Answered step by step

Verified Expert Solution

Question

1 Approved Answer

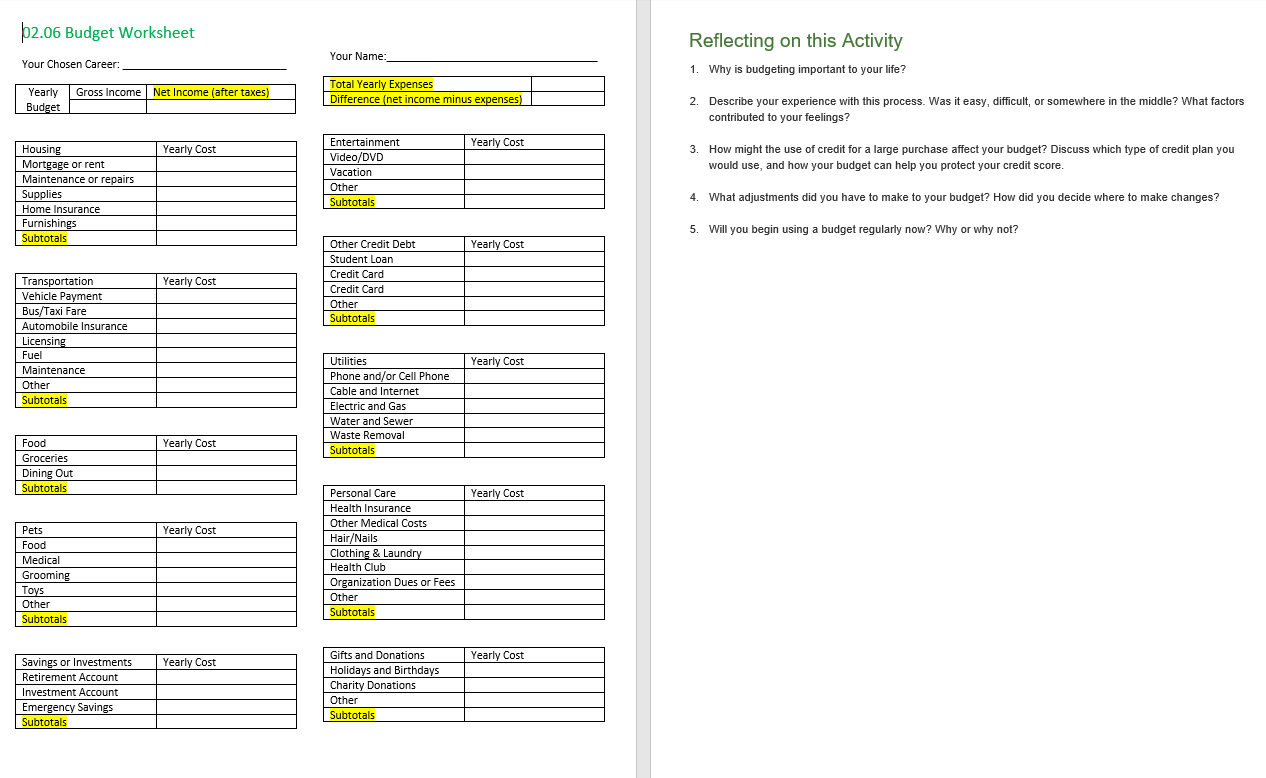

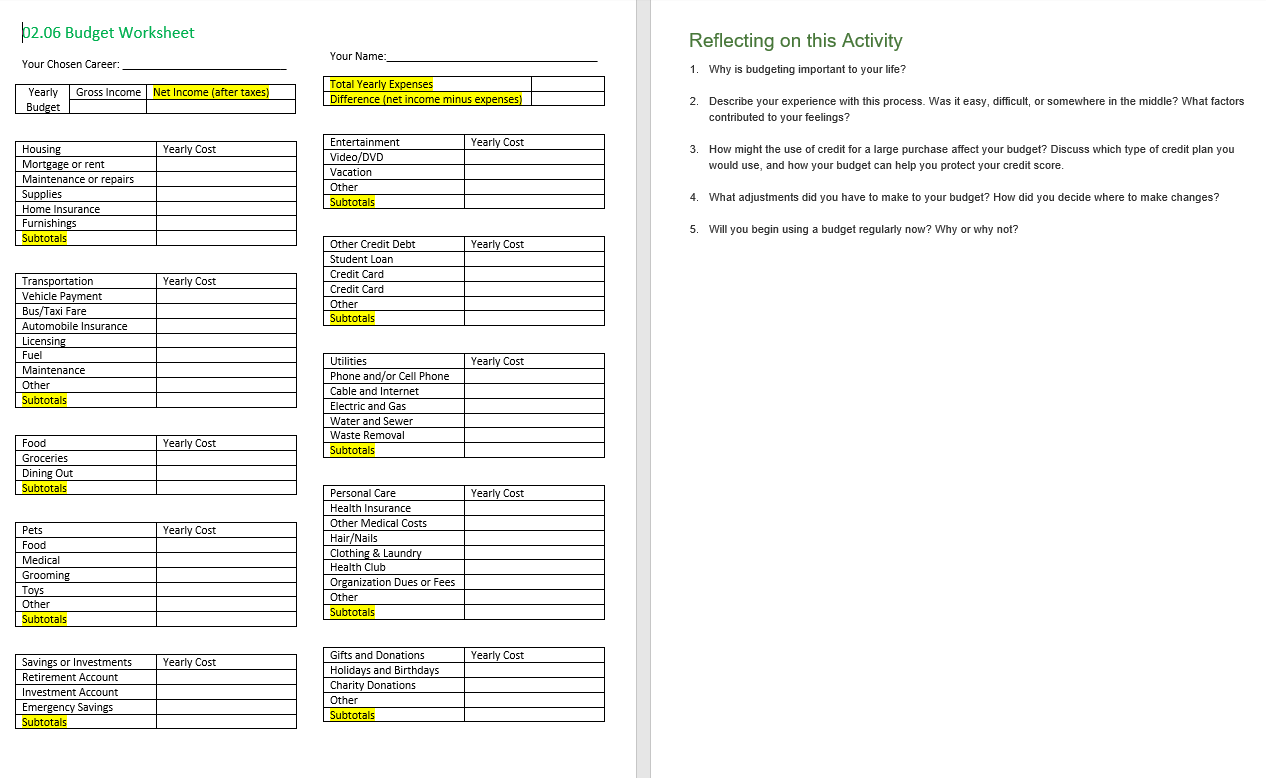

2.06 Budget Worksheet Your Name: Your Chosen Career: Total Yearly Expenses Yearly Gross Income Net Income (after taxes} Difference net income minus ense5 Housing

2.06 Budget Worksheet Your Name: Your Chosen Career: Total Yearly Expenses Yearly Gross Income Net Income (after taxes} Difference net income minus ense5 Housing Mortgage or rent Maintenance or repairs Supplies Home Insurance Furnishings Subtotals Transportation Vehicle Payment Bus/TaXl Fare Automobile Insurance Licensi Maintenance Subtotals Groceries Dining Out Subtotals Medical Grooming Subtotals Savings or I ruestments Retirement Account I ruestment Account Emergency Savings Subtotals Entertainment Yearly Cost Video/DVD Vacation Subtotals Other Credit Debt Student Loan Credit Card Yearly Cost Credit Card Subtotals Utilities Phone and/or Cell Phone Cable and Internet Electric and Gas Water and Sewer Waste Remova Yearly Cost Subtotals Personal Care Health Insurance Other Medical Costs Yearly Cost Ha ir/NaiIs Clothi & Laund Health Club Organization Dues or Fees Subtotals Gifts and Donations Yearly Cost Holidays and Birthdays Charity Donations Subtotals Yearly Cost Yearly Cost Yearly Cost Yearly Cost Yearly Cost Reflecting on this Activity Why is budgeting important to your life? Describe your experience with this process. Was it easy, difficult, or somewhere in the middle? What factors contributed to your feelings? How might the use of credit for a large purchase affect your budget? Discuss which type of credit plan you would use, and how your budget can help you protect your credit score What adjustments