Answered step by step

Verified Expert Solution

Question

1 Approved Answer

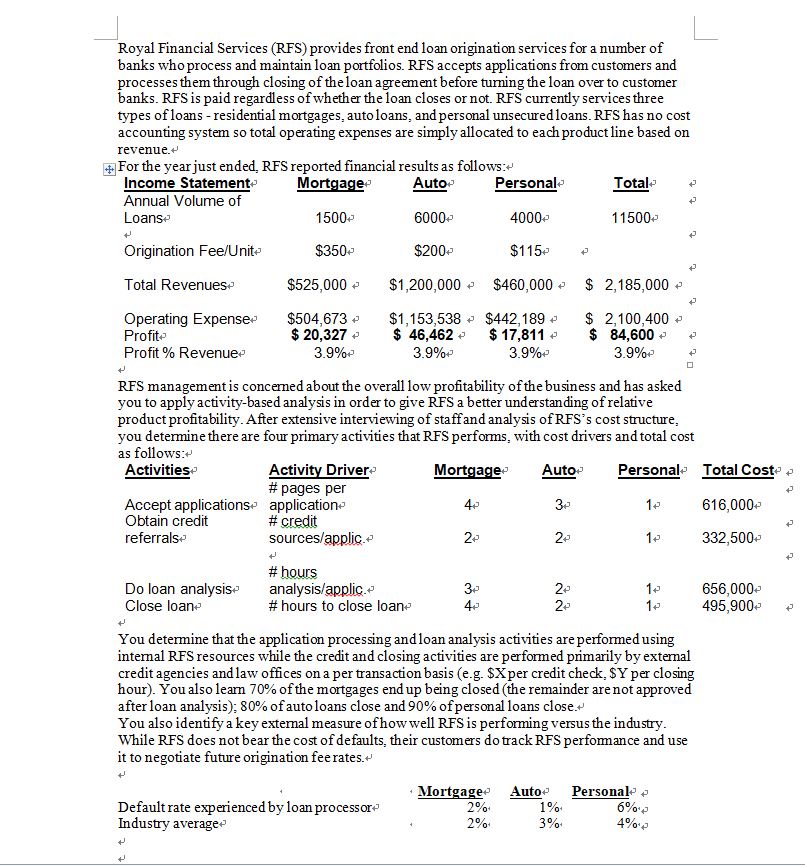

Royal Financial Services (RFS) provides front end loan origination services for a number of banks who process and maintain loan portfolios. RFS accepts applications

Royal Financial Services (RFS) provides front end loan origination services for a number of banks who process and maintain loan portfolios. RFS accepts applications from custonlers and processes them through closing of the loan agreenlent before turning the loan over to custonler banks _ RFS is paid regardless of whether the loan closes or not. RFS currently services three types of loans - residential mortgages auto loans and personal unsecured loans _ RFS has no cost accounting systenl so total operating expenses are simply allocated to eacll product line based on revenue_v BFor the year just ended: RFS reported financial results as follows:e Income Statemente Annual Volume of Loanse Origination Fee/Unite Total Revenuese Operating Expensee Profite Profit % Revenuee Mortgagee 15000 S525,ooo e $504,673 $ 20,327 Autoe 60000 $ 46,462 Personale 40000 S115e $460,000 e $442,189 e $ 17,811 Totale 115000 2,185,000 e 84,600 RFS management is concerned about the overall low profitability of the business and has asked you to apply activity-based analysis m order to give RFS a better understanding of relative product profitability _ After extensive interviewmg of staffand analysis of RFS' s cost structure: you detennine there are four primary activities that RFS performs: with cost drivers and total cost as follows:e Activities. Activity Drivere # pages per Accept applicationse applicatione Obtain credit referralse Do loan analysise Close Ioane # credit sources/appUG_e # hours analysis/appliG-e # hours to close Ioane 20 30 Autoe 30 20 20 20 Personale Total Coste 616,oooe 332,500e 656,oooe 495,900e You determine that the application pres sing and loan analysis es are performed using internal RFS resources while the credit and closing activities are performed primarily by external credit agencies and law offices on a per transaction basis (e.g. SXper credit check: SY per closmg hour). You also learn 70% of the mortgages end up being closed (the remainder arenot approved after loan analysis); 80% of auto loans close and 90% of personal loans close_e You also identi$ a key external measure of how well RFS is performing versus the industry RFS does not bear the cost of defaults: their custonlers do track RFS perfonnance and use it to negotiate future ongmation fee rates. e Default rate experi enced by loan processore Indus try averagee Mortgagee Autoe Personale e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started