Answered step by step

Verified Expert Solution

Question

1 Approved Answer

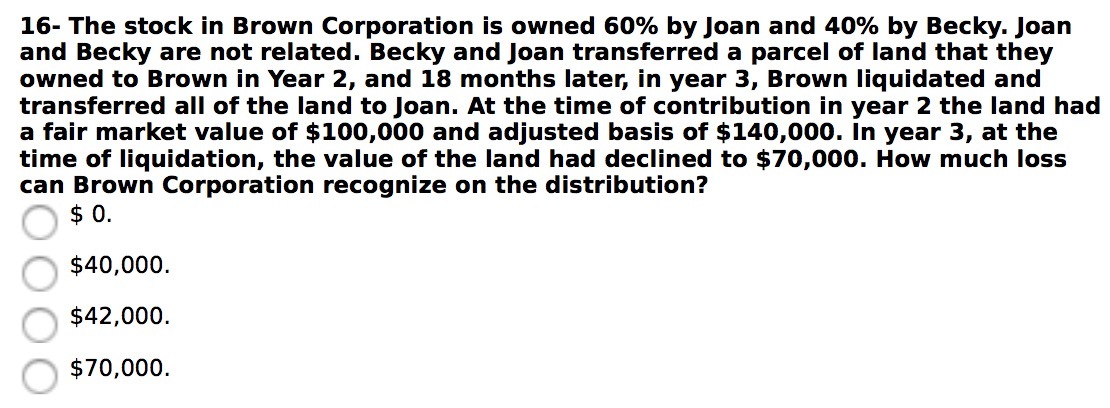

16- The stock in Brown Corporation is owned 60% by Joan and 40% by Becky. Joan and Becky are not related. Becky and Joan

16- The stock in Brown Corporation is owned 60% by Joan and 40% by Becky. Joan and Becky are not related. Becky and Joan transferred a parcel of land that they owned to Brown in Year 2, and 18 months later, in year 3, Brown liquidated and transferred all of the land to Joan. At the time of contribution in year 2 the land had a fair market value of $100,000 and adjusted basis of $140,000. In year 3, at the time of liquidation, the value of the land had declined to $70,000. How much loss can Brown Corporation recognize on the distribution? O $40,000. O $42,000. O O $70,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started