Answered step by step

Verified Expert Solution

Question

1 Approved Answer

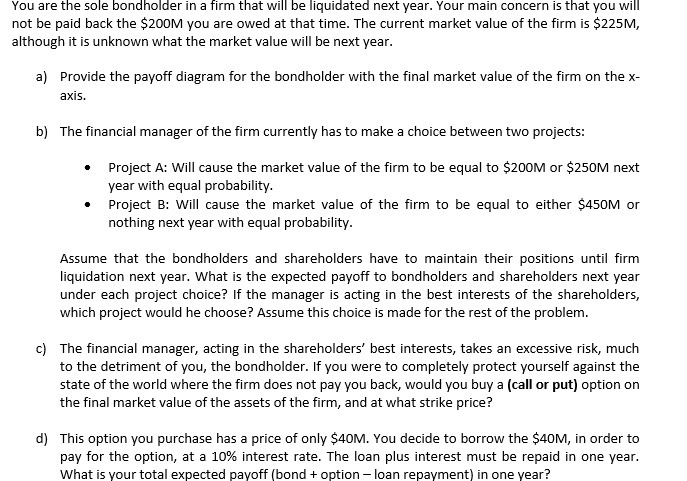

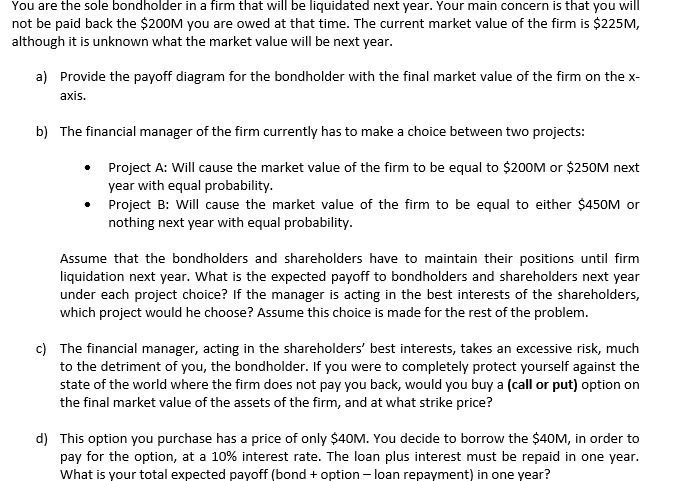

You are the sole bondholder in a firm that will be liquidated next year. Your main concern is that you will not be paid

You are the sole bondholder in a firm that will be liquidated next year. Your main concern is that you will not be paid back the $200M you are owed at that time. The current market value of the firm is $225M, although it is unknown what the market value will be next year. b) c) d) Provide the payoff diagram for the bondholder with the final market value of the firm on the x- axis. The financial manager of the firm currently has to make a choice between two projects: Project A: Will cause the market value of the firm to be equal to $200M or $250M next year with equal probability. Project B: Will cause the market value of the firm to be equal to either S450M or nothing next year with equal probability. Assume that the bondholders and shareholders have to maintain their positions until firm liquidation next year. What is the expected payoff to bondholders and shareholders next year under each project choice? If the manager is acting in the best interests of the shareholders, which project would he choose? Assume this choice is made for the rest of the problem. The financial manager, acting in the shareholders' best interests, takes an excessive risk, much to the detriment of you, the bondholder. If you were to completely protect yourself against the state of the world where the firm does not pay you back, would you buy a (call or put) option on the final market value of the assets of the firm, and at what strike price? This option you purchase has a price of only $40M. You decide to borrow the $40M, in order to pay for the option, at a 10% interest rate. The loan plus interest must be repaid in one year. What is your total expected voff (bond + option loan repayment) in one year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started