Answered step by step

Verified Expert Solution

Question

1 Approved Answer

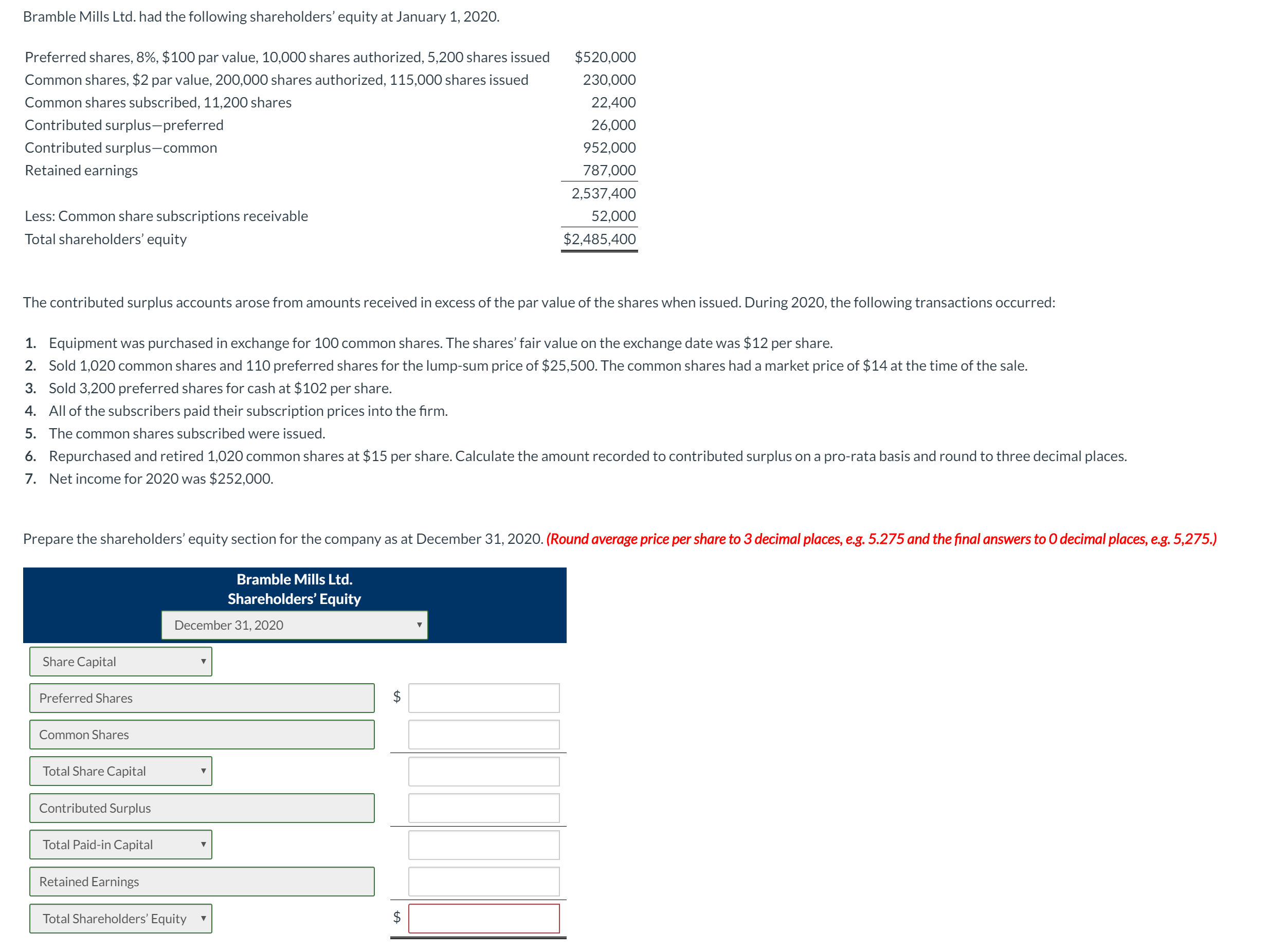

Bramble Mills Ltd. had the following shareholders' equity at January 1, 2020. Preferred shares, 8%, $100 par value, 10,000 shares authorized, 5,200 shares issued

Bramble Mills Ltd. had the following shareholders' equity at January 1, 2020. Preferred shares, 8%, $100 par value, 10,000 shares authorized, 5,200 shares issued Common shares, $2 par value, 200,000 shares authorized, 115,000 shares issued Common shares subscribed, 11,200 shares Contributed surpluspreferred Contributed surpluscommon Retained earnings Less: Common share subscriptions receivable Total shareholders' equity $520,000 230,000 22,400 26,000 952,000 787,000 52,000 The contributed surplus accounts arose from amounts received in excess of the par value of the shares when issued. During 2020, the following transactions occurred: 1. 2. 3. 4. 5. 6. 7. Equipment was purchased in exchange for 100 common shares. The shares' fair value on the exchange date was $12 per share. Sold 1,020 common shares and 110 preferred shares for the lump-sum price of $25,500. The common shares had a market price of $14 at the time of the sale. Sold 3,200 preferred shares for cash at $102 per share. All of the subscribers paid their subscription prices into the firm. The common shares subscribed were issued. Repurchased and retired 1,020 common shares at $15 per share. Calculate the amount recorded to contributed surplus on a pro-rata basis and round to three decimal places. Net income for 2020 was $252,000. Prepare the shareholders' equity section for the company as at December 31, 2020. (Round average price per share to 3 decimal places, e.g. 5.275 and the final answers to O decimal places, e.g. 5,275.) Bramble Mills Ltd. Shareholders' Equity December 31, 2020 Share Capital Preferred Shares Common Shares Total Share Capital Contributed Surplus Total Paid-in Capital Retained Earnings Total Shareholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started