Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EyeLight, Incorporated, a distributor of cosmetics, is in the process of assembling a cash budget for the first quarter of 20x1. The following information

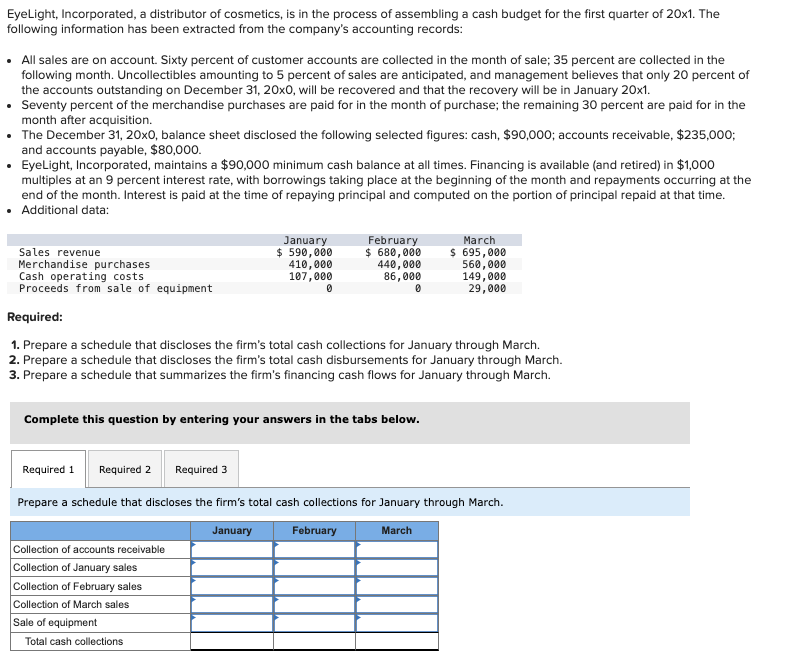

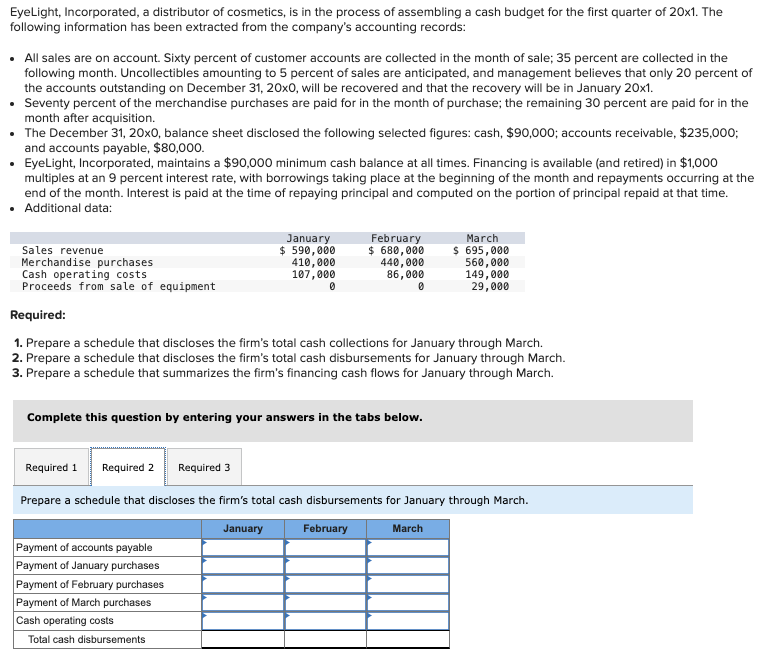

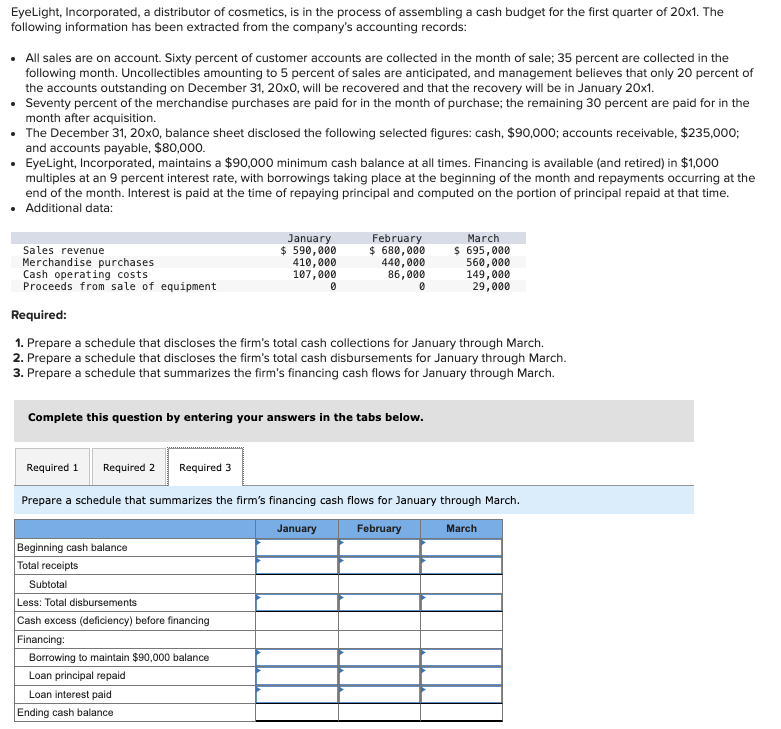

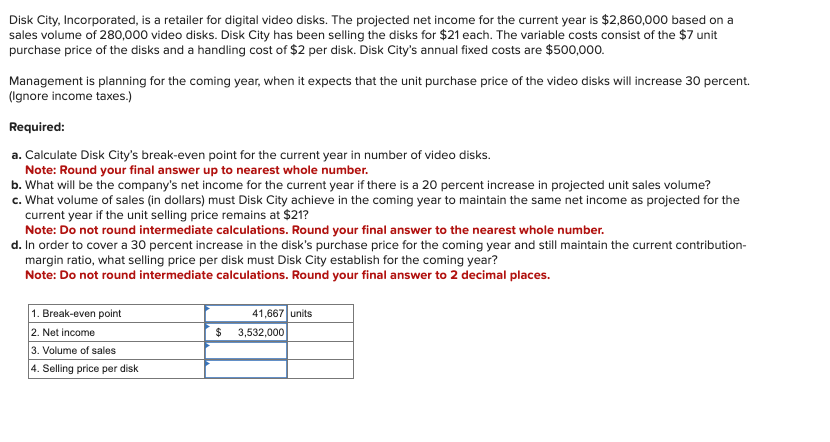

EyeLight, Incorporated, a distributor of cosmetics, is in the process of assembling a cash budget for the first quarter of 20x1. The following information has been extracted from the company's accounting records: All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1. Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the month after acquisition. The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $90,000; accounts receivable, $235,000; and accounts payable, $80,000. EyeLight, Incorporated, maintains a $90,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at an 9 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time. Additional data: Sales revenue Merchandise purchases January $ 590,000 410,000 February $ 680,000 March $ 695,000 440,000 560,000 Cash operating costs 107,000 86,000 Proceeds from sale of equipment 0 0 149,000 29,000 Required: 1. Prepare a schedule that discloses the firm's total cash collections for January through March. 2. Prepare a schedule that discloses the firm's total cash disbursements for January through March. 3. Prepare a schedule that summarizes the firm's financing cash flows for January through March. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a schedule that discloses the firm's total cash collections for January through March. Collection of accounts receivable Collection of January sales Collection of February sales Collection of March sales Sale of equipment Total cash collections January February March EyeLight, Incorporated, a distributor of cosmetics, is in the process of assembling a cash budget for the first quarter of 20x1. The following information has been extracted from the company's accounting records: All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1. Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the month after acquisition. The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $90,000; accounts receivable, $235,000; and accounts payable, $80,000. EyeLight, Incorporated, maintains a $90,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at an 9 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time. Additional data: Sales revenue Merchandise purchases Cash operating costs Proceeds from sale of equipment Required: January $ 590,000 410,000 107,000 February $ 680,000 440,000 86,000 March $ 695,000 560,000 0 149,000 29,000 1. Prepare a schedule that discloses the firm's total cash collections for January through March. 2. Prepare a schedule that discloses the firm's total cash disbursements for January through March. 3. Prepare a schedule that summarizes the firm's financing cash flows for January through March. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a schedule that discloses the firm's total cash disbursements for January through March. Payment of accounts payable Payment of January purchases Payment of February purchases Payment of March purchases Cash operating costs Total cash disbursements January February March EyeLight, Incorporated, a distributor of cosmetics, is in the process of assembling a cash budget for the first quarter of 20x1. The following information has been extracted from the company's accounting records: All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1. Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the month after acquisition. The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $90,000; accounts receivable, $235,000; and accounts payable, $80,000. EyeLight, Incorporated, maintains a $90,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at an 9 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time. Additional data: Sales revenue Merchandise purchases Cash operating costs Proceeds from sale of equipment Required: January $ 590,000 410,000 107,000 February $ 680,000 440,000 86,000 March $ 695,000 560,000 0 149,000 29,000 1. Prepare a schedule that discloses the firm's total cash collections for January through March. 