Question

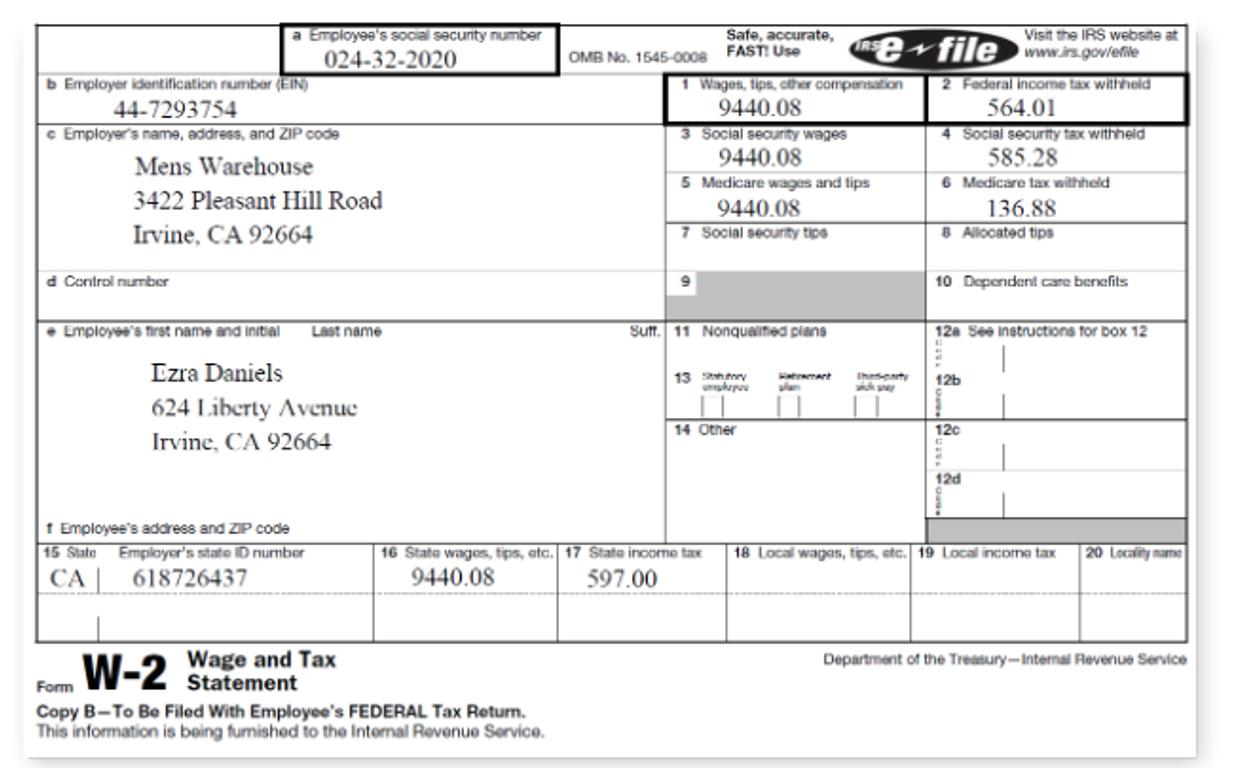

Ezra a high school senior; he works at The Home Depot as a sales associate, approximately 10 hours per week during the school year and

Ezra a high school senior; he works at The Home Depot as a sales associate, approximately 10 hours per week during the school year and 30 during the summer. He received this W-2 from his employer in February and needs to file his taxes for the first time.

He heard about the IRS Free File Program but he is a bit nervous to file taxes for the first time.Ezra is 18 and lives at home, his parents do not claim him as a dependent.

For tax purposes, he is single,has one job and doesn’t pay for his own living expenses. Ezra’s birthday is December 21, 2002.

Ezra doesn’t pay rent and has no other complex expenses (deductions.)

what is the amount of the federal tax return that appears at the top of the Tur-tax screen?

Safe, accurate, Visit the IRS website at efile www.irs.goviefile a Employee's Social security number IRS 024-32-2020 OMB No. 1545-0008 FAST Use b Employer identification rumber (EIN) 44-7293754 c Employer's name, address, and ZIP code Wages, tips, other compensation 9440.08 Social security wages 9440.08 5 Medicare wages and tips 9440.08 7 Social security tipe 2 Federal income tax withheld 564.01 4 Social security tax withheld 585.28 6 Medicare tax withheld Mens Warehouse 3422 Pleasant Hill Road 136.88 8 Alocated tips Irvine, CA 92664 d Control number 10 Dependent care benefits Employee's first name and initial Last name Suft. 11 Nonqualitied piens 12a See instructions for box 12 Czra Daniels 624 Liberty Avenue Irvine, CA 92664 13 y Iheenty remart 126 14 Otner 12c 12d 1 Employee's address and ZIP code 15 Slate Emplayer's state ID nurmber CA 16 State wages, tips, atc. 17 State income tax 18 Local wagas, tips, etc. 19 Local income tax 20 Locality mame 618726437 9440.08 597.00 W-2 Wage and Tax Statement Department of the Treasury-Internal FRevenue Service Form Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being fumished to the Internal Revenue Service.

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The amount of federal tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started