Question

F. A. Sloan purchased two adjoining 75-foot business lots in 19X0. Lot 1 was purchased for $36,000 early in the year and Lot 2 was

F. A. Sloan purchased two adjoining 75-foot business lots in 19X0. Lot 1 was purchased for $36,000 early in the year and Lot 2 was purchased for taking 25 feet from each to make Lot 3. The cost of this third lot was determined by allocating a portion of the cost of the original two lots to it. Sloan then built a store on Lot 3 at a cost of $36,000. It was completed and paid for on June 30, 19X5, and had an estimated life of 20 years.

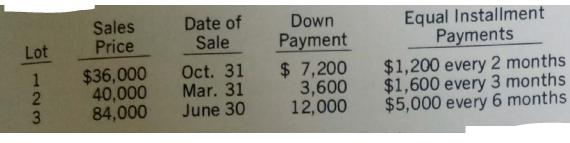

The three pieces of property were sold during 19X5 on the following terms:

Each installment payment is to be applied first to accrued interest on the principal amount owed at the rate of 12%, the balance to a reduction of principal.

The purchaser of Lot 3 did not complete the contract, falling to meet the installment due on June 30, 19X6, and property was repossessed.

Instructions:

(1) Prepare journal entries to record the transaction for 19X5 on Sloan’s books.

(2) Prepare the entry to record the realized gross profit when the books are closed on December 31, 19X5.

(3) Record the repossession of Lot 3 in 19X6. (Assume that upon repossession the lot is recorded at original cost; the building, at original cost less depreciation to date based upon original estimates.)

Lot 2 3 Sales Price $36,000 40,000 84,000 Date of Sale Oct. 31 Mar. 31 June 30 Down Payment $ 7,200 3,600 12,000 Equal Installment Payments $1,200 every 2 months $1,600 every 3 months $5,000 every 6 months

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Date Account Debit Credit Dec 31 Property 36000 Accounts Payable 36...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started