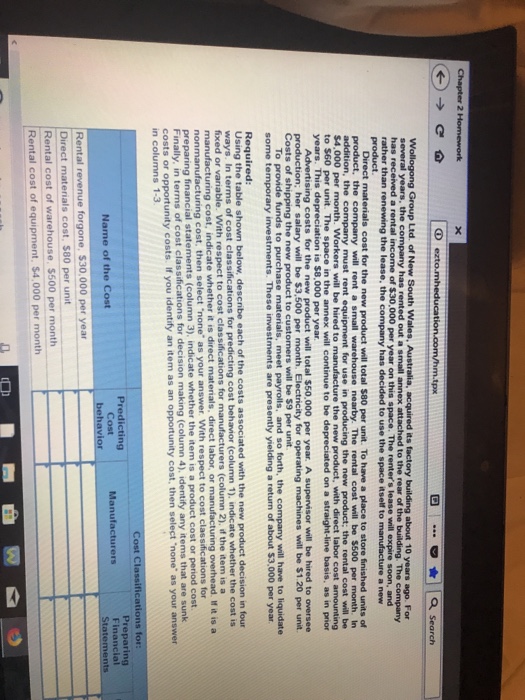

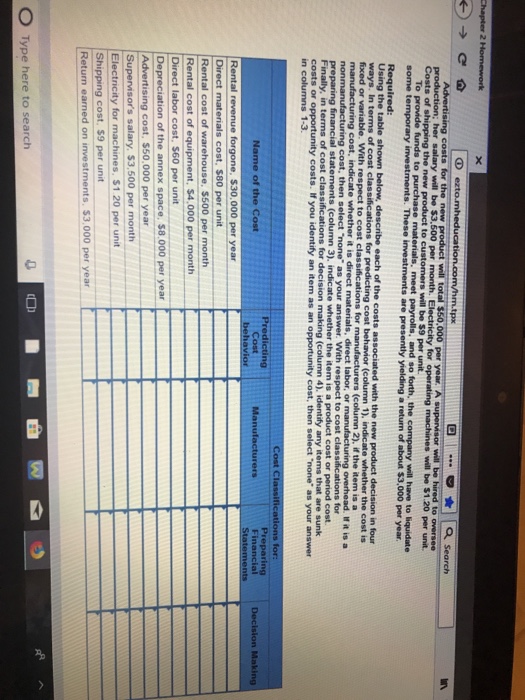

eztom Wollogong Group Ltd. of New South Wales. Australia, acquired its factory building about 10 years ago. For company has rented out a small annex attached to the rear of the building. The company years, the of $30,000 per year on this space. The renters lease will expire soon, and company has decided to use the space itself to manufacture a new rather than renewing the lease, the Direct materials cost for the new product will total 580 per unit. To have a place to store finished units of will rent a small warehouse nearby. The rental cost will be $500 per month. In ion, the company must rent e for use in producing the new the rental cost will be to manufacture the new product, with direct labor cost amounting to $60 per unit. The space in the annex will continue to be depreciated on a straight-line basis, as in prior $4,000 per month. W will be hired years. This is $8,000 per year costs for the new product will total $50,000 per year. A supervisor will be hired to oversee ion; her salary will be $3,500 per month. Electricity for operating machines will be $1.20 per unit. Costs of shipping the new product to custoners will be $9 per unit and so forth, the company will have to liquidate To provide funds to purchase materials, meet some temporary investments. These investments are presently yielding a return of about $3,000 per year. Using the table shown below, describe each of the costs associated with the new product decision in four ways. In terms of cost classifications for predicting cost behavior (column 1). indicate whether the cost is fixed or variable. With respect to cost class manufacturing cost, indicate whet nonmanufacturing cost, then select "none" as your answer. With respect to cost classifications for preparing financial statements (colu Finally, in terms of cost classi costs or opportunity costs. If you identify an item as an opportunity cost, then select 'none' as your answer s for manufacturers (column 2), if the item is a her it is direct matenals, direct labor, or manufacturing overhead. If it is a mn 3), indicate whether the item is a product cost or period cost making (column 4), identify any it items that are sunk in columns 1-3 Cost Classifications for: ring Predicting Cost Name of the Cost Rental revenue forgone, $30,000 per year Direct materials cost, 580 per unit Rental cost of warehouse $500 per month Rental cost of equipment, $4,000 per month