2. Prepare a schedule that discloses the firm's total cash disbursements for January through March. 3. Prepare a schedule that summarizes the firm's financing cash flows for January through March. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a schedule that summarizes the firm's financing cash flows for January through March. Beginning cash balance Total receipts Subtotal Less: Total disbursements Cash excess (deficiency) before financing Financing: Borrowing to maintain $90,000 balance Loan principal repaid Loan interest paid Ending cash balance January February March Disk City, Incorporated, is a retailer for digital video disks. The projected net income for the current year is $2,860,000 based on a sales volume of 280,000 video disks. Disk City has been selling the disks for $21 each. The variable costs consist of the $7 unit purchase price of the disks and a handling cost of $2 per disk. Disk City's annual fixed costs are $500,000. Management is planning for the coming year, when it expects that the unit purchase price of the video disks will increase 30 percent. (Ignore income taxes.) Required: a. Calculate Disk City's break-even point for the current year in number of video disks. Note: Round your final answer up to nearest whole number. b. What will be the company's net income for the current year if there is a 20 percent increase in projected unit sales volume? c. What volume of sales (in dollars) must Disk City achieve in the coming year to maintain the same net income as projected for the current year if the unit selling price remains at $21? Note: Do not round intermediate calculations. Round your final answer to the nearest whole number. d. In order to cover a 30 percent increase in the disk's purchase price for the coming year and still maintain the current contribution- margin ratio, what selling price per disk must Disk City establish for the coming year? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. 1. Break-even point 2. Net income $ 41,667 units 3,532,000 3. Volume of sales 4. Selling price per disk EyeLight, Incorporated, a distributor of cosmetics, is in the process of assembling a cash budget for the first quarter of 20x1. The following information has been extracted from the company's accounting records: All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1. Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the month after acquisition. The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $90,000; accounts receivable, $235,000; and accounts payable, $80,000. EyeLight, Incorporated, maintains a $90,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at an 9 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time. Additional data: Sales revenue Merchandise purchases January $ 590,000 410,000 February $ 680,000 March $ 695,000 440,000 560,000 Cash operating costs 107,000 86,000 Proceeds from sale of equipment 0 0 149,000 29,000 Required: 1. Prepare a schedule that discloses the firm's total cash collections for January through March. 2. Prepare a schedule that discloses the firm's total cash disbursements for January through March. 3. Prepare a schedule that summarizes the firm's financing cash flows for January through March. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a schedule that discloses the firm's total cash collections for January through March. Collection of accounts receivable Collection of January sales Collection of February sales Collection of March sales Sale of equipment Total cash collections January February March EyeLight, Incorporated, a distributor of cosmetics, is in the process of assembling a cash budget for the first quarter of 20x1. The following information has been extracted from the company's accounting records: All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1. Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the month after acquisition. The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $90,000; accounts receivable, $235,000; and accounts payable, $80,000. EyeLight, Incorporated, maintains a $90,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at an 9 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time. Additional data: Sales revenue Merchandise purchases Cash operating costs Proceeds from sale of equipment Required: January $ 590,000 410,000 107,000 February $ 680,000 440,000 86,000 March $ 695,000 560,000 0 149,000 29,000 1. Prepare a schedule that discloses the firm's total cash collections for January through March. 2. Prepare a schedule that discloses the firm's total cash disbursements for January through March. 3. Prepare a schedule that summarizes the firm's financing cash flows for January through March. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a schedule that discloses the firm's total cash disbursements for January through March. Payment of accounts payable Payment of January purchases Payment of February purchases Payment of March purchases Cash operating costs Total cash disbursements January February March EyeLight, Incorporated, a distributor of cosmetics, is in the process of assembling a cash budget for the first quarter of 20x1. The following information has been extracted from the company's accounting records: All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1. Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the month after acquisition. The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $90,000; accounts receivable, $235,000; and accounts payable, $80,000. EyeLight, Incorporated, maintains a $90,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at an 9 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time. Additional data: Sales revenue Merchandise purchases Cash operating costs Proceeds from sale of equipment Required: January $ 590,000 410,000 107,000 February $ 680,000 440,000 86,000 March $ 695,000 560,000 0 149,000 29,000 1. Prepare a schedule that discloses the firm's total cash collections for January through March. 2. Prepare a schedule that discloses the firm's total cash disbursements for January through March. 3. Prepare a schedule that summarizes the firm's financing cash flows for January through March. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a schedule that summarizes the firm's financing cash flows for January through March. Beginning cash balance Total receipts Subtotal Less: Total disbursements Cash excess (deficiency) before financing Financing: Borrowing to maintain $90,000 balance Loan principal repaid Loan interest paid Ending cash balance January February March Disk City, Incorporated, is a retailer for digital video disks. The projected net income for the current year is $2,860,000 based on a sales volume of 280,000 video disks. Disk City has been selling the disks for $21 each. The variable costs consist of the $7 unit purchase price of the disks and a handling cost of $2 per disk. Disk City's annual fixed costs are $500,000. Management is planning for the coming year, when it expects that the unit purchase price of the video disks will increase 30 percent. (Ignore income taxes.) Required: a. Calculate Disk City's break-even point for the current year in number of video disks. Note: Round your final answer up to nearest whole number. b. What will be the company's net income for the current year if there is a 20 percent increase in projected unit sales volume? c. What volume of sales (in dollars) must Disk City achieve in the coming year to maintain the same net income as projected for the current year if the unit selling price remains at $21? Note: Do not round intermediate calculations. Round your final answer to the nearest whole number. d. In order to cover a 30 percent increase in the disk's purchase price for the coming year and still maintain the current contribution- margin ratio, what selling price per disk must Disk City establish for the coming year? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. 1. Break-even point 2. Net income $ 41,667 units 3,532,000 3. Volume of sales 4. Selling price per disk

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate Disk Citys breakeven point for the current year in the number of video disks Contributio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started