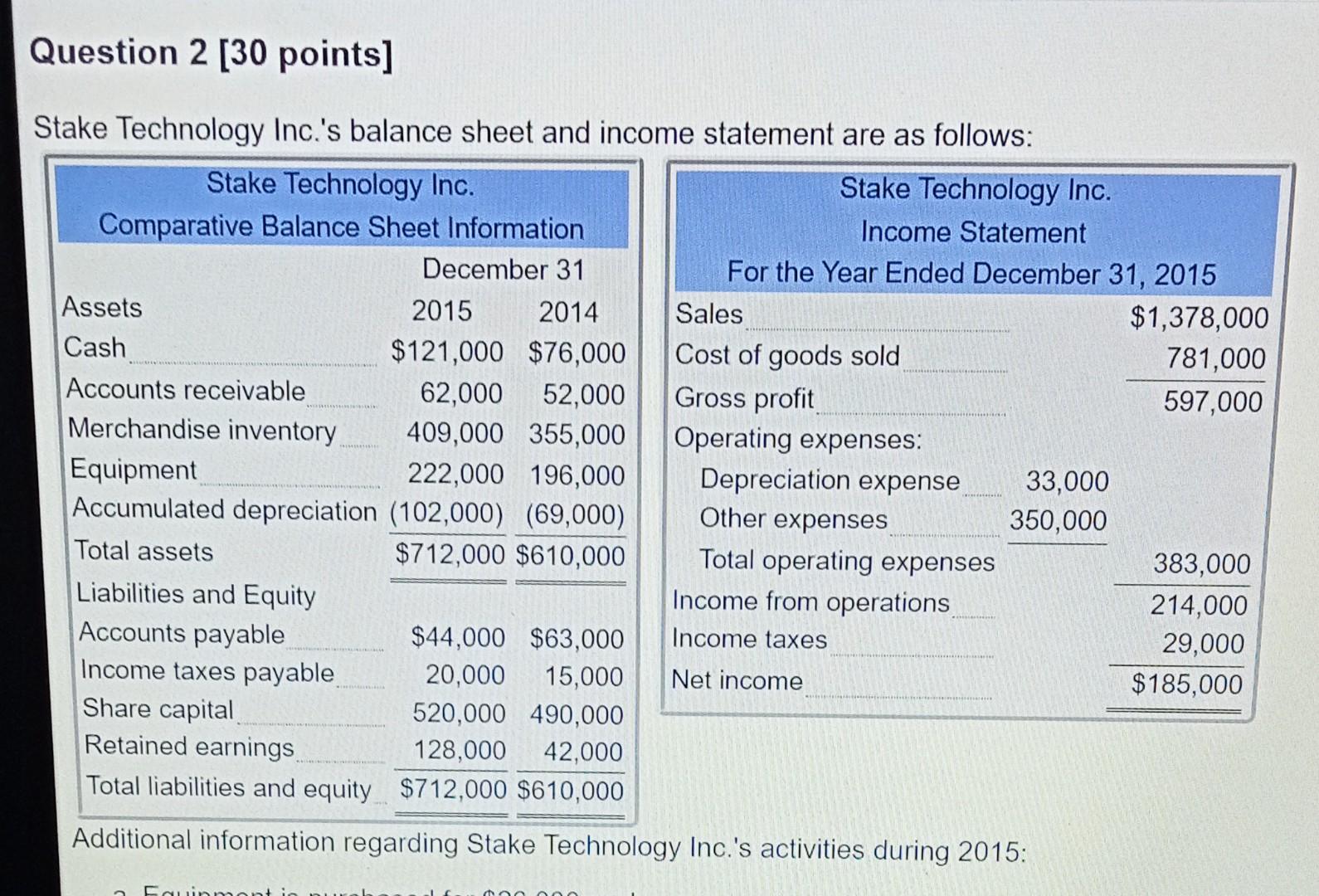

Question 2 [30 points] Stake Technology Inc.'s balance sheet and income statement are as follows: Stake Technology Inc. Stake Technology Inc. Comparative Balance Sheet Information Income Statement December 31 For the Year Ended December 31, 2015 Assets 2015 2014 Sales $1,378,000 Cash $121,000 $76,000 Cost of goods sold 781,000 Accounts receivable 62,000 52,000 Gross profit 597,000 Merchandise inventory 409,000 355,000 Operating expenses: Equipment 222,000 196,000 Depreciation expense 33,000 Accumulated depreciation (102,000) (69,000) Other expenses 350,000 Total assets $712,000 $610,000 Total operating expenses 383,000 Liabilities and Equity Income from operations 214,000 Accounts payable $44,000 $63,000 Income taxes 29,000 Income taxes payable 20,000 15,000 Net income $185,000 Share capital 520,000 490,000 Retained earnings 128,000 42,000 Total liabilities and equity $712,000 $610,000 Additional information regarding Stake Technology Inc.'s activities during 2015: Einman a. Equipment is purchased for $26,000 cash. b. 20,000 common shares are issued for cash at $1.50 per share. Prepare a statement of cash flows for 2015. Use the indirect method to report cash inflows and outflows for the operating activities section. (select one) Statement of Cash Flows (select one) X X X X X + +Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started