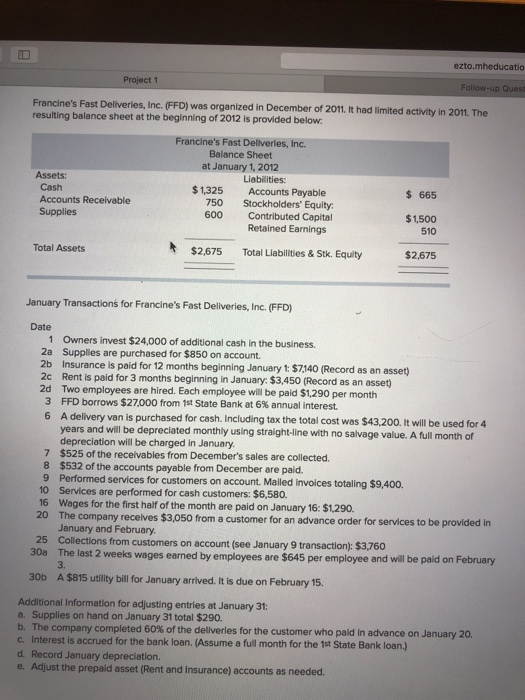

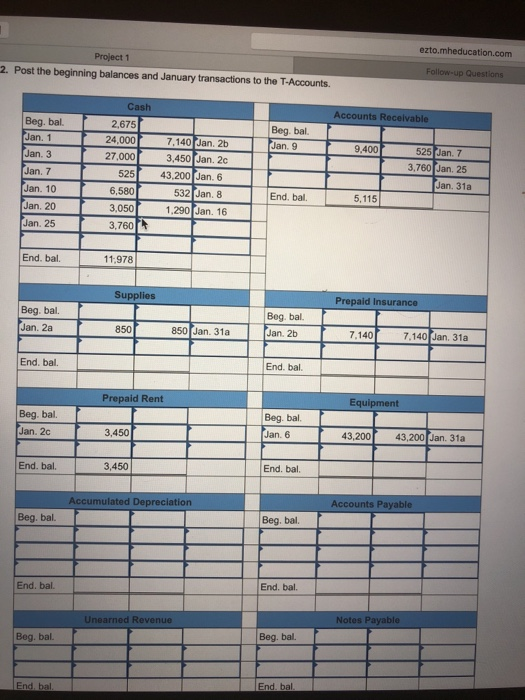

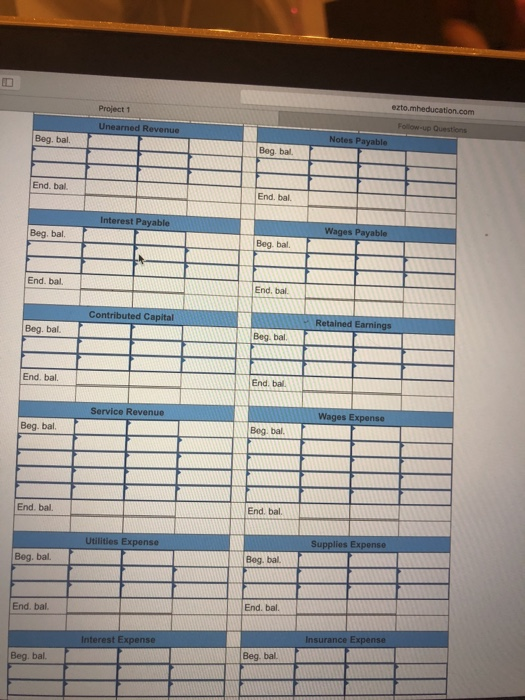

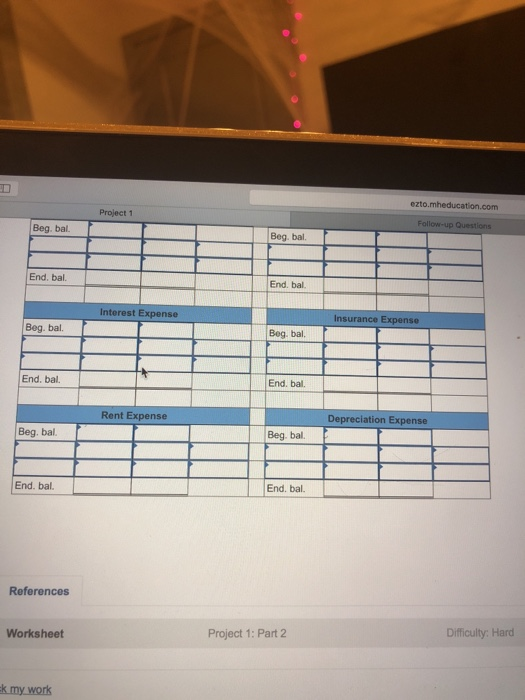

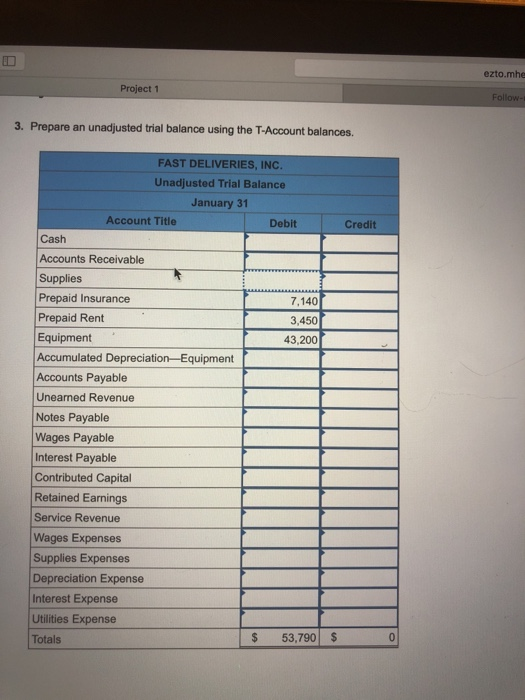

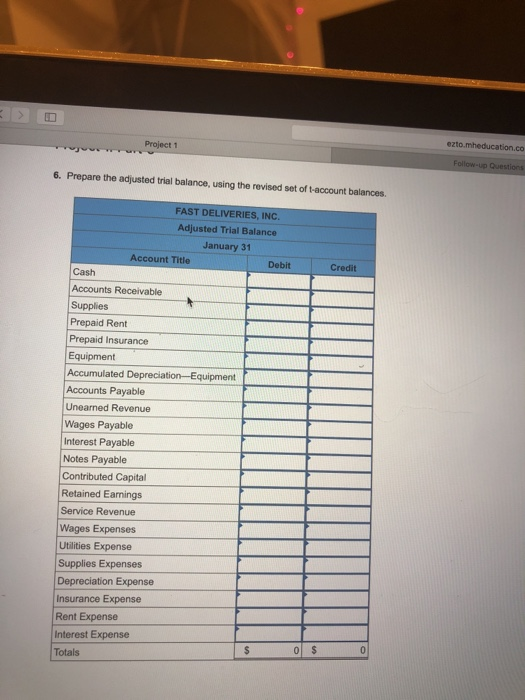

ezto.mheducatio Project 1 Follow-up Quest Francine's Fast Deliveries, Inc. (FFD) was organized in December of 2011. t had limited activity in 2011. The resulting balance sheet at the beginning of 2012 Is provided below Francine's Fast Deliveries, Inc. Balance Sheet at January 1, 2012 Assets: Liabilities: $1,325 Accounts Payable Cash Accounts Receivable $ 665 750 Stockholders' Equity 600 Contributed Capital $1,500 510 Retained Earnings $2,675 Total Liablities & Stk. Equity $2.675 Total Assets January Transactions for Francine's Fast Deliveries, Inc. (FFD) Date 1 Owners invest $24,000 of additional cash in the business. 2a Supplies are purchased for $850 on account. 2b Insurance is paid for 12 months beginning January 1: $7140 (Record as an asset) 2c Rent is paid for 3 months beginning in January: $ 2d Two employees are hired. Each employee will be paid $1,290 per month 3 FFD borrows $27,000 from 1st State Bank at 6% annual interest. 3,450 (Record as an asset) 6 A delivery van is purchased for cash. Including tax the total cost was $43.200. It will be used for 4 years and will be depreciated monthly using straight-line with no salvage value. A full month of depreciation will be charged in January 7 $525 of the receivables from December's sales are collected. 8 $532 of the accounts payable from December are paid. 9 Performed services for customers on account. Mailed invoices totaling $9,400. Services are performed for cash customers: $6,580. Wages for the first half of the month are paid on January 16: $1.290. The company receives $3,050 from a customer for an advance order for services to be provided in January and Februany Collections from customers on account (see January 9 transaction): $3760 10 16 20 last 2 weeks wages earned by employees are $645 per employee and will be paid on February 3. 