Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Warner Music Group became the only stand-alone music company to be publicly traded in the United States in May 2005. The company has tW3

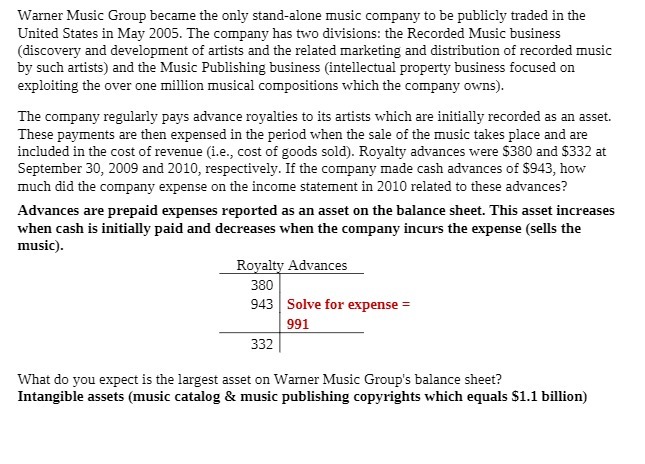

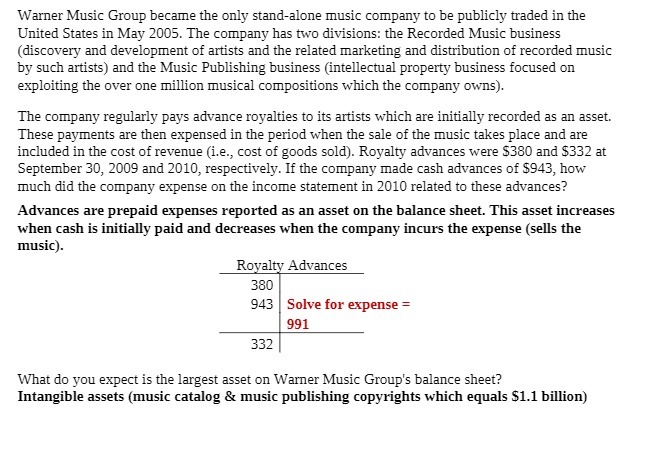

Warner Music Group became the only stand-alone music company to be publicly traded in the United States in May 2005. The company has tW3 divisions: the Recorded Music business (discovery and development of artists and the related marketing and distribution of recorded music by such artists) and the Music Publishing business (intellectual property business focused on exploiting the over one million musical compositions which the company owns). The company regularly pays advance royalties to its artists which are initially recorded as an asset. These payments are then expensed in the period when the sale of the music takes place and are included in the cost of revenue (i.e., cost of goods sold). Royalty advances were 5380 and 5332 at September 30, 2009 and 2010, respectively. If the company made cash advances of 5943, how much did the company expense on the income statement in 2010 related to these advances? Advances are prepaid expenses reported as an asset on the balance sheet. This asset increases when cash is initially paid and decreases when the company incurs the upense (sells the music). Ro al 380 943 332 Advances Solve for expense = 991 \'Vhat do expect is the largest asset on Wamer Music Group's balance sheet? Intangible assets (music catalog & music publishing copyrights which equals Sl.1 billion)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started