Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case #2 Hoyoh Skateboards Company (HSC) is looking to acquire another skateboard manufacturer, FreeLife Limited. Freelife Ltd. recently filed for bankruptcy and management at

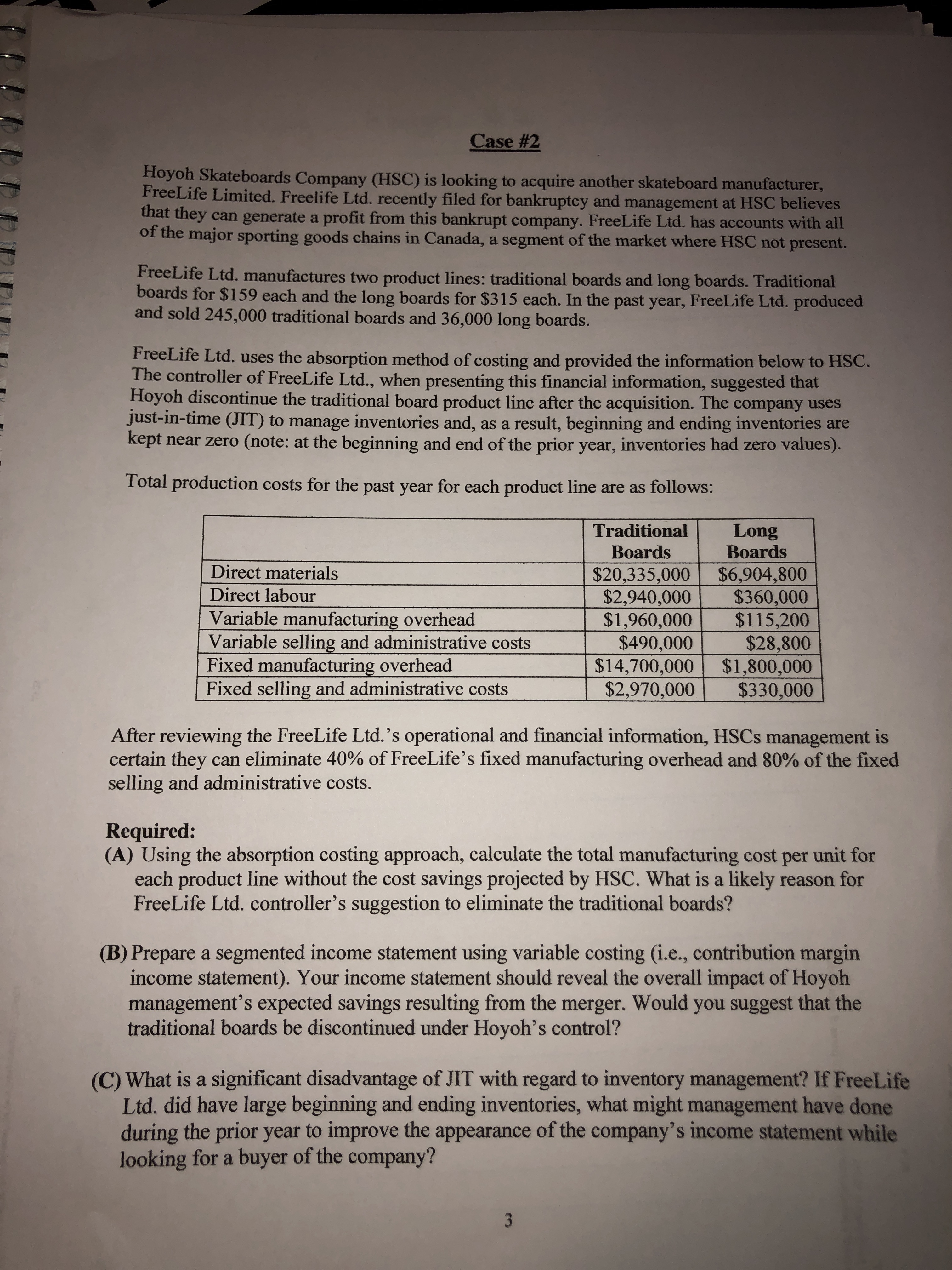

Case #2 Hoyoh Skateboards Company (HSC) is looking to acquire another skateboard manufacturer, FreeLife Limited. Freelife Ltd. recently filed for bankruptcy and management at HSC believes that they can generate a profit from this bankrupt company. FreeLife Ltd. has accounts with all Of the major sporting goods chains in Canada, a segment of the market where HSC not present. FreeLife Ltd. manufactures two product lines: traditional boards and long boards. Traditional boards for $159 each and the long boards for $315 each. In the past year, FreeLife Ltd. produced and sold 245,000 traditional boards and 36,000 long boards. FreeLife Ltd. uses the absorption method of costing and provided the information below to HSC. The controller of FreeLife Ltd., when presenting this financial information, suggested that Hoyoh discontinue the traditional board product line after the acquisition. The company uses just-in-time (JIT) to manage inventories and, as a result, beginning and ending inventories are kept near zero (note: at the beginning and end of the prior year, inventories had zero values). Total production costs for the past year for each product line are as follows: Direct materials Direct labour Variable manufacturin overhead Variable sellin and administrative costs Fixed manufacturin overhead Fixed selling and administrative costs Traditional Boards $490,000 Long Boards $360,000 $115,200 $28,800 $330,000 After reviewing the FreeLife Ltd. 's operational and financial information, HSCs management is certain they can eliminate 40% of FreeLife's fixed manufacturing overhead and 80% of the fixed selling and administrative costs. Required: (A) Using the absorption costing approach, calculate the total manufacturing cost per unit for each product line without the cost savings projected by HSC. What is a likely reason for FreeLife Ltd. controller's suggestion to eliminate the traditional boards? (B) Prepare a segmented income statement using variable costing (i.e., contribution margin income statement). Your income statement should reveal the overall impact of Hoyoh management's expected savings resulting from the merger. Would you suggest that the traditional boards be discontinued under Hoyoh's control? (C) What is a significant disadvantage of JIT with regard to inventory management? If FreeLife Ltd. did have large beginning and ending inventories, what might management have done during the prior year to improve the appearance of the company's income statement while looking for a buyer of the company? 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started