30a The 30b A $815 utlity bill for January arrived. t is due on February 15. Additional Information for adjusting entries at January 31: a. Supplies on hand on January 31 total $290. b. The company completed 60% of the deliveries for the customer who paid in advance on January 20, c. Interest is accrued for the bank loan. (Assume a full month for the 1st State Bank loan,) d. Record January depreciation. e. Adjust the prepaid asset (Rent and Insurance) accounts as needed. ezto.mheducatio Project 1 Follow-up Quest Francine's Fast Deliveries, Inc. (FFD) was organized in December of 2011. t had limited activity in 2011. The resulting balance sheet at the beginning of 2012 Is provided below Francine's Fast Deliveries, Inc. Balance Sheet at January 1, 2012 Assets: Liabilities: $1,325 Accounts Payable Cash Accounts Receivable $ 665 750 Stockholders' Equity 600 Contributed Capital $1,500 510 Retained Earnings $2,675 Total Liablities & Stk. Equity $2.675 Total Assets January Transactions for Francine's Fast Deliveries, Inc. (FFD) Date 1 Owners invest $24,000 of additional cash in the business. 2a Supplies are purchased for $850 on account. 2b Insurance is paid for 12 months beginning January 1: $7140 (Record as an asset) 2c Rent is paid for 3 months beginning in January: $ 2d Two employees are hired. Each employee will be paid $1,290 per month 3 FFD borrows $27,000 from 1st State Bank at 6% annual interest. 3,450 (Record as an asset) 6 A delivery van is purchased for cash. Including tax the total cost was $43.200. It will be used for 4 years and will be depreciated monthly using straight-line with no salvage value. A full month of depreciation will be charged in January 7 $525 of the receivables from December's sales are collected. 8 $532 of the accounts payable from December are paid. 9 Performed services for customers on account. Mailed invoices totaling $9,400. Services are performed for cash customers: $6,580. Wages for the first half of the month are paid on January 16: $1.290. The company receives $3,050 from a customer for an advance order for services to be provided in January and Februany Collections from customers on account (see January 9 transaction): $3760 10 16 20 last 2 weeks wages earned by employees are $645 per employee and will be paid on February 3. 30a The 30b A $815 utlity bill for January arrived. t is due on February 15. Additional Information for adjusting entries at January 31: a. Supplies on hand on January 31 total $290. b. The company completed 60% of the deliveries for the customer who paid in advance on January 20, c. Interest is accrued for the bank loan. (Assume a full month for the 1st State Bank loan,) d. Record January depreciation. e. Adjust the prepaid asset (Rent and Insurance) accounts as needed