Answered step by step

Verified Expert Solution

Question

1 Approved Answer

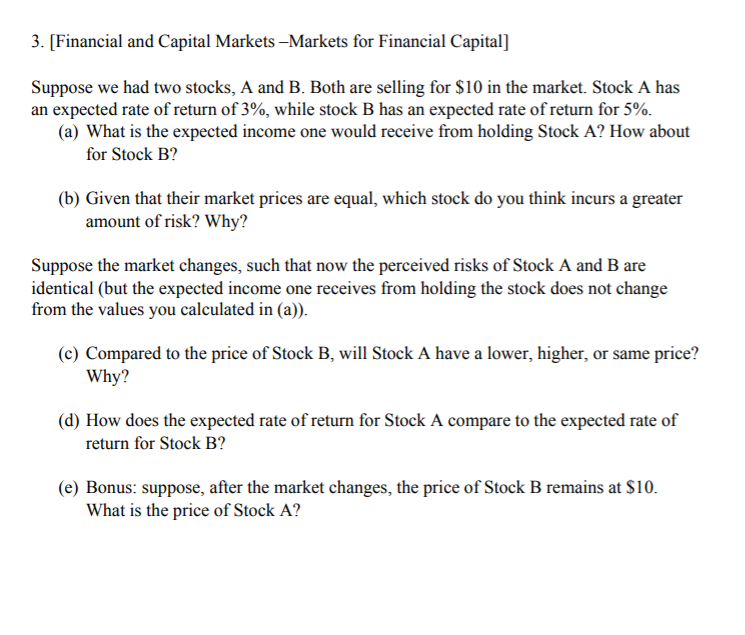

3. [Financial and Capital Markets Markets for Financial Capital] Suppose we had two stocks, A and B Both are selling for SIO in the

3. [Financial and Capital Markets Markets for Financial Capital] Suppose we had two stocks, A and B Both are selling for SIO in the market. Stock A has an expected rate Of return Of 3%, while stock B has an expected rate Of return for 5%_ (a) What is the expected income one would receive from holding Stock A? How about for stock B? (b) Given that their market prices are equal, which stock do you think incurs a greater amount Of risk? Why? Suppose the market changes, such that now the perceived risks of Stock A and B are identical (but the expected income one receives from holding the stock does not change from the values you calculated in (c) Compared to the price Of Stock B, will Stock A have a lower, higher, or same price? Why? (d) How does the expected rate Of return for Stock A compare to the expected rate Of return for Stock B? (e) Bonus: suppose, after the market changes, the price Of Stock B remains at SIO_ What is the price Of Stock A?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started