f. [15 marks] Montreal Holding Corporation wishes to hedge the balance sheet in exhibit 1 with Treasury bond futures contracts, which currently have a

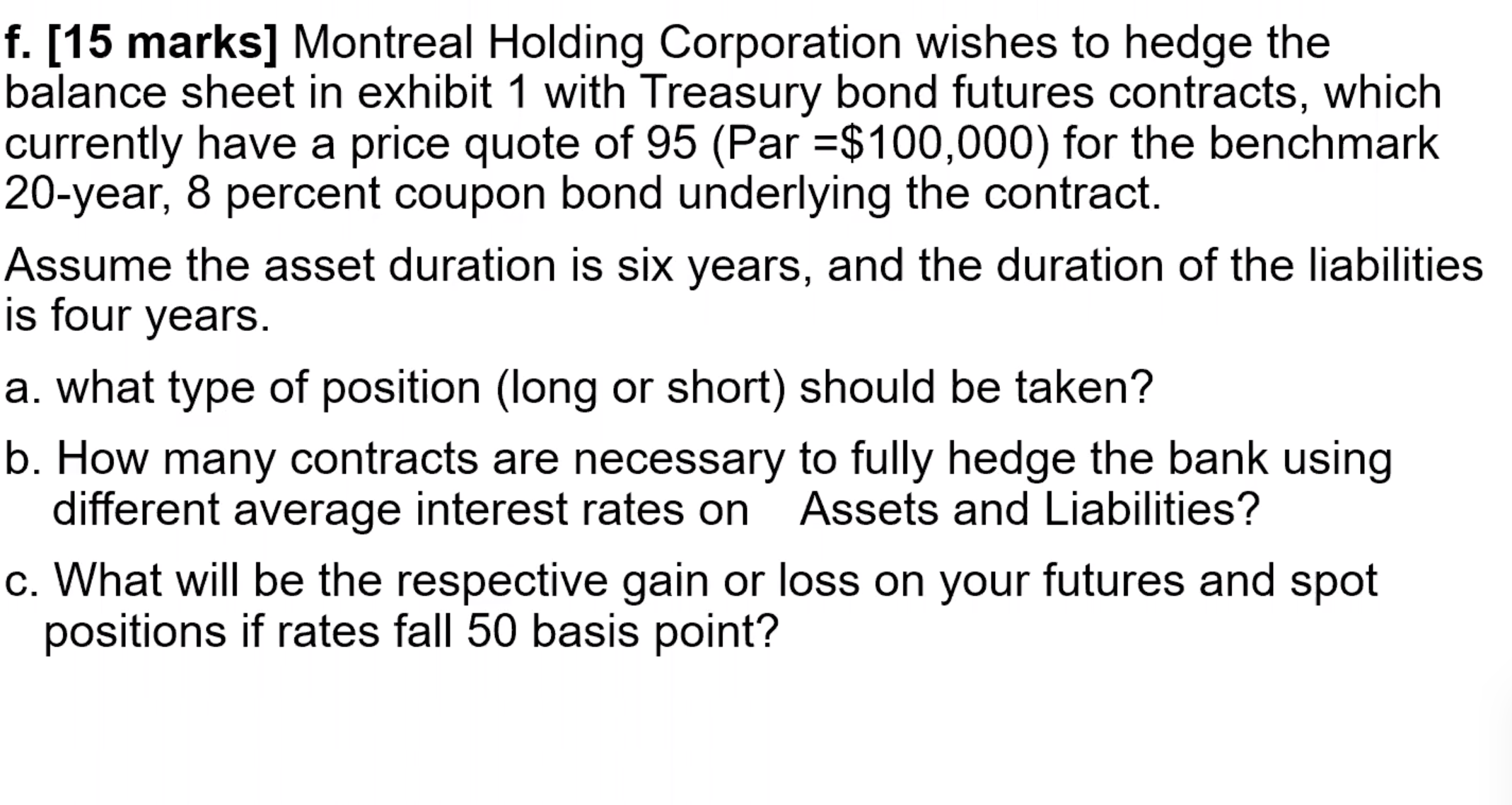

f. [15 marks] Montreal Holding Corporation wishes to hedge the balance sheet in exhibit 1 with Treasury bond futures contracts, which currently have a price quote of 95 (Par =$100,000) for the benchmark 20-year, 8 percent coupon bond underlying the contract. Assume the asset duration is six years, and the duration of the liabilities is four years. a. what type of position (long or short) should be taken? b. How many contracts are necessary to fully hedge the bank using different average interest rates on Assets and Liabilities? c. What will be the respective gain or loss on your futures and spot positions if rates fall 50 basis point?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To hedge the balance sheet with Treasury bond futures contracts we need to consider the durations of assets and liabilities and determine the appropriate position and number of contracts required a Wh...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started