did you have to make to your budget? How did you decide where to make changes? Will you begin using a budget regularly now? Why or why not? 2.06 Budget Worksheet Your Name: Your Chosen Career: Total Yearly Expenses Yearly Gross Income Net Income (after taxes} Difference net income minus ense5 Housing Mortgage or rent Maintenance or repairs Supplies Home Insurance Furnishings Subtotals Transportation Vehicle Payment Bus/TaXl Fare Automobile Insurance Licensi Maintenance Subtotals Groceries Dining Out Subtotals Medical Grooming Subtotals Savings or I ruestments Retirement Account I ruestment Account Emergency Savings Subtotals Entertainment Yearly Cost Video/DVD Vacation Subtotals Other Credit Debt Student Loan Credit Card Yearly Cost Credit Card Subtotals Utilities Phone and/or Cell Phone Cable and Internet Electric and Gas Water and Sewer Waste Remova Yearly Cost Subtotals Personal Care Health Insurance Other Medical Costs Yearly Cost Ha ir/NaiIs Clothi & Laund Health Club Organization Dues or Fees Subtotals Gifts and Donations Yearly Cost Holidays and Birthdays Charity Donations Subtotals Yearly Cost Yearly Cost Yearly Cost Yearly Cost Yearly Cost Reflecting on this Activity Why is budgeting important to your life? Describe your experience with this process. Was it easy, difficult, or somewhere in the middle? What factors contributed to your feelings? How might the use of credit for a large purchase affect your budget? Discuss which type of credit plan you would use, and how your budget can help you protect your credit score What adjustments did you have to make to your budget? How did you decide where to make changes? Will you begin using a budget regularly now